Last week US inflation data came in higher than expected which moved USD stronger once again. With the Fed looking at the data the market is predicting where the terminal rate will be. The US Dollar would have ended higher but for Friday’s reversal. The DXY ended the week 0.6% higher at 109.64.

Euro ended the week flat against the USD but gained against other major currencies. Against the USD the single currency still trades around parity but gained over 1% vs the Pound.

GBP is still very weak. Our previous weekly bulletins have said for a while now that there is no reason to be buying GBP at the moment and this still remains the case. GBP hit multi decade lows during the week and we still do not see any positives in going against the current trend.

Commodity currencies lost due to the overall market risk of post inflation data. All commodity currencies lost ground with AUD, NZD and CAD all losing around 2%

Oil prices fell for another week, but support seems to be forming here. WTI fell 1% to $85.28.

The week ahead will be dominated by the Fed meeting and decision as markets look to try and understand where the endgame is in rate rises. We also have rate announcements from the BoJ, SNB and BoE this week along with PMI data.

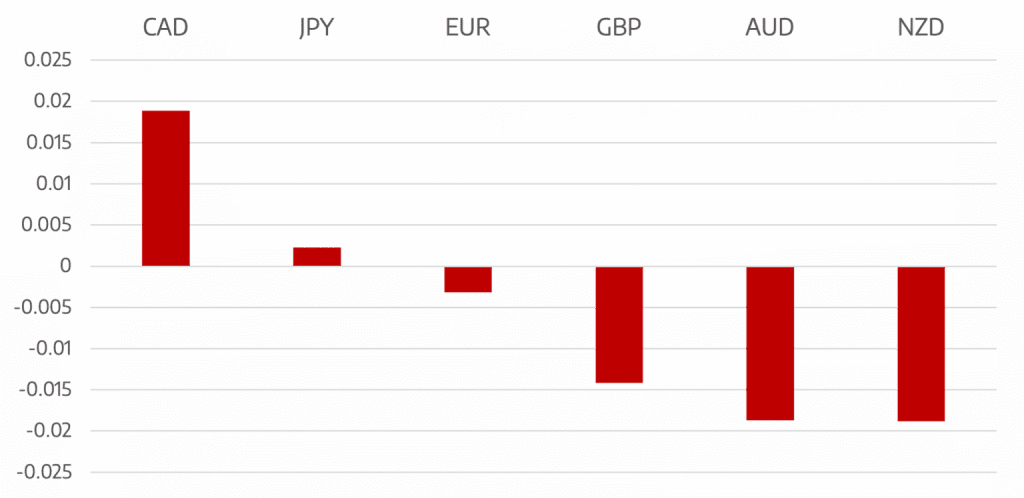

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

US Inflation Spurs the USD Higher

appeared first on JP Fund Services.

The post Cromwell FX Market View US Inflation Spurs the USD Higher first appeared on trademakers.

The post Cromwell FX Market View US Inflation Spurs the USD Higher first appeared on JP Fund Services.

The post Cromwell FX Market View US Inflation Spurs the USD Higher appeared first on JP Fund Services.