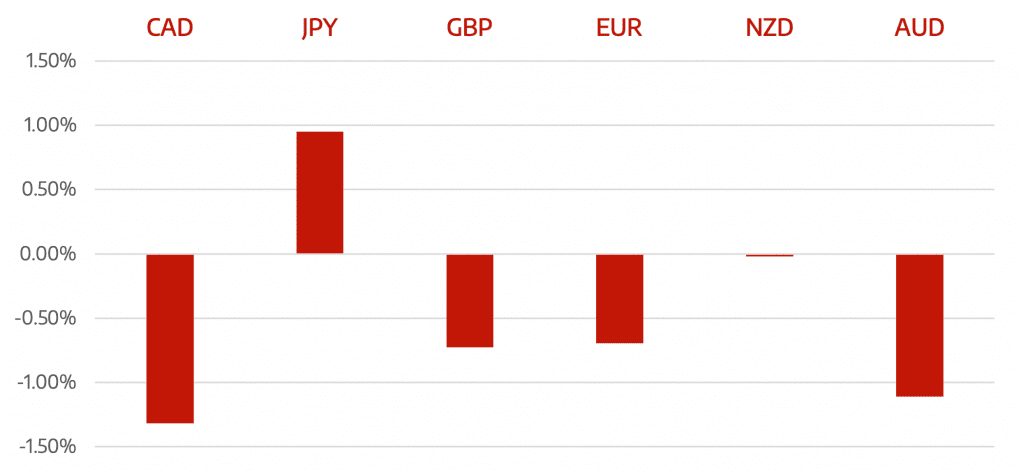

USD and JPY were the key winners as risk of sentiment in stock continued throughout the week. China’s Evergrande continued to worry equity markets with a risk off theme playing out throughout the week.

Evergrande is China’s second-largest property developer by sales, and has managed to rack up some $300 billion in debts. Doubts are growing over whether it will be able to make a bond interest payment of $83.5 million due on Thursday. A messy default could have wider implications on the Chinese economy at a time when growth is already looking fragile.

The week ahead is dominated by central bank meetings. There are no fewer than a dozen central banks holding meetings but the week will look to the FOMC meeting. While it is unlikely to announce tapering this week, we do expect Chairman Powell to continue to be positive on the economy and look to start reducing the pace of asset purchase this year.

Weekly Majors Market Change

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adheres to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

USD Ascendancy Continues China’s Worries

appeared first on JP Fund Services.

The post Cromwell FX Market View USD Ascendancy Continues China’s Worries first appeared on trademakers.

The post Cromwell FX Market View USD Ascendancy Continues China’s Worries first appeared on JP Fund Services.

The post Cromwell FX Market View USD Ascendancy Continues China’s Worries appeared first on JP Fund Services.