The Chamber’s Token Alliance has introduced “Considerations and Guidelines for Anti-Money Laundering Compliance” to complement their ongoing “Understanding Digital Tokens” series. This report supplements earlier reports from the series on securities and non-securities tokens, consumer protection, and the data and trends in the industry.

AML compliance continues to be a primary focus of industry since before FinCEN published its original guidance on convertible virtual currencies in 2013. The latest approval by the FATF of Recommendations involving virtual assets and virtual asset service providers and FinCEN’s most recent guidance for virtual currency businesses keep these issues at the forefront of industry priority.

This report provides an overview of laws in the United States aimed at the prevention of money laundering and at combating the financing of terrorists (“CFT”), as well as the rules and regulations that certain categories of businesses must follow with respect to establishing formal anti-money laundering (“AML”) policies and practices. It concludes with a set of guidelines for token sponsors and token trading platforms to consider when crafting AML and CFT compliance programs.

As the Chamber gathered in their report, modernizing the United States’ AML laws is an important goal, particularly in light of the advances in blockchain and digital asset technology that enable people and industries to engage in commerce in new and important ways. Like any industry and any currency, these technologies can be used for incredibly important purposes; but also, in some cases, to engage in unlawful activity.

These AML guidelines and considerations are designed to assist the industry to detect and deter illicit activity by:

- Stressing the importance of preventing money laundering and terrorist financing;

- Setting out the rules and regulations that certain categories of businesses must follow with respect to establishing formal anti-money laundering policies and practices;

- Highlighting OFAC requirements and sanctions screening; and

- Establishing a set of guidelines for token sponsors and token trading platforms to consider when crafting AML compliance programs.

The Blockchain Alliance: Combating Criminal Activity on the blockchain

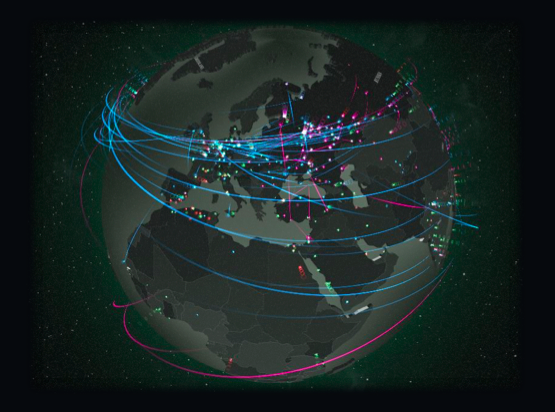

In addition to releasing this report, the Chamber has also pointed out the great effort that the Blockchain Alliance, a joint venture between the chamber and Coin Center, is doing towards improving cybersecurity on blockchain based platforms. This Blockchain Alliance is a forum for open dialogue between law enforcement and the blockchain industry to increase blockchain security and deter its use for unlawful purposes. This Blockchain Alliance is the public-private forum that enables the blockchain community and law enforcement to work together to help combat criminal activity. It is comprised of 20+ state, federal and international law enforcement agencies. The Blockchain Alliance serves as a resource for law enforcement and regulatory agencies by providing educational, technical assistance and periodic informational sessions regarding the use of blockchain-based technologies.

Furthermore, the Blockchain Alliance serves as a critical step for protecting public safety by combating criminal activity on the blockchain – and it is also a critical step for the growth of the blockchain industry. The Blockchain Alliance promotes an approach to enforcement and regulation that does not stifle innovation. The group aims to address misperceptions about blockchain technology, as well as bitcoin and other digital currencies, by highlighting the industry’s good-faith efforts to cooperate with investigations.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals