Last week the markets continued to embrace the clarity that data is giving towards the Feds path of interest rate cuts. The case for a November 25bps cut has risen after stronger than expected CPI data. The week saw the Dollar boosted by rising treasury yields but both are beginning to head towards key resistance levels.

In strong contrast to the stability, we have seen in the way the Fed is moving the Asian markets have been anything but calm. The Chinese stimulus package has sky rocketed equities, but doubts are beginning to creep in to if these bazooka effect will jump start the Chinese stock market. Large profits taking was seen in HK and China post the meteoric short term gains stocks had seen.

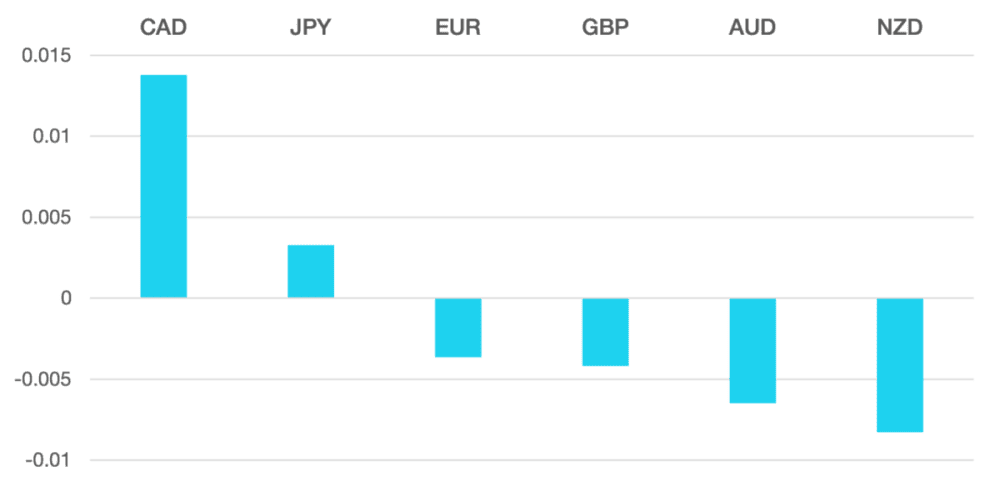

Risk currencies had the worse of the week. CAD ended the week the worst performer followed by NZD and AUD. CAD suffered as strong employment data and a fast-paced interest rate easing cycle led the currency to fall. Kiwi lost ground post the 50bps rate cut coupled with the additional China effect.

Both GBP and EUR continued their mid table performance. With both losing marginally with the stronger dollar.

Oil had a quieter week gaining 1.4% to close around $80. The gain was more subdued as we have not seen a large escalation in the middle east.

The week ahead continues to focus on The Middle East and what further escalation could come from the region. The market will also be trying to fully digest any further Chinese stimulus package.

Market wise we have inflation from UK, Japan and Eurozone along with the ECB interest rate decision.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Data Gives Dollar Bounce first appeared on trademakers.

The post Data Gives Dollar Bounce first appeared on JP Fund Services.

The post Data Gives Dollar Bounce appeared first on JP Fund Services.