The fast spread of the coronavirus outbreak is putting at risk not only hundreds of thousands of people but also major economies across the world. Germany is one of those countries that can suffer the consequences of a widespread COVID-19 within their borders. According to the latest study published by Deutsche Bank Research, the coronavirus outbreak could cause the German economy to fall into a technical recession this year.

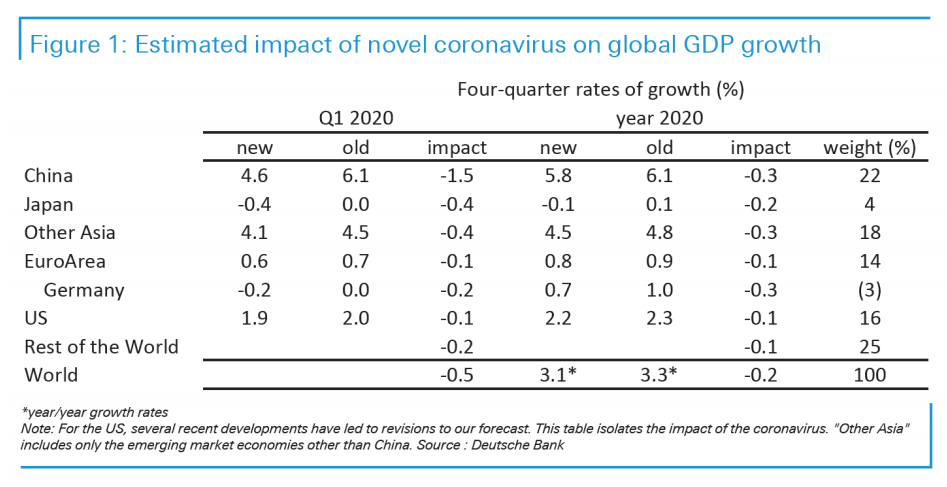

“We expect the coronavirus to dampen gross domestic product by 0.2 percentage points in the first quarter, making a technical recession highly possible in the winter half-year,” the study says. The economists added that the coronavirus “poses a risk to the global recovery, as hopes rest on a recovery in the Chinese economy.”

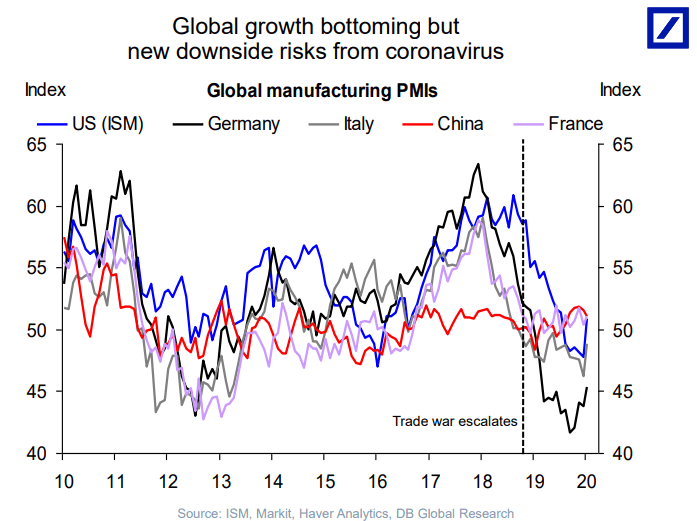

And although Deutsche Bank said that its January data had suggested that German economic growth would stabilize, the coronavirus outbreak might change that drastically, as the data was collected before the outbreak.

The consequences of COVID-19 pandemy to the global economy are obviously negative in this globalized world economy. Germany’s export-driven economy is heavily reliant on China, its most important trading partner. As such, Germany’s exporters already felt the effects of the cooling Chinese economy in 2019, and its car manufacturing industry is particularly vulnerable to any weakening demand from the enormous Chinese automotive market.

It also doesn’t help that Germany’s chancellor, Angela Merkel said that that two-thirds of Germany could become infected by the new coronavirus COVID-19, according to the New York Times. “Given a virus for which there is no immunity and no immunization, we have to understand that many people will be infected. The consensus among experts is that 60 to 70 percent of the population will be infected,” she said.

In her first public appearance to address the epidemic, which has already infected more than 1,200 people in Germany, Ms. Merkel said that her government was following the advice of medical experts. She urged citizens to do the same. “We are at the start of a development that we cannot yet see the end of,” Ms. Merkel told reporters. “But we as a country will do whatever is necessary to do, working within the European bloc.”

That means stimulus packages to help SMEs, enterprises and employers and keep the economy afloat. The German government has already approved a first fiscal plan to tackle the economic impact from the coronavirus.

· The conditions to apply for the so-called short-time work schemes, subsidised by the government, which helped stabilise the German labour market during the 2008/9 crisis, will be loosened. Also, the government announced an increase to its share in the subsidies.

· Investments will be increased by €3.1bn per year, from 2021 to 2024. This is less than 0.1% GDP per year.

· The government will discuss and prepare liquidity support for companies suffering from the economic impact of Covid-19. Exact numbers were not mentioned.

As stated by ING in a recent research: “The German government’s decisions tick the right boxes. However, as so often, the absolute size of the measures could quickly prove to be too small. One reason for the relatively small size is the fact that the current set of measures allows the government to postpone the politically-sensitive question of how to deal with the debt brake and the “Black Zero”. Last night’s decisions will lower the fiscal surplus, without pushing the budget into negative territory. In our view, the German government’s package is a good step in the right direction, but it will only tackle the impact from a short-lived economic shock. If Covid-19 spreads further and the economic impact worsens, last night’s move will not have been the final word.”

A Global Economy at the brink of collapse

The economic fallout of the coronavirus pandemic could include recessions in the U.S., euro-area and Japan, the slowest growth on record in China, and a total of $2.7 trillion in lost output—equivalent to the entire GDP of the U.K, according to Bloomberg.

All eyes are now on China. In there, automobile sales have plunged 80%, passenger traffic is down 85% from normal levels, and business surveys are touching record lows. The Chinese economy, in other words, has practically ground to a halt. Bloomberg Economics estimates that GDP growth in the first quarter of 2020 has slowed to 1.2% year on year—the weakest on record. If China doesn’t get quickly back on its feet in March, even that forecast could prove optimistic.

In the US, where the worst is still to come, President Trump has signaled that he will consider ways to stimulate the economy. Options include cutting payroll taxes and extending the American tax filing deadline past April 15.

Britain’s government promised nearly $39 billion in stimulus to its economy, including about $6.5 billion for Britain’s frayed National Health Service and other public bodies. The country’s aggressive economic rescue plan contrasts starkly with its muted public-health response to the coronavirus.

In Italy, Prime Minister Giuseppe Conte of Italy announced that his government was developing a plan to spend about $28 billion to confront the coronavirus emergency. Italy is the hardest hit country outside of China. But China’s new cases have dwindled, while Italy’s are escalating. “We will do everything necessary,” Mr. Conte said.

Prime Minister Benjamin Netanyahu of Israel announced about $2.8 billion spending to counter the economic fallout. Israel has imposed a mandatory 14-day isolation of anyone entering the country, abruptly choking off tourism.

Based on other coronaviruses, the researchers believe the transmission rate will decrease as we go through the spring and summer, but will then increase again. In Europe, the outbreak is mainly affecting Italy and Spain, which has forced their governments to reconsider their growth forecast.

COVID-19, the last known coronavirus capable of infecting animals and humans, is thought to end up infecting as many as a 100 million people in total between this winter season and next year’s. As of now, the toll is significant: there are more than 110.000 infected and over 4.000 deaths related to it. Governments around the world are trying to act and break the transmission chain. That means shutting down schools and universities, cancelling events, asking businesses to send workers home and even locking down entire regions as a precautionary measure.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.