Japan’s “Society 5.0” refers to the fifth stride in human civilization evolution to create a “super-smart” future society which leverages the technological innovations of the current fourth industrial revolution (4IR) to achieve economic advancement and embed these in society to solve people’s problems so that they can live better lives. And Digital Asset Fintech Hubs can play a key part in that project. Let’s take a look at the reasons.

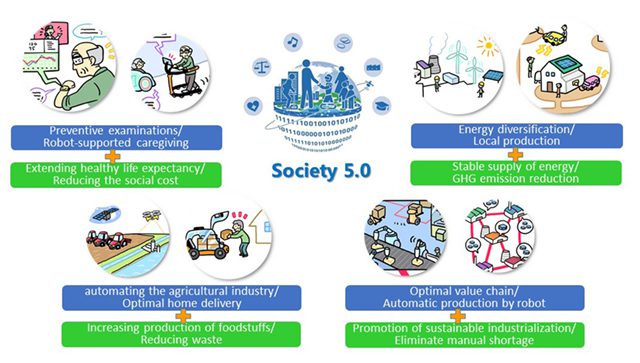

Society 5.0 addresses a number of key pillars: Infrastructure, Fintech (including blockchain), Healthcare, Logistics and Artificial Intelligence (AI).

Whilst the pandemic has accelerated 4IR development through rapid digital transformation, it will also be the catalyst to kick start Society 5.0. Nations that harness this effectively will become the super societies of the future. Taking Fintech to the next level will be essential for such enablement to reinvent the way financial services are conducted.

How can Fintech Hubs become smarter?

A FinTech Hub is the focal point for FinTech activity within a region or a network yet such hubs are largely silos with no interconnectedness. With the advent of Society 5.0 Fintech Hubs will increasingly interconnect with each other to become ‘Smart Digital Fintech Hubs’. This new age digital infrastructure will have the power to assist in the economic recovery as it will bring hundreds of millions of the most underprivileged and displaced members of society into a new digital financial system.

The use of digital currencies and alternative forms of digital assets with seamless smart contract-driven cross border exchange between them as well as their exchange with goods and services will result in less frictional cost and more efficiency. This will lead to greater opportunities not just for governments and institutions, but also for the individual fuelling an Internet of People (IoP) for the masses as opposed to merely an Internet of Things (IoT).

According to the World Bank 1.7 billion adults remain unbanked globally. Digital technology has the power to direct the flow of their cash transactions onto a new Fintech-based global super highway.

Integrated into these Smart Digital Fintech Hubs, the use of blockchain technology, coupled with artificial intelligence (AI), can ensure users control over their information and data finally giving governments and their citizens ownership over the digital information they create and the economic value that derives from it. This will help achieve Society 5.0’s goals of a better society aligned with the United Nations Sustainable Development Goals (UN SDGs).

What next for Digital Financial Services?

Early adoption of Society 5.0 will also be a key differentiator for Japan in the race to lead the globe in digital financial services of which digital asset exchanges are an integral part – offering digital services encompassing wealth management, primary listing of securities, the listing of alternative assets and secondary-market trading of digital assets with trusted digital custody. The potential for early adopter countries to take the lead is further facilitated as round-the-clock transactions become easier, cheaper and more secure with a global reach.

Digital asset exchanges will play an important role offering participants the ability to monetize their activity over this digital infrastructure, essentially serving as the capital markets for Society 5.0.

The issue to date has been the inability to deploy capital and move assets seamlessly between legacy platforms. This is a historic problem for exchanges which has persisted since their inception as floor-based marketplaces and continued as they moved to electronic trading. They remained standalone pools of liquidity making interoperability between them difficult and expensive and only possible via multiple intermediaries. Interconnected Smart Digital Fintech Hubs will solve this issue to create more efficient asset portability.

The future of exchanges will combine digital and traditional assets in ways that change the decades-old exchange model. The impact of such changes could be dramatic, especially for startups and SME’s. Tokenisation and blockchain-based solutions can revolutionise the ability for smaller companies to raise capital, and make the process more streamlined and cost-effective.

Digital asset exchanges represent a huge opportunity globally – the APAC region included. The market for digital assets has evolved substantially as security tokens have started to gain more traction with institutional investors. A survey conducted by the World Economic Forum, predicted that 10% of GDP will be stored on blockchain technology by 2027, equivalent to US$24 trillion of financial assets.

Is a Digital Assets revolution in the offing?

Society 5.0 is a golden opportunity to put Japan into the heart of the digital assets revolution by positioning itself as a global leader in digital financial services. Domestically this will facilitate the development of local expertise in digital assets and related services as well as attracting the most innovative international Fintech companies and greater foreign investment into Japan. The positive effects of this will be job creation, associated GDP growth and export of this knowledge to interconnect and enhance other similar hubs not only in the APAC region, but also in other parts of the world.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.