Proshares Bitcoin Strategy exchange-traded fund (BITO) launched early last week, and it did well on its first day, closing at $41.94 per share. Meanwhile, the price of Bitcoin (BTC) soared on Tuesday of last week, reaching a high of $64,367 on the crypto exchange Bitstamp just fifteen minutes after the closing bell on Wall Street at 4pm EST. The Proshares Bitcoin ETF commanded serious volume throughout its first day. As BITO shares swapped hands on the New York Stock Exchange (NYSE), it reached a daily high of over $42. Bloomberg Intelligence analyst James Seyffart tweeted at the end of the day: “Looks like the final tally is gonna be right around ~$990 million in trading for BITO on its first day trading.” The senior ETF analyst for Bloomberg, Eric Balchunas, also tweeted about the action the Proshares Bitcoin Strategy ETF saw on Tuesday. He said, “BITO just about $1 [billion] in total volume today (curr $993m but trades still trickling in). Easily the biggest Day One of any ETF in terms of ‘natural’ volume. It also traded more than 99.5% of all ETFs ([including] some big [ones] like DIA, ARKK, SLV). It [definitely] defied our expectations.” The analyst then added: “If we don’t exclude ETF’s where their day one volume was literally one pre-planned giant investor or BYOA (not natural), it still ranks #2 overall.”

While the Proshares Bitcoin ETF had a decent day, Bitcoin (BTC) spot markets also rampaged on October 19. BTC’s market cap swelled to over $1.2 trillion on Tuesday and there had been $42.4 billion in global trade volume throughout the day. Balchunas stressed that the result of the day’s first Bitcoin ETF performance in the U.S., “makes life that much harder for the next in line ETFs to succeed. Everyday counts [because] once an ETF gets [known] as ‘the one’ and has tons of [liquidity], it’s virtually imposs to steal (see SPY, GLD).” Balchunas concluded: “What does this mean for assets? My guess is about half of this volume will end up as flows next two days. [probably] looking at $750 [million] by end of week, something like that. Tomorrow’s volume will be interesting and how much it comes down to earth vs [staying] high.”

Wall Street Strategist Puts Bitcoin as High as $168,000 by Year-End

According to a Bloomberg report, co-founder of Fundstrat and Wall Street Strategist Tom Lee has revealed his expectations for Bitcoin before the year runs out. Lee explained that he had high expectations for the digital asset, which he believes will hit the $100,000 mark by the end of the year a conservative estimate. He added that the asset could easily go as high as $168,000 if certain factors come into play. Lee has always maintained a bullish stance on cryptocurrencies, and he is doubling down on his prediction, which he had first made back in May. The asset’s volatility has never worried the Wall Street strategist and he fully acknowledges its highly volatile nature. “I think Bitcoin is hyper-volatile,” Lee told TechCheck in May. “That’s the nature of it, but that’s what creates the reward for people.” The co-founder of Fundstrat explained the factors driving his price prediction for BTC, and the recent ETF approvals for Bitcoin was the major one. The first U.S. Bitcoin Futures ETF began trading last week and Lee believed that this will be the major reason behind the asset hitting the $100K price mark.

Since adoption is the name of the game, the Bitcoin Futures ETF will help to drive large inflows, which will translate into a higher value for the asset. With the Futures ETFs, Lee explains that the fund will allow many more individuals to allocate a portion of their investment portfolios into crypto, and “this will drive significant new inflows.” Bitcoin at $100,000 is an increasingly common prediction amongst top market participants. Even though the asset had taken quite a beat-down in the market in September, most market participants maintained their predictions that the asset would hit $100,000 before the year ended. These predictions have been attributed to numerous factors, but the forecasts have always remained the same: the market will see BTC at $100K before the next bull market. Skybridge Capital CEO Anthony Scaramucci has also said the asset will hit $100,000 by year’s end, pointing out that as adoption grows worldwide, so will the value of BTC. Meantime, Fidelity analyst Jurrien Timmer told CNBC that BTC could be far from hitting $100,000. Jurrien believed the price will eventually hit this point, but puts it on a much longer time frame.

ETH/USD Bulls Eyeing 4000: Sally Ho’s Technical Analysis 20 October 2021 ETH

Ethereum (ETH/USD) has been in a tight range and has sought to extend recent gains as it continued its comeback following recent selling pressure which had emerged around $3968. That was a level that was close to an upside price target of $3964. During a subsequent and rather quick sell-off at that level, ETH/USD traded as low as $3643, which represented a test of the previous upside price objective and had translated to buying pressure around the $3269. Buying pressure had also been seen around the $3688 level, and this was representative of the 23.6% retracement of the appreciating range from 2781 to 3968. Additional upside price objectives include 4058, 4097, 4190, 4318, 4330, 4490, 4523, 4793, and 4893. Following the recent appreciation, downside price retracement levels and areas of potential technical support include 3688, 3515, 3375, 3235, 3082, and 3035. Traders observe that the 50-bar MA (4-hourly) is bullish above the 100-bar MA (4-hourly) and above the 200-bar MA (4-hourly). Also, the 50-bar MA (hourly) is bearish below the 100-bar MA (hourly) and above the 200-bar MA (hourly). Price activity is nearest the 50-bar MA (4-hourly) at 3701.79 and the 100-bar MA (Hourly) at 3829.22. Technical Support is expected around 3515.25/ 3375.24/ 3235.23 with Stops expected below.

How Bitcoin Grants “The Highest Degree of Assurances” To Holders

In a recent episode of “The Center Cannot Hold,” Pete Rizzo joined host Alex McShane to discuss his latest article in Forbes entitled, “Against Cryptocurrency: The Ethical Argument for Bitcoin Maximalism.” During the interview, they explored the following topics: how Bitcoin is the only cryptocurrency that truly protects users’ rights, the various disagreements between crypto agnostics and Bitcoin maximalists, and why it’s important to distinguish, for new people coming into the space, Bitcoin from crypto; along with other things. At one point, Rizzo stated, “Do you have the right to your money – absolutely, in any case where you would disagree with anyone? In Bitcoin, I think we have the highest degree of assurances that it is providing that.” They also discussed how Bitcoin is the only system of money that protects minority users’ rights, Bitcoin’s immaculate conception, how this makes Bitcoin different, and why Bitcoin isn’t “old technology” and can’t just be replaced by some new system. “In Bitcoin, you had a period where bitcoin was worth nothing,” Rizzo said. “And then Bitcoin monetized. It was almost like the spontaneous creation of life. You have data that was valueless, and then Bitcoin crossed that chasm. It became life, it became value.”

X8, The World’s first Stablecoin backed by 8 currencies will be issued under the Swiss Sandbox regime

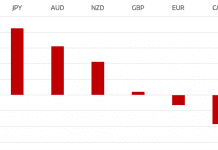

On October 18th, 2021, X8 AG announced that the company will commence with the issuance of the X8 Global Stablecoin under the Swiss Sandbox regime, and it is expected to be available Q1 of 2022. Further, X8 AG stated that they have added key expertise in order to assist pursuance of a FinTech license and provide leadership for organic corporate development. Right from the start, the X8 Stablecoin has been designed and developed from the ground up to be fully compliant with the regulatory environment in Switzerland. X8 will be comprehensively backed by eight currencies (USD, EUR, JPY, GBP, AUD, CAD, CHF, and NZD). The stability of X8 will be managed by its proprietary algorithmic risk management process, which is designed to monitor currency fluctuations and to then adjust the weighting of the currency portfolio backing the X8 Stablecoin. Because of this, X8 will remain relevant as it adjusts to the ever-changing competitive landscape between the eight currencies. X8 AG believes this will ensure that the X8 Stablecoin will retain optimal stability with minimal liquidity risk. This is the first time anywhere that this feature will exist for any Stablecoin. X8 should have an innate capacity to be bought and sold against any or all of the eight fiat currencies.

X8 AG is a Swiss-based Fintech company owned by the X8 Group, Inc. Building on the successful ICO of the X8X utility token in 2018, the company progressed with the development of the World’s first Stablecoin backed by eight currencies. Due to its regulatory compliant structure, X8’s goal is to become the Global Stablecoin most fit for international exchange by both institutional and retail users. The development of proprietary tools and platforms using global tech megatrends such as AI and Blockchain has created stability in value for financial market players. X8 will focus on three main fields: Professional portfolio risk management platforms, Stablecoins, and Algorithmic investment models used in asset management. X8 AG is driven by its founder’s focus to bring compatibility between the traditional and the new decentralized financial landscape. The company is built upon the foundation to operate in a regulatory compliant way. Contacts for X8 AG: Investor information contact: Bashar Alsaneh, Listing Partners, SL support@listingpartners.lu +46 728 3842 50; Media Relations: Triona McHale, Partner, Ignite Communications triona@ignitecomms.com +353 87 2651473; and finally, X8 AG, Gregor Koželj, CEO ceo@x8ag.io +41 79 199 84 51.

X8 is now in the process of being granted a FinTech license. Under a FinTech license, X8 would be authorized to accept deposits from the public, up to a maximum threshold of CHF 100 million. These deposits will not be invested and no interest will be paid on them. X8 AG founder and CEO Gregor Koželj, who will be an invited speaker at the upcoming Redeye Fintech Day Conference, commented: “X8 AG is excited to announce the Swiss sandbox launch of the X8 Stablecoin during such an epochal period of digital money. We are conscious that the Stablecoin market is growing at a fast pace and with a recent valuation near $130B is correctly drawing attention from global regulators. Resultantly, with the addition of these key resources announced here, we are working toward having the X8 Stablecoin emerge from Switzerland in a regulatory compliant way. Socioeconomics at large awaits an effective Stablecoin that provides efficient payments in a fully compliant environment and for the holders, a way to keep liquidity in a multi-currency value preserving coin. The scaling of X8 will require significant effort and resources, we are confident that our plans will attract and reward our stakeholders.”

To assist with the introduction and issuance of the X8 Stablecoin, the company has engaged METI Advisory AG as their lead advisor, along with a Big Four Swiss legal practice to pursue the FinTech license. METI Advisory AG’s managing partner, Dr. Mattia Rattaggi, has twenty-five years of experience in the financial industry, and is considered an expert in digital finance and regulation. He has both advised and carried out several Fintech and crypto projects and is a regularly invited keynote speaker at global conferences (he was to be featured at the upcoming Redeye Fintech Day Conference on October 20, 2021). Issuance of the X8 Stablecoin into the Swiss sandbox is a milestone for the X8 AG. The importance of the Swiss sandbox is that it provides an innovative space for Fintech applications along with their business models to be tested. It allows for a company, without the prior approval or review by the regulator and no license requirement, to accept deposits from the public in an amount of up to CHF 1 million, regardless of the number of depositors. The deposits are not supervised by regulators, and they are not covered by the depositor protection regime. X8 AG will operate under the Swiss sandbox in compliance with AMLA and KYC provisions and affiliation to a self-regulatory organization. During Swiss sandbox, X8 deposits amounts shall not exceed the CHF 1 million limit. It is the company’s intention, that during the sandbox trial period, all other benchmarks will be accomplished and exceeded. These include capital reserves, user protection, compliance, and anti-money laundering requirements. This means that X8 is currently not subject to FINMA supervision and that the funds will not be protected by the Swiss depositor protection system until X8 has obtained the FinTech license.

Meantime, Bitcoin Hits Another All-Time High!

Bitcoin (BTC) recently achieved a significant milestone of setting a new all-time high (ATH) price at the $66,900 level after 189 days of waiting. Nevertheless, the leading cryptocurrency is facing a correction, having retraced to the $63,349 area during intraday trading late last week, according to CoinMarketCap. Despite this trend, holders remain unperturbed that history may well repeat itself. Lucas Outumuro, the head of research at IntoTheBlock, explained: “Is Bitcoin facing a deeper correction? Unlikely. Historically, after breaking an ATH, following a correction of 30+ days, BTC proceeds to increase by 145%, and on average, hodlers remain unfazed by the recent dip.”

Walmart Installing Bitcoin ATMs in Its Retail Stores

Daring to go where no crypto has gone before: Walmart Inc, the world’s largest retailer, announced on Thursday, October 21, that customers at some of its U.S. stores will be able to buy Bitcoin using ATMs installed by Coinstar. You heard that right – Walmart stated that it has begun a pilot program where consumers can purchase Bitcoin at Coinstar kiosks in some of its U.S. stores. Molly Blakeman, Walmart communications director, stated that: “Coinstar, in partnership with Coinme, has launched a pilot that allows its customers to use cash to purchase bitcoin. There are 200 Coinstar kiosks located inside Walmart stores across the United States that are part of this pilot.” Blakeman said that the pilot test by Coinstar started earlier this month, and the program includes two-hundred kiosks in Walmart stores. The program is part of a broader initiative by Coinstar, and they have partnered with a cryptocurrency exchange and payment firm called CoinMe, which specializes in Bitcoin ATMs. These specialized ATMs allow customers to purchase Bitcoin at its equipped kiosks.

Coinstar is currently best known for its machines that allow customers to exchange physical coins for cash. They plan to ramp up in order to provide Bitcoin at more than 8,000 kiosks worldwide. Meanwhile, Walmart is truly expanding its virtual payment options and is testing the pilot service program just weeks after the firm became a subject of a cryptocurrency hoax in September. That’s when a fake press release was published, claiming that Litecoin (LTC) would be accepted as payment at Walmart stores. The phony news sent values of the lesser-known crypto token surging. Though the announcement was false, Walmart was examining the future of cryptocurrency in its business operations. As reported by Blockchain.News in August, Walmart was then advertising that they were hiring cryptocurrency experts to help the firm develop “the digital currency strategy and product roadmap” while identifying “crypto-related investment and partnerships.” Important final note: an ever-increasing number of Fortune 500 companies are warming up to digital currencies.

The post <h5>Digital Asset Insights #38</h5> <h3>Proshares Bitcoin Strategy ETF Debut Captures Close to $1 Billion in Volume</h3> appeared first on JP Fund Services.