Last week was more of a risk on week and the volatility in the currency markets dampened slightly as the market looks towards what the Fed will do coupled with the ongoing Presidential campaigns.

The US Dollar traded in a much tighter range with Yen the biggest winner. The market has priced in the full 25bps from the Fed and is now looking for indicators as to if they will cut by 50bps instead. Last week payrolls pointed towards a more modest cut however it remains on a knife edge.

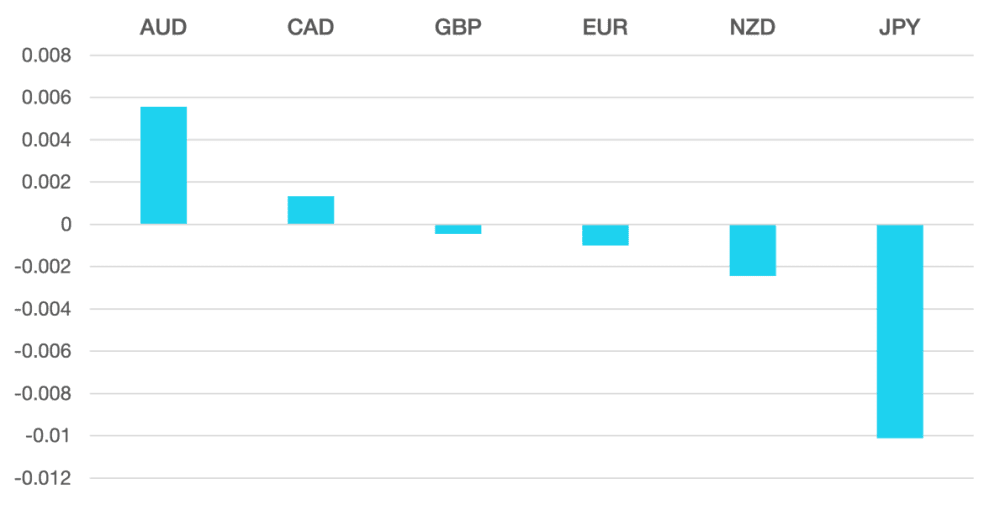

Yen was the winner on the week as Dollar traded nervously along with support from expectations that the BoJ will continue along the monetary tightening route. AUD was the other winner as strong consumer confidence and inflation expectations.

Both GBP and EUR had a non-moving week. The market is now expecting the BoE to skip making any changes at the next meeting.

Oil managed to post a positive week after the last few weeks of turmoil. WTI clawed back just 1.7% to close just below the $70 mark.

The week ahead will be all about the Fed decision and if it will be 25 or 50bps. 25bps will probably be viewed as negative with 50bps being a more welcomed decision.

We also have a host of data with the BOE and inflation numbers from Canada the UK and Europe.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Dollar Continues to Trade Nervously. Fed Awaits first appeared on trademakers.

The post Dollar Continues to Trade Nervously. Fed Awaits first appeared on JP Fund Services.

The post Dollar Continues to Trade Nervously. Fed Awaits appeared first on JP Fund Services.