Last week as Donald Trump took office the US Dollar ended the week the worst performer.

This was mostly due to further risk on and an expectation of more aggresive tariffs from the new administration.

With the new President looking at the Fed to reduce rates the markets disagree. The market currently projects 98% chance of rates to remain in the upcoming meeting. Unless we see any change in the data, we still expect rates to remain steady.

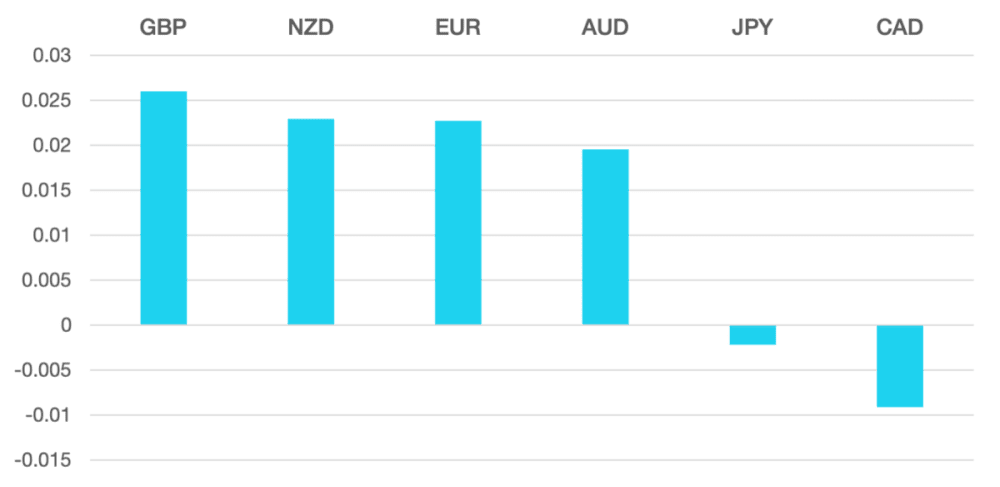

The Yen ended the week second worst after last week’s gains. Post rates hike any level of support for the Yen seemed to evaporate sending the currency weaker through the week vs all major pairs.

GBP art last had some respite gaining almost 2.5%. Perceived threats on trade to the UK from the US seem to have been over inflated and a better PMI reading helped sterling regain some of the losses.

Commodity currencies were the real winners of the week as the US Dollar retreated.

Oil moved lower with WTI falling around 3.%. Trumps drill baby drill is still ringing in the market’s ears, but oil remains stubbornly in the middle of the long term range.

The week ahead we have ECB and Bank of Canada along with the Fed looming over the horizon next week.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Dollar Loses Ground first appeared on trademakers.

The post Dollar Loses Ground first appeared on JP Fund Services.

The post Dollar Loses Ground appeared first on JP Fund Services.