Last week we expected US Yields to be the focus but, in the end, it was commodities. With Friday also being US Payrolls the beat that we saw Yields creep, but commodities sold off.

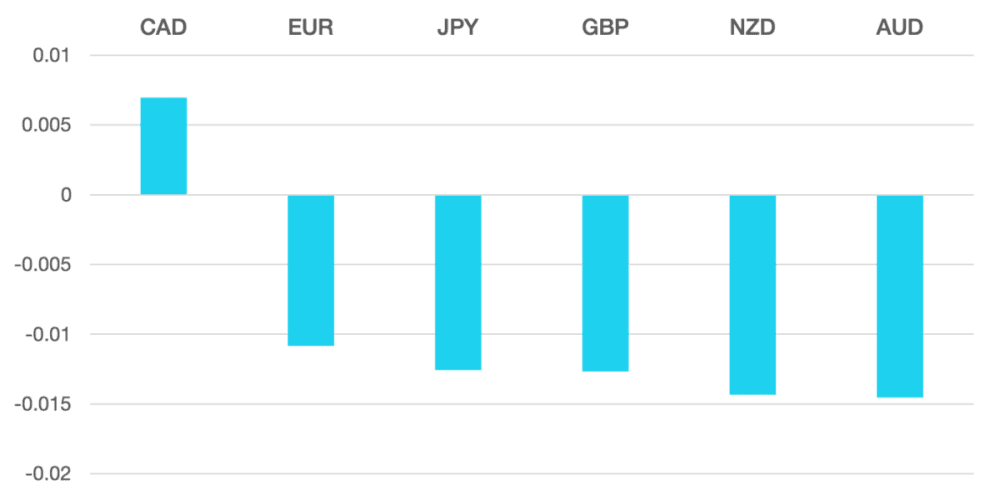

The Dollar finally had a positive week. The DXY gained 0.8% to close just below 104 as US economic data came in better than expected.

The Euro lost had a poor week as economic releases continue to remain weak. The single currency moved 1% lower against the US Dollar.

The GBP didn’t have any better of a week either losing 1% against the US Dollar and 0.25% vs the Euro.

Commodity currencies is where the action sat. The pairs had a terrible week as the US Dollar moved higher. CAD had the best week losing 0.6% but AUD and NZD both lost around 1.5%. The weeks winner was JPY which gained 1.2% after hawkish BoJ comments during the week.

The week ahead is a very very busy one. We have a large amount of interest rate decisions with the Fed, BoE and ECB taking centre stage during the week. This will set the scene for Q1, and we will expect the markets post this week to begin their Christmas slowdown.

This is the final report for Cromwell for 2023. So, from us we wish you a peaceful Christmas and prosperous 2024.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Dollar Regains Strength first appeared on trademakers.

The post Dollar Regains Strength first appeared on JP Fund Services.

The post Dollar Regains Strength appeared first on JP Fund Services.