Last week the Trump Trade we had seen over the previous weeks came back into action as the Dollar moved higher.

The dollar made gains across the board as investors look to the December Fed decision and expectations are for a 25bps cut. While this could be the last for some time as we move into 2025 market expectations are for slowing rate of cuts. With Trump taking office in January the overhang of tariffs still poses a level of market risk.

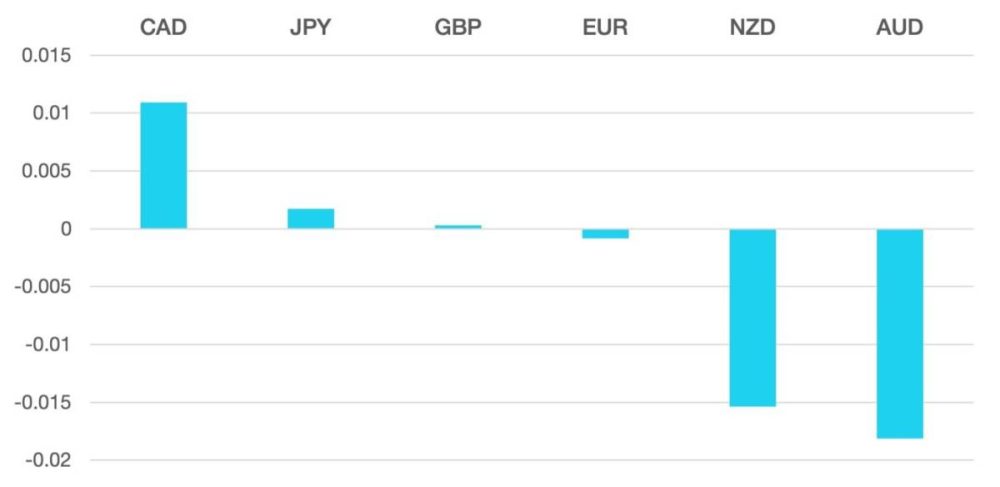

The Tariff risk is being amplified in risk currencies such as AUD and NZD and their reliance on a buoyant China economy. AUD is the currency most at risk and ended the week the worst performer.

Both GBP and EUR ended the week flat vs the Dollar and we expect to see this moving towards year end. We have upcoming ECB meeting which could offer further dovish guidance along with the BoE moving towards a more gradual approach to rate cutting.

Oil continued its weak trend albeit at a slower and less volatile pace. WTI ended the week 1.5% lower.

The week ahead we have inflation readings from around most of the developed world along with RBA, RBOC and ECB rate decisions.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Dollar Regains Upper Hand first appeared on trademakers.

The post Dollar Regains Upper Hand first appeared on JP Fund Services.

The post Dollar Regains Upper Hand appeared first on JP Fund Services.