Last week the US Dollar fell as the Fed rate focus shifted dramatically. The US CPI coupled with the previous payroll numbers all points towards a cooling economy.

This has shifted the view of traders who view a September and December rate cut as near certainties with some also forecasting a potential third cut in November.

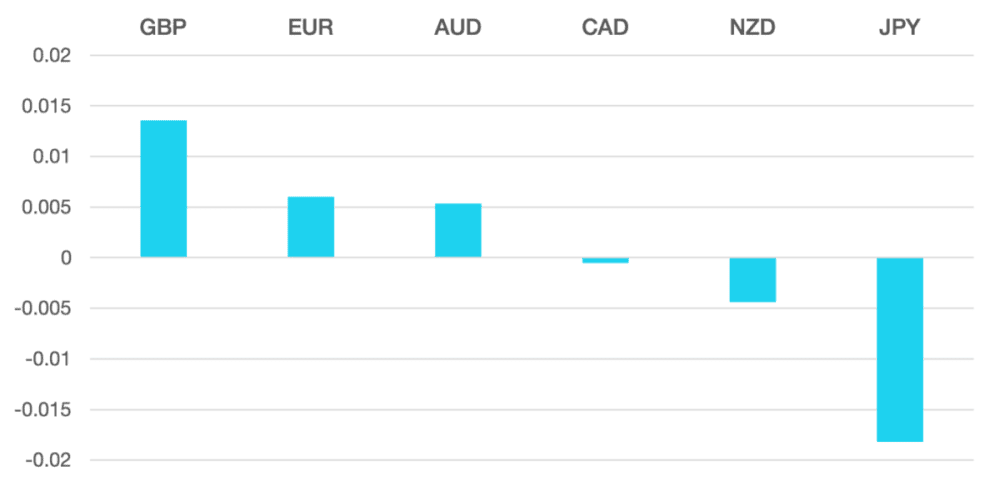

Despite the volatility in the US Dollar where majors posted gains the NZD lost ground post RBNZ. Dovish comments and hints of policy easing led the Kiwi to be the worst performer of the week.

Yen soared as some BOJ intervention as the dollar fell moved JPY to the best performer of the week. In order for it to maintain its momentum traders will be looking at the next BoJ meeting.

Both GBP and EUR had a good week. With a falling USD the 2 currencies performed but GBP had a standout week. Traders felt post-election we could see interest rates cut in August however these were thwarted by the BoE Chief Economist who citing persistent wage growth and inflation said that there was a preference to maintain rates at 5.25%

Oil finally lost ground after a month of straight gains. WTI fell 1.4% to close just above $82.

The week ahead is loaded with inflationary prints. We will also see what reaction the markets have post the assassination attempt of Former President Trump.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Dollar Sinks as Fed Multi Rate Cut Gains Momentum first appeared on trademakers.

The post Dollar Sinks as Fed Multi Rate Cut Gains Momentum first appeared on JP Fund Services.

The post Dollar Sinks as Fed Multi Rate Cut Gains Momentum appeared first on JP Fund Services.