Last week the US Dollar gained significantly despite US Yields struggling to move higher. Markets are now looking at the Feds monetary policy path to be slower along with fewer adjustments as we reach the end of 2024.

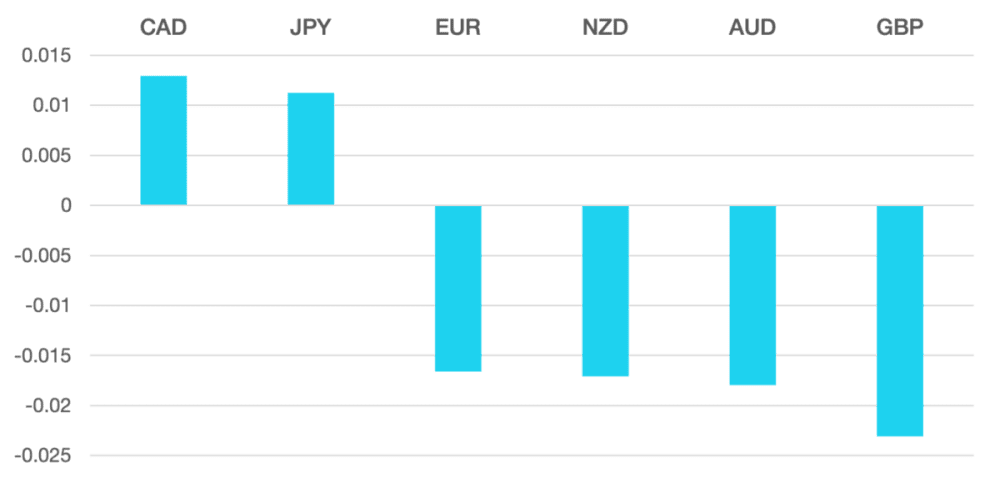

Alongside the US Dollar, Yen also surprised in its strength. Yen had a strong rebound without any verbal acknowledgement of intervention from the BoJ. While it lost vs the strong Dollar it made gains against the crosses.

GBP Ended the week as the wort performer, followed closely by AUD and NZD. All three had come under pressure by the deterioration in risk sentiment. GBP was under pressure as the latest GDP numbers revealed a weaker than expected growth number for the economy and an uptick in the unemployment numbers. This further cemented the possibility of a further rate cut in the near term.

Both AUD and NZD struggled as the markets are becoming concerned that the China stimulus has failed to create any real action.

Oil suffered and is now beginning to push support levels. WTI lost 5% to close below $67.

The week ahead we could see the Trump Trade continue with strong momentum. The fall in the indexes could see them regain the bullish momentum.

Data wise we have inflation numbers from EU, Canada and the UK.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Dollar Strength Dominates the Week first appeared on trademakers.

The post Dollar Strength Dominates the Week first appeared on JP Fund Services.

The post Dollar Strength Dominates the Week appeared first on JP Fund Services.