Seen through the eyes of an investor, the entire world is a market place that presents various opportunities and threats to his investment portfolio. All economies in this market have their strengths and weaknesses, and each is subject to various determinants that dictate its success or failure.

Despite this absolutely valid perspective, world economies are divided into several categories. Income and development being the deciding factors of this division, the rate and nature of investments is then determined by how well an economy fares. While some markets are highly mature and developed, attracting highly calculated and thoughtful investments, others are yet to experience such formalization.

What are Emerging Markets and how can they be classified?

Classification of an Emerging Market

The term, Emerging Markets has become quite a buzzword. An EM is defined as an economy that has low to middle tier national income. Such a market has some attributes of a developed economy but is not quite there in terms of classification because it still exhibits many characteristics of developing nations as well.

Classification of Emerging Markets is at best subjective. Even though there are many statistical and objective indicators of these economies, Economists agree that very strict and inflexible limits should not be applied when classifying EM from those that are developed. Therefore, it is unanimously agreed that the term emerging markets is loosely defined, comprising of close to 80% of the worlds economies.

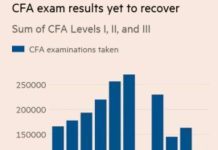

The biggest characteristic to define an EM is the rate of industrialization and growth. With the manufacturing sector booming, a countrys economy is sure to speed towards development. Hence, another word for Emerging Markets is fast growing economies, because these countries are known to use the abundance of natural resources to turn the economic wheel and emerge on the globe.  Source: Future of China and Emerging Markets, June 25, 2013, Global Foresights

Source: Future of China and Emerging Markets, June 25, 2013, Global Foresights

Consequently, what is in focus is an Economic Reform Program that will change the way the country is run economically. This reform changes the status of the market from being closed to open and transitional in nature. Bringing stability is the main goal for an EM because with economic stability comes a positive effect on exchange rate, confidence and efficiency.

Classification of Emerging Markets is never done based on the size of the country. EMs can be small or large, the example of China being the most applicable. Even though China is known for its super-fast development and industrialization, it still falls in the category of Emerging Markets.

For an emerging market to truly emerge and be recognized, principles of transparency and internal accountability are a prerequisite. If the economy is to function in sync with the progress and development of the world (read: developed nations), the improvements in its state should be measured with absolute certainty and transparency.

Emerging Markets from the Investment Perspective

Apart from the characteristics defined above, one key attribute of Emerging Markets is an increase in investment, both local and foreign. The buildup of confidence in the local market is the impetus needed for investors to think about putting their money in major projects with long-term yields. Within the economy, investors now start to access the movements in the countrys stock exchange that will enable them to earn sizeable returns.  Source: Future of China and Emerging Markets, June 25, 2013, Global Foresights

Source: Future of China and Emerging Markets, June 25, 2013, Global Foresights

From a global perspective, when an EM introduces reforms, it sets the stage for foreign investment as well. Keen interest from investors outside the economy is an indicator that the world is now taking notice of this market because of its fast-paced development. For the economy itself, this attention is much needed. Why is that so?

Interested investors, who have watched the progress of the country, eventually start to pour money into its markets. The influx of foreign investment and investor confidence are a key determinant in future growth plans. Emerging Markets are a very lucrative investment option for institutional investors who have a lot of financial support.

They provide a new avenue for the investors of developed countries to put their money into infant projects with high-predicted demands. Nonetheless, EMs pose a high risk as well. Investors who like a bit of risk in their well-balanced portfolios are the ones who are usually drawn to Emerging Economies because for them, the higher the risk, the greater the return.

Source: Outrageous Predictions 2014 Infographics, Saxo Markets,

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals