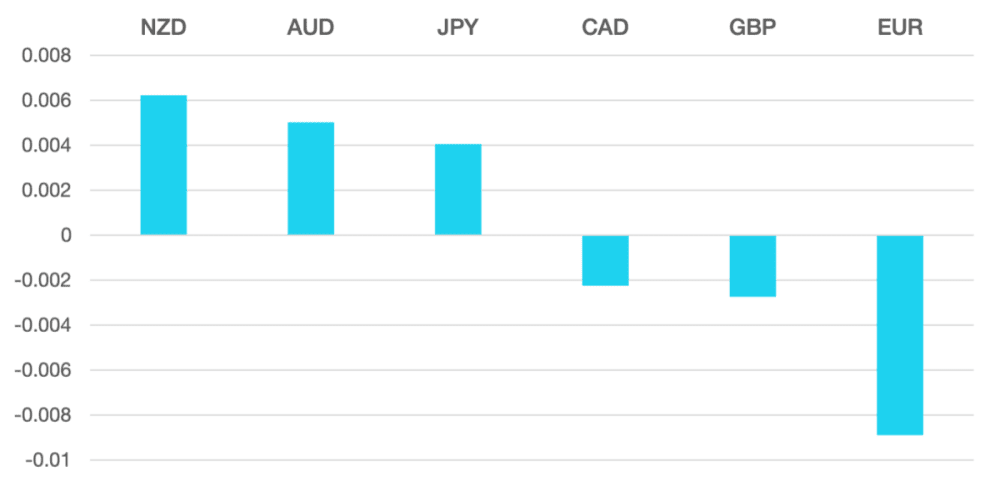

Last week we had the results of the latest European Elections and it delivered. The Euro was the worst performer of the week as President Macron chose to call a snap election on the shortest timetable allowable.

Across the Eurozone mainstream parties lost significant ground to their rivals heaping further pressure on the Union.

The dollar had a positive week with the FOMC decision and CPI dominating the US market. CPI came in slightly softer which helped move markets higher and with the Fed watching the data could lead to a move softer stance. The DXY ended the week 0.6% better.

GBP did not end the week unscathed. Mired naturally by the turmoil in Europe the Pound fell as the country gears up for its own elections in July. This moved GBP lower making it the second worst performer of the week.

JPY saw a rally later in the week. The BoJ failed to hold a strong stance on bond tapering going forward and later in the week declines in US and European yields provided some relief for the Yen.

Oil once again continued its volatile path. WTI rose 4% to close just below $78.50

The week ahead could see a continuation of the volatility. We have further interest rate decisions from RBA and BoE alongside inflation data from the EU and the UK.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Euro Elections Prove to Be Troublesome first appeared on trademakers.

The post Euro Elections Prove to Be Troublesome first appeared on JP Fund Services.

The post Euro Elections Prove to Be Troublesome appeared first on JP Fund Services.