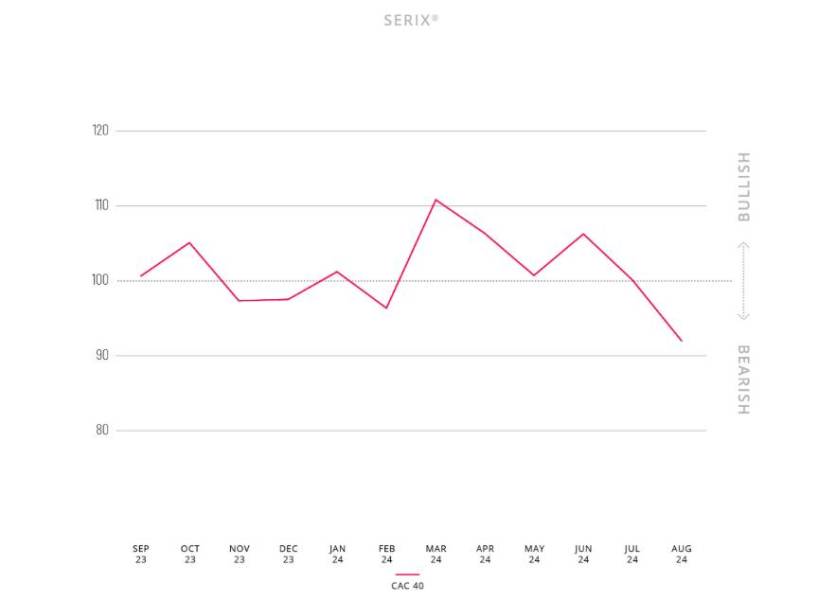

Spectrum Markets’ August SERIX data shows a bearish shift in European retail investor sentiment toward the CAC 40, dropping from 100 to 93, as economic and political uncertainty rises post-Olympics. Increased after-hours trading reflects heightened caution, with 38.7% of trades occurring outside traditional hours. Investor sentiment towards other indices, like the DAX 40, also turned bearish.

Spectrum Markets, the pan-European trading venue focused on retail investors, revealed a significant bearish sentiment shift in European retail investors’ attitudes towards the CAC 40 index. According to Spectrum Markets’ SERIX® sentiment index, sentiment toward the CAC 40 dropped from a neutral 100 in July to a bearish 93 in August, reflecting increasing apprehensions about the French economy. The latest SERIX data signals a pivot in retail investor sentiment, possibly driven by persistent political uncertainties, flat corporate earnings, and slowed growth in France’s luxury sector.

The heightened bearish sentiment, coming shortly after the conclusion of the Olympics, appears linked to both ongoing political issues in France and concerns over economic performance. Spectrum Markets recorded that 38.7% of trades in August occurred after traditional European trading hours – a peak in after-hours trading activity unmatched since November 2022.

Bearish sentiment and increased after-hours trading reflect economic concerns

The decline in CAC 40 sentiment is linked to broader economic concerns in France. Michael Hall, Head of Distribution at Spectrum Markets, noted that “our bearish investor sentiment index indicates a degree of pessimism among retail investors, as the attention switched back to politics.”

Following a temporary respite during the Olympics, Hall observed, political uncertainties have continued to unsettle investors, compounded by “headwinds in French corporate earnings, especially in the luxury goods sector.”

Declining global demand, particularly from China, has impacted major French companies, with underperformance seen in well-known firms such as LVMH and L’Oréal.

The post-Olympics economic outlook has likely contributed to the 38.7% rise in Spectrum’s after-hours trades, underscoring the demand for continuous market access. Spectrum’s unique 24/5 trading environment, allowing trades beyond traditional market hours, offers retail investors flexible entry points to manage the evolving economic landscape.

SERIX data analysis and trading activity in August

Spectrum Markets reported €306.3 million in total order book turnover for August, with 82.2% of trades focused on indices, 2.8% on currency pairs, 7.4% on commodities, 4.5% on equities, and 3.1% on cryptocurrencies. The NASDAQ 100 dominated the indices trading at 34.3%, followed by the DAX 40 at 26.6%, and the DOW 30 at 11.4%. SERIX data further indicated a bearish shift for the DAX 40, which decreased from a neutral 100 to a bearish 96, while the DOW 30 saw a slight rise but remained bearish, moving from 96 to 98.

The SERIX® index measures sentiment monthly by analysing retail investor trades across Europe, with scores below 100 indicating bearish sentiment and scores above 100 showing bullish sentiment. Spectrum’s proprietary methodology, which excludes matched trades and assesses long and short positions to gauge market sentiment, remains an essential indicator for understanding investor sentiment in the dynamic retail trading landscape.

Calculating SERIX data

The Spectrum European Retail Investor Index (SERIX) leverages pan-European trading data from the trading venue to provide insights into retail investor sentiment towards ongoing market developments.

The SERIX index is calculated monthly by analysing retail investor trades and subtracting the percentage of bearish trades from the percentage of bullish trades, yielding a single figure rebased at 100 to reflect the sentiment’s direction and strength:

SERIX = (% of bullish trades – % of bearish trades) + 100

In this context, bullish trades include instances where long instruments are bought and short instruments are sold. Bearish trades encompass scenarios where long instruments are sold, and short instruments are bought. Any trades matched directly between retail clients are excluded from the calculation.

About Spectrum Markets

Operating as a MiFID II-regulated Multilateral Trading Facility (MTF), Spectrum Markets provides retail investors access to a wide range of trading products across Europe, extending access with its 24/5 trading capability. Spectrum is committed to providing liquidity, stability, and low-latency order processing, and offers unique products like Turbo24, the world’s first 24-hour turbo warrant. Established in 2019, Spectrum continues to expand its reach across European markets, including Germany, Italy, France, Spain, Sweden, Norway, the Netherlands, Ireland, and Finland.

Shikha Negi is a Content Writer at ztudium with expertise in writing and proofreading content. Having created more than 500 articles encompassing a diverse range of educational topics, from breaking news to in-depth analysis and long-form content, Shikha has a deep understanding of emerging trends in business, technology (including AI, blockchain, and the metaverse), and societal shifts, As the author at Sarvgyan News, Shikha has demonstrated expertise in crafting engaging and informative content tailored for various audiences, including students, educators, and professionals.