FinTech associations from across the Asia-Pacific region have announced the development of the Asia-Pacific FinTech Network. The new network aims to facilitate greater association throughout the region and encourage innovation across borders. The Asia-Pacific region is so vast and diverse it usually resists any generalizations. The Asia-Pacific Fintech Network will focus on a range of sectors, such as artificial intelligence (AI). In fintech, AI can be used to hyper-target and respond to customers’ immediate needs.

Asia is taking the lead in Fintech adoption according to the latest EY Global Fintech Adoption Index 2019. And we are going to take a look at why Asia is becoming the Fintech hub of the world and what is next in Fintech in Asia.

Advanced FinTech systems are adopted by the vast majority from fast-growing young economies, such as China and India, to mature markets, such as Australia and Japan, and becoming part of everyday life. Today, almost every consumer has smartphones, and in Asia, the majority of people are gaining access to a growing range of virtual financial services, and at a faster rate than in most of the world’s other markets.

Within two years, consumer usage rates of FinTech-powered services have doubled across key Asia-Pacific markets. Hong Kong, Singapore, and South Korea have 67% FinTech adoption, while Australia now stands at 58%. For now, most markets still lag far behind China’s 87% penetration, except for India, which is now nearly tied with Asia’s leading digital power. A smaller five-market survey of 1,000 small and medium enterprises (SMEs) in Mainland China, the US, the UK, South Africa, and Mexico suggests that a similar dynamic holds true for businesses.

1. China keeps its lead

In Asia, China is still the market setting the pace for FinTech innovation. Unsurprisingly, China leads the way in SME Fintech adoption, with 61% of SMEs interviewed having used a banking and payments, financial management and financing and insurance service from fintechs in the past 6 months. The survey found that 87% of Chinese respondents now use one or more FinTech services and a stunning 99.5% are aware of online apps that facilitate money transfer, mobile payments, and non-bank money transfers. Unencumbered by legacy technology, and aided by their integration with China’s powerful and global ecommerce and social media platforms, such as Alibaba and WeChat, FinTech services are now thoroughly integrated into the life of the Chinese consumer. The global average is 25%, but EY suggests that China skews the data significantly, given the highly digitized and platform centric nature of the financial services economy.

Daily Fintech recently said about it in an article: “Skewed or not, it represents the future that the western world is lagging behind on.”

The SMEs survey told a similar story: at work as at home, online apps are now handling a steadily growing volume of businesses payments, borrowing, and investments. In developed markets, such as the UK and the US, the most widely used services are online bookkeeping, payroll management, online billing and online payment processors. In emerging markets SMEs are also frequent users of payments and billing services, but mobile point-of-sale devices and readers also feature in the mix.

2. But the game is changing – again

But don’t confuse ubiquity with maturity. Over the next few years, we expect to see many more changes in the Asian financial services landscape, driven by advances in technology, loosening regulations, and competition among these companies.

Based on current trends, we expect three themes to dominate Asia-Pacific headlines over the next two to three years:

Markets continue to deregulate. In Asia, financial regulators have tended to be the traffic cops of banking and other financial services, dedicated to keeping the stream of transactions moving safely. Now, in some markets, they are taking on a second role: helping build a market that is still safe, or even safer, but much more flexible and encouraging of innovation.

Virtual bank competition heats up. This year, Hong Kong bank regulators approved licenses for eight virtual banks. Most are slated to open for business in Hong Kong in the first quarter of next year. While startups with little experience and less capital led the virtual banking charge in the United Kingdom, Hong Kong’s new contenders will be new only to the city.

Primarily consisting of joint ventures backed by major Chinese financial services and/or tech firms, the virtual banks are likely to be formidable from the beginning. Rich, smart and experienced, they represent a very different challenge than startups usually do.

One measure of just how serious a threat they pose is the fact that Hong Kong’s brick and mortar banks are already cutting deposit minimums and sweetening account offers, even before any of the new banks have launched. Nor will the competition stay in Hong Kong: Singapore is also expected to license a range of virtual banking contenders soon.

Open banking takes off. The combination of a new regulatory infrastructure and a more advanced technical infrastructure is already changing financial services in some markets. Over the next two years, we expect that for more and more Asian consumers, “bank” will become less of a noun and more of a verb. Goodbye, lobby; good night, sleepy guards; farewell, portfolio of three or four products. Hello, personal finance app store, with hundreds or even thousands of virtual financial services tailored to your particular needs, for your family and your business, and available 24/7.

3. Competition everywhere

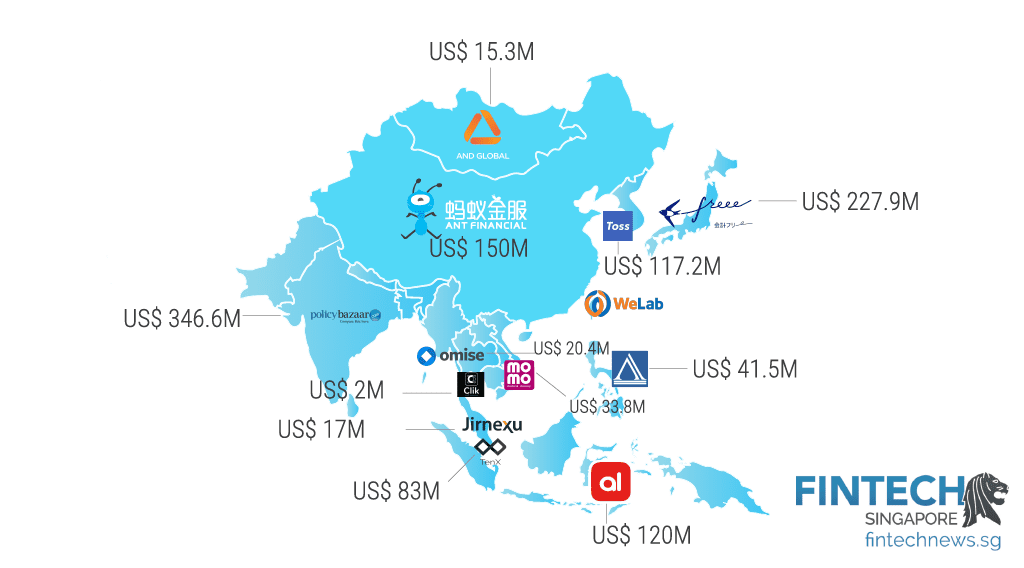

Most Asian markets continue to benefit from a powerful FinTech feedback loop, with increased adoption driving increased innovation – and vice-versa. Mainland China still leads in consumer and SME-focused financial services innovation, but in other Asian markets, Chinese investments, and the inspiration of their example to local entrepreneurs, are driving rapid market penetration and innovation. In India, in particular, competition between the Chinese giants and the US tech companies for slices of the colossal, fast-growing market should continue to drive rapid changes to the financial ecosystem.

At the same time, strategists at incumbent financial services in Asia’s mature economies, such as Australia, Singapore, and Japan, are bracing for the kind of sophisticated and well-capitalized competitors that Hong Kong banks see in their immediate future. The more far-sighted players have determined, correctly in our view, that their continued success will depend on how well they can disrupt their own businesses before these competitors arrive from the US, the UK, and most of all, China.

On top of that, they must be on guard against the occasional successful homegrown startup that lures away traditional customers with a value proposition more closely aligned to their needs. These changes won’t happen overnight, but the next two years will be a very important period of technical, marketing, and regulatory experimentation in Asia’s new financial ecosystem.

Fintech companies and products consumer adoption has risen rapidly worldwide from 16% in 2015, the year the first EY FinTech Adoption Index was published, to 33% in 2017, to 64% in 2019. The EY Global Fintech Adoption Index 2019 has identified that 96% of global consumers are aware of at least one money transfer and payment FinTech service. Out of 4 global consumers, 3 of them use FinTech money transfer and payment service, and consumer adoption of insurance service has increased from 8% in 2015 to about 50% in 2019. Adoption is used here to refer to the widespread use of a new application, product or process.

It has also confirmed the reasons why consumers use a FinTech competitor. Consumers like what they see. Consumers aren’t aware of or don’t understand how FinTech challengers work and trust incumbents more than FinTech challengers. It has stated in its consumer survey: “33% Consumers rather than their main banks turn towards other banks, 68% Consumers would consider a nonfinancial services company for financial services and 46% Consumer adopters are willing to share their bank data with other organizations.”

Read More:

which item is a benefit of using the travel card

why is self-discipline the key to becoming a good saver?

which of the following is a benefit of unified command?

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.