FinTech Alternative Investments Digital Fund Management solutions.

The ability to manage and extract value using solid and secure software such as fund management solutions from the right financial data and services has emerged as the most powerful competitive advantage for alternative investment organisations. FinTech Digital Fund Management solutions, such as fund management software, are critical for the asset management, funds and alternative investors, institutional clients and industry regulators.

The financial industry faces increasing regulatory regimes, tries to understand and execute various risks, manage increasing data challenges. Fund management solution technology that transforms and supports the way financial services operate, special fund management are critcial for teh industry.

“Now is the time to embrace digitization to gain competitive advantage in this dynamic market.”

Linedata Report, 2016

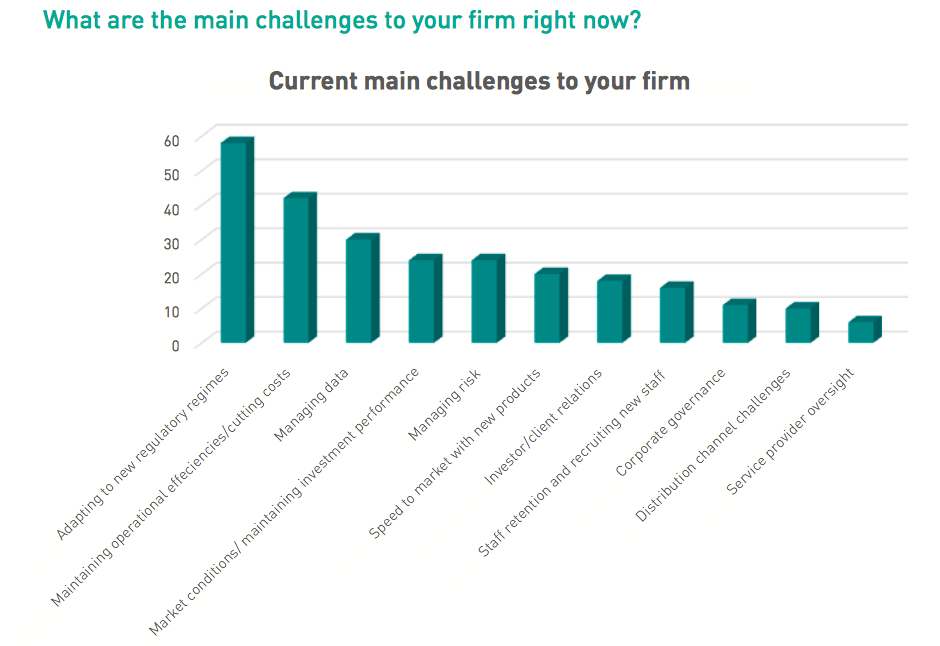

A Linedata report, from 2016, on Global Asset Management and Administration Survey, highlighted that the right fund management solutions, regulatory and operational concerns are the top challenges. Fund administrators, fund managers, and other alternative investment stakeholders have to cope with it.

The same study highlights that now more than ever, fintech driven intelligent applications of technology play a vital part in financial services industry. Tech fund management solutions are critical for investing, trading, compliance, risk, client and regulatory reporting software digital solutions and services. These solutions can and do make the difference for the most successful fund companies.

Alternative Investments And The Digitalisation of the Fund Management.

The financial industry, and special alternative investing sector are going through an accelerated revolution, partly developed by the digitalisation of the industry and its services. Digitisation – which is defined by Gartner as the use of digital technologies to change a business model and provide new revenue and value-producing opportunities – have a broader effect. This is sensitive in a fast disrupted alternative investing industry.

Tech fund management solutions improve a firm’s perception and helps assisting with new business development. This while creating a better data processing, full scope company and customer relationship management. The process also creates a dynamic workplace which encourages further innovation, promote staff retention and better business solutions.

The alternative investments industry as a whole, and the asset management industry are irreversible changing. Despite all the ongoing challenges of regulation and reform, new practices and processes are showing an outlook that is largely positive, with global assets under management topping US $74 Trillion at the end of 2014 (Source: BCG). This in a scenario of a predicted growth rate of 6% in the next four years – faster than the predicted growth in GDP (Source: PWC).

Such positive numbers are showing new possibilities. They have attracted the interest of diverse emerging forces outside of the financial industry. But also highlighted new challenges such as cyber security, fragile culture and legacy systems that needs to be replaced. All these factors add further challenges to the global fund and alternative investing market in deep flux. A place where increasing complexity has to be simplified to an old business of turning a profit whilst meeting sensitive obligations to regulators, investors and stakeholders. While keeping increasing flows of data, regulation needs and its related security.

The main solutions to these challenges in the industry are software as a service (SAAS) financial technology solutions. Examples are advanced fund digital management software that helps fund managers to optimise their efforts and processes.

Digital Software Designed for Fund Administrators.

Fund Administrators software designed targeting special at fund administrators is critical. Some solutions are:

- 1. Software to adapt to new regulatory regimes

- 2. SAAS that maintain operational efficiencies/cutting costs

- 3. SAAS that improve client service as a means of differentiation

Automated and secure software brings together a powerful layer of software as services that go through regulation, data intelligence, reporting, workflow management, tagging, and document storage that was specifically designed for the alternative investment industry.

SAAS platform for fund management and administration.

SAAS platforms for fund management and administration simplifies and automates the management and administration for small/medium sized private funds (private equity, real estate, hedge funds and venture capital). These platforms offer a solid fund management software that uses modern, cloud-based technology to make the complicated work of managing and administrating a fund simple and easy.

With the emergence of new fund administration platforms, fund managers are able to track investor communications and share documents from your personalized, secure vault. It doesn’t matter if you are a fund administrator, private bank, or a fund manager, you’ll quickly see that we’ll help you spend less time on operations and more time driving growth. Some services include:

- Regulatory and Tax notifications and reporting

- KYC preparations, and secure document distribution

- Encrypted delivery of sensitive investor communications

- Personalized fund management notifications and updates on request

- Contact grouping for simplified document distribution and enhanced scale of communication

- Internal messaging and communication

- Compliance facilities and management

SAAS for alternative investing are a solid fintech offer that the asset management, fund management industry increasingly needs. Its digital fund management software allows fund managers to better interact with investors, manage funds, execute investments, move money and raise capital

The ongoing fintech revolution shows that is innovating with fund management software and digital new fintech solutions the way to go for fund administrators. New fund management software solutions offer innovative ways to collaborate and interact between fund managers, clients and investors. This in a holist and optimised way that comprehends multiple areas such as digital reporting, fund / investor relationship management, document storage, distribution, operations, regulation, compliance, and more.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals