To ensure global long-term financial stability and economic development, the banking sector needs to significantly change its attitudes and actions to promote more responsible and sustainable business practices. The private and public sectors need to more urgently acknowledge and take meaningful action on significant global ESG challenges, such as climate change, population growth and resource scarcity. These ESG challenges have particular relevance to banks in relation to their role as financial intermediaries and as capital raising agents. Here are four key actions that financial institutions should be taking to prepare for the post-COVID-19 ESG mantra.

Banks are significant catalysts in promoting economic development. This role needs to include the promotion of sustainable business practices. Otherwise, banks will end up facilitating practices which have significant negative environmental and social impacts and will miss opportunities to create new products and services that capitalize on ESG issues. Banks can do this through timely and strategic integration of ESG into their business practices and processes.

Banks and financial institutions, like every business, are deeply intertwined with environmental, social, and governance (ESG) concerns. It makes sense, therefore, that a strong ESG proposition can create value. COVID-19 may have focused minds on the need for faster action on the ESG agenda, but it has also demonstrated that there are many complexities and considerations that must be understood and managed.

Four Key Actions

The financial shock caused by the pandemic created havoc in the global economy and has put both banks and borrowers under severe strain. For Banks their priority would be protecting their customer base to survive this pandemic without enduring significant long-term damage. Banks should make it possible to quickly identify their most valuable relationships, engage with such customers regularly and understand their changing needs, as well as empower employees to act quickly and decisively on the insights discovered. While COVID-19 may have slowed progress somewhat, it is clear that banks continue to embrace the ESG agenda.

Shifting towards more ESG-related business strategies, banks, regulators, and politicians are in a dilemma to understand all of the potential unintended consequences. Diminishing to renew loans on existing coal mines, for example, may improve a banks’ carbon disclosures. But it could lead to important social implications as mines close and unemployment grows (which, in turn, would have a massive impact on that market’s retail lending and potential losses). Having the experience, insight and data to map all those potential consequences/repercussions is proving to be a challenge.

The IMF said recently: “The lingering uncertainties about the ultimate length and impact of the shocks poses profound challenges to banking supervisors. Supervisors find themselves confronted with unprecedented challenges which call for decisive action to ensure that banking systems support the real economy while preserving financial stability. This is critical to prevent the health and economic crisis morphing into a financial crisis.”

In the latest report of KPMG, they mentioned the four key actions that bank executives should be addressing today. As said in the report, supervisors and regulators, in turn, are also working collaboratively Contributors in groups. The Network for Greening the Financial System (NGFS), a group of central banks and supervisors, was created to share best practices around key systemic challenges (such as integrating climate related risks into financial stability monitoring and micro-supervision).

Further added in report was that while some big questions and uncertainties exist, it is clear that bank executives can no longer afford to take a ‘wait and see’ approach. Public and regulatory expectations are rapidly changing and the most competitive banks are already moving to take advantage of that situation.

Following are the four key actions

1. Understand your current baseline

Banks should focus on the understanding of common ESG expectations of key stakeholders and build awareness of leading ESG practices more than simply qualifying the financial risks and probabilities, in particular among senior management and board members. This process of understanding takes time in their current practices and exposures, whether they have the right data, the right skills and the right methods to monitor and manage ESG appropriately going forward.

2. Know what’s expected

While regulatory and supervisory authorities are examining different approaches concerning how they might provide specific targets or expectations, banks executives should be communicating to their regulatory authorities to understand what is being expected and how those expectations may change over the short or medium-term. They should also be working proactively with their regulators and authorities to seek out facts, develop standards and identify solutions.

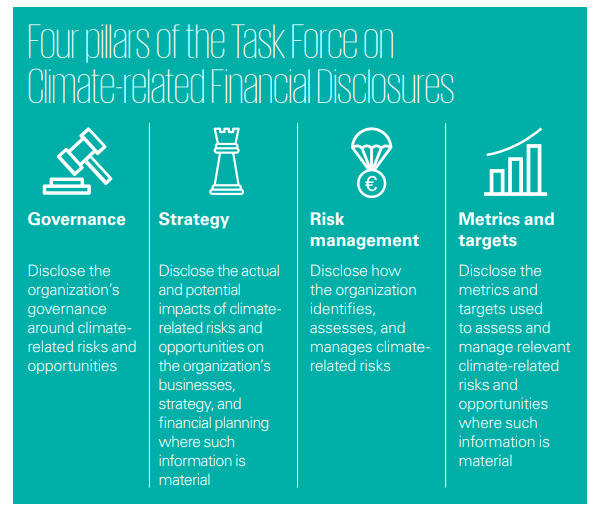

3. Put it on your risk radar

ESG factors remain a reputational risk for many banks. But they need to be more than that. Bank executives (and particularly boards) should be ensuring that ESG risks are a lens through which all decisions are made, in particular in relation to credit and valuation risks in their portfolios, reflecting the strategic nature of these risks.

4. Develop a strategy

ESG risks cannot be managed off the side of a desk. It requires banks to develop a robust strategy that is integrated into the overall business strategy for the organization. While the strategy must retain a level of flexibility, it must also be actionable and measurable.

Leading Towards a Sustainable Future

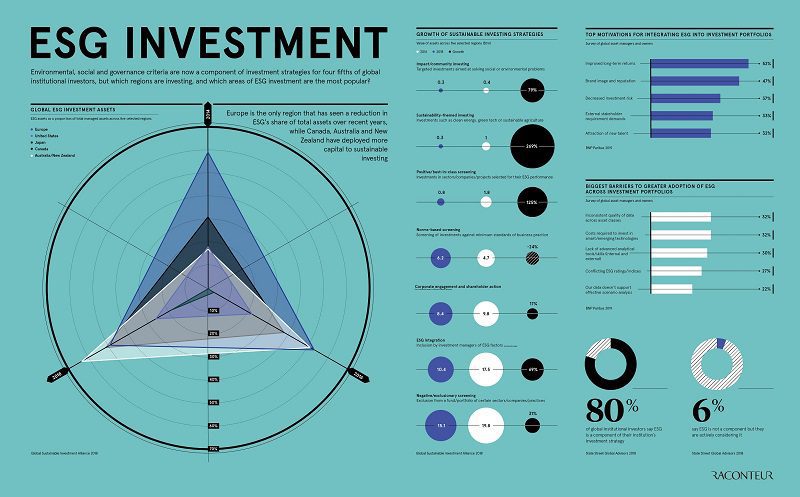

There will be no longer a discernible distinction between sustainable and traditional investing within 36 months. Sustainable investment is increasingly gaining a foundation in mainstream financial markets, including socially responsible, ethical, and ESG (environmental, social, and governance) investing. Sustainable actions can also be driven by financial institutions, and high-quality investment managers will use multiple capitals thinking into their lending and investment decisions, taking ESG considerations into account. These financial institutions can drive sustainable practices through their portfolio companies.

Corporate attention to environmental, social, and corporate governance (ESG) is not just a matter of ethics or morals. It’s also good business. ESG investing has been gathering attention since the 1990s. ESG performance, directly and indirectly, affects companies’ access to capital and long-term profitability. ESG policies and practices have a positive impact on a company’s financial performance and long-term business strategy as well as the attraction and retention of diverse talent. Traditionally, the main focus of ESG investing has been on equity markets. In recent years, however, ESG has spread out increasingly to other asset classes, in particular fixed income, given that bonds constitute a substantial percentage of institutional investors’ assets.

Few companies make it a priority to communicate their sustainability performance to investors, or even develop a strong story about their sustainability performance. Understanding investor priorities is an important responsibility for a company’s top executives and its board of directors. Based on their understanding of investor interests, an organization’s leadership will often focus corporate strategy and behavior in one direction rather than another.

Investors and analysts consider ESG performance in their fundamental analysis of companies. And they do so with the underlying premise that companies that proactively manage ESG issues are better placed than their competitors to generate long-term tangible and intangible results. However, a growing number of investors are paying attention to ESG performance, as evidence mounts that sustainability-related activities are material to the financial success of a company over time.

Investors care more about sustainability issues than many executives believe. With greater numbers of investors making investment decisions based on sustainability performance, it is time for corporate leaders to recognize that an increasing number of shareholders are (literally) invested in whether a company’s ESG activities connect with its financial success.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.