Only equity markets trade higher as risk appetite falls

As the Delta variant of the corona virus subdued several major economies around the globe, the Dollar strengthened last week. In countries such as Japan and Australia as well as parts of the Eurozone, economic activities had fallen due to the implementation of some quarantine restrictions. The unfortunate flooding seen in regions of Germany, Belgium and China will also have a negative impact on their economies. Furthermore, the ascending greenback trended higher during a period of softer short-term rates. Until recently the Dollar had been following interest rate trending patterns, which was atypical over the first half of the year.

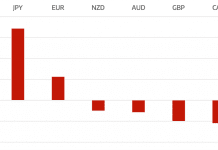

The impact on the financial markets from the spread of the Delta variant along with the severe flooding, has led to a low risk appetite in trading. Combined with the typically slower moving markets over the summer period, volatility has fallen in G-10 currency trading. However, with the exception to the rallying equity markets, the financial benchmarks traded lower over the past seven days. Heading into the current week, non-equity indices are on the heavier side with the Dollar starting the trading sessions softer against the majors. Commodities such as Gold and US Oil are relatively firm, however facing resistance at the higher levels traded from last week.

Investor attention for this week will clearly be focused on the FED meeting on Wednesday. Concerns will be directed to the fact that US inflation trend is elevated, despite the expectations that it will shortly fall back. June saw a period of accelerating inflation leading the markets to question the FEDs view on transitionary inflation was accurately evaluated. Therefore, can be hints towards fiscal tightening coming sooner than expected. Further data in to the health of jobs growth and number of homes sales will give an indication on the strength in the US economy. German GDP and Eurozone CPI data will be monitored for any weaknesses in the economic recovery in Europe.

FX Multi Core Trade Overview

19.07.21 – 23.07.21

| Total | |

|---|---|

| Total Buy Trades | 58 |

| Total Sell Trades | 47 |

| Total Trades | 105 |

What is FXMC?

FX Multi Core (FXMC) is a balanced, diversified portfolio from a number of different strategies, the portfolio is distributed across 4-5 trading styles which execute to its own risk/reward profile. The strategies are traded actively, and the allocations are monitored by strict risk management procedures to control trading exposure, drawdown levels, leverage and position limits.

The post FX Market View #21 appeared first on JP Fund Services.