The Investment Association (IA) data for September 2023 offers a glimpse into the evolving financial landscape in the UK, marked by notable changes in investor behavior and fund preferences.

The Investment Association (IA) data for September 2023 provides valuable insights into the dynamics of the UK investment landscape, indicating how investors responded to evolving market conditions and preferences for different asset classes.

The data highlights a fascinating pattern in the course of the year. The first quarter of 2023 experienced substantial net inflows of £3.9 billion, suggesting a robust appetite for investments at the beginning of the year. However, this enthusiasm waned in the second quarter, with net inflows dropping to £2.2 billion. While the third quarter saw a resurgence with £1.2 billion in net inflows, it is apparent that investors displayed varying degrees of confidence and caution throughout the year.

Outflows Reach Highest Point of the Year

UK savers withdrew a substantial £1.4 billion from funds in September 2023, signifying the most significant outflow witnessed throughout the year. This data suggests that investors may have been reevaluating their investment strategies or responding to specific market conditions.

Mixed Asset Funds Witness Modest Inflows

In September, mixed asset funds experienced modest inflows amounting to £781 million. This increase in investment marked a notable uptick from the £478 million inflow witnessed in August. It indicates a preference among investors for diversified investment options, potentially driven by a desire to mitigate risks and balance their portfolios.

Shifting Sentiment in Equity Funds

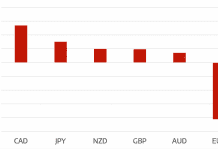

Equity funds, which cover a wide spectrum of investments in stocks and shares, recorded outflows totaling £1.6 billion in September. This contrasts with the moderate inflow observed in the previous month. The shift in sentiment towards equity investments during this period may reflect changing market dynamics or a response to specific economic conditions.

Fixed Income Outflows Slow Down

Outflows from fixed income funds notably decreased in September, amounting to £79 million. This marked a substantial reduction from the £298 million in outflows recorded in August. The shift toward reduced outflows from fixed income may be indicative of investors seeking the stability and income provided by bond investments.

Record Outflows for Responsible Investments

Responsible investments experienced record outflows of £544 million in September. This suggests that, despite strong overall demand for responsible investing, performance fluctuations in this sector led to some investors reallocating their funds. It is important to note that overall growth in responsible funds has been substantial, rising by more than 70% since 2020 according to IA data.

Sector Highlights

In terms of specific sectors, the UK All Companies sector saw the highest outflows, totaling £884 million. On the other hand, UK Gilts emerged as the most popular sector, attracting inflows of £237 million. These sector-specific trends reflect the varying priorities and preferences of investors during this period.

Emma Wall, head of investment analysis and research, Hargreaves Lansdown:

“It is not a surprise to see gilt funds topping the table for the most popular with retail investors across the industry. Enticing yields are offering investors with a five year view the chance of a real return over inflation. After a decade languishing at near zero rates, government bonds offer an exciting opportunity for income seekers. And this environment looks set to stay; higher for longer rhetoric has been repeated in the past week by both the Federal Reserve and the Bank of England, though chances of another hike by either central bank have dwindled. Investors should therefore ensure they have a balanced portfolio, with assets for growth, income and income growth – i.e. well-covered dividends, in their portfolio. In a falling rate environment, you want bond funds – witness the near three-decade bull run in recent history – and equities, as the falling cost of capital spurs capex, and dividends offer a real yield and a boost to total returns. In preparation for when the cycle turns, it is worth noting now what is currently undervalued – Japan, the UK and emerging markets on a regional view, and consumer stocks, REITs and financials for global sectors.

Responsible funds saw their highest level of outflows in September, as performance elsewhere has relative appeal. It is worth noting that underlying client demand is still strong in the retail space – frothy money leaves when performance dipped but that is the same with any momentum investment. While market-wide stats have shown some investors selling in recent months, Responsible funds have grown more than 70% since 2020 according to the IA’s data, and our own data shows strong demand from investors of all ages – not just younger investors.

Our recent survey highlighted that environmental, social and governance (ESG) related factors are a priority for HL investors when making investment decisions. Deforestation and corruption are big no-nos for portfolio inclusion, and 70% of our investors consider climate change extremely or very important when making investment decisions The message to companies is clear: transparency, ethical behaviour, and good governance practices are essential in attracting and retaining investors. Amongst HL investors, September saw a new addition to the cash and tech dominated charts of the past six months – Indian equity funds, driven by strong performance in the region.”

Diving Deeper into HL’s September Data: Top Fund and Trust Picks

Among the top funds that garnered net buys during this period, Jupiter India appeared to pique investor interest, reflecting confidence in the growth prospects of the Indian market. The Royal London Short Term Money Market fund saw increased interest, likely as investors sought the relative stability and liquidity offered by short-term money market instruments. Furthermore, the Fidelity Index World fund, with its global investment approach, appealed to investors looking for diversified exposure to international markets.

Tech-focused investments remained in demand, as indicated by the net buys for the Legal & General Global Technology Index Trust. Investors appeared to have temporarily parked their capital in the Legal & General Cash fund, possibly in response to prevailing market conditions. The Legal & General US Index also witnessed interest, reflecting continued enthusiasm for US market exposure. Moreover, the Pictet Security fund and the Pictet Premium Brands fund seemed to capture investor attention, as did the UBS S&P 500 Index, indicating a sustained interest in the US market.

Additionally, during the same period, several investment trusts stood out for attracting net buys. The India Capital Growth Fund Ltd Ord GBp0.01, focused on Indian capital growth, appeared to align with investors’ interests. Meanwhile, the JPMorgan Global Growth & Income plc Ordinary 5p trust drew attention from investors seeking global growth and income opportunities. In the renewable energy sector, the Greencoat UK Wind plc Ordinary 1p trust captured investors’ attention with its specialization in UK wind assets.

Within the smaller companies’ segment of the Scottish Oriental sector, the Scottish Oriental Smaller Cos Trust Ordinary 25p garnered net buys. Investors remained attracted to infrastructure investments, as indicated by the HICL Infrstructure plc ORD GBP0.0001 trust’s net buys. The BlackRock World Mining Trust plc Ordinary 5p aligned with investor interests in the mining sector, while the Sequoia Economic Infrastructure Income Fund Ltd NPV provided an avenue for income-seeking investors. Moreover, the CVC Income & Growth Limimted Ord NPV GBP trust seemed to cater to investors looking for both income and growth investments. In the public partnerships sector, the International Public Partnerships Limited Ord GBP0.01 trust saw net buys, reflecting investor interest in this segment. Lastly, Indian equity investments remained attractive, as evidenced by net buys for the Ashoka India Equity Inv Trust Plc Ord GBP0.01 trust.

These preferences in both funds and investment trusts reflect the diverse strategies and interests of investors during the period, encompassing global, regional, sector-specific, and income-focused investments that captured their attention.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals