Fintech is at a tipping point. Financial technology startups and companies have truly disrupted the financial services value chain. This is a thriving sector that has created their own ecosystems all around the world. In North America, the biggest Fintech ecosystem, Fintech startups are enabling any startup to become a Fintech company. In Europe, the biggest winners are now looking to expand abroad, trying to compete with well-founded and thriving companies from Asia Pacific. Elsewhere, Fintech startups in Latin America are lending to underserved consumers and SMBs, while in Middle East and Africa, Fintech enterprises are in arms to enable online and offline payments. Here is an overview of the state of fintech ecosystems worldwide.

Funding to global venture-backed Fintech companies has continued to set records. FinTech funding in 2019 has already surpassed 2017’s total, coming to $24.6 billion through the end of Q3 ’19. However, Fintech deals are expected to fall short of 2018’s record with a continued pullback in early-stage Fintech investing. This comes as the maturing sector is seeing increased deal flow at later stages.

Likewise, where they once catered to specific demographics, the sector is now — to all demographics, in a much larger playing field. And after proving product-market fit in their home geographies, the most successful Fintech companies are testing altered products in new geographies with unfamiliar regulations. In addition, these players are continuing to build out a tech-first financial infrastructure. Echoing other sectors, Fintech companies first “unbundled” incumbent offerings and are now “rebundling” them in an entirely reimagined financial stack.

Said so, let’s take a look at the state of Fintech ecosystems worldwide according to a report by CB Insights in partnership with Mastercard Start Path and titled FinTech in 2020: Five Global Trends to Watch. This report looks at Fintech trends and companies in five geographies: North America; Europe; Asia Pacific; Latin America and the Caribbean and Middle East and Africa.

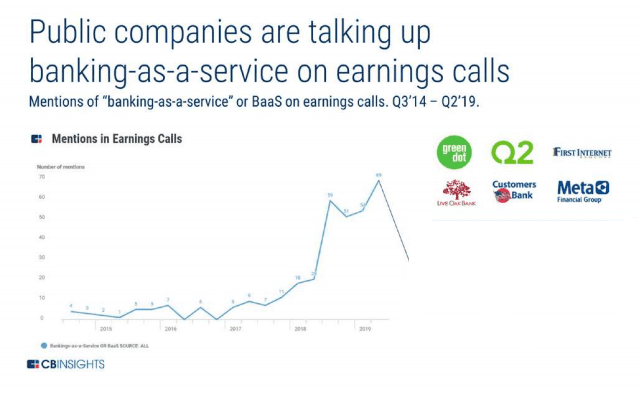

North America: The Rise of Banking-as-a-Service (BaaS)

In North America, the biggest Fintech ecosystem by companies and innovation, an emerging set of startups in the U.S. are providing suites of APIs, which other companies are leveraging to build banking and payments products. This is a model called Banking-as-a-Service (BaaS) and in practice, this means that companies across verticals are bundling Fintech into their platforms, echoing broader “unbundling and rebundling” efforts across the tech ecosystem.

Some innovators are Denver-based Infinicept, which provides a suite of automated services and APIs which allow companies to become payment facilitators; San Francisco based Bond (disclosed funding of $10 million), that connects banks with companies looking to offer financial services or New York-based Sure (disclosed funding of $23 million), a Fintech startup that offers insurance tech tools to retailers and insurance partners.

One of the characteristics of this market in NA is that startups here are building this infrastructure layer without top-down, comprehensive Fintech regulation. Such regulation is present in other geographies; Europe’s Open Banking regulatory initiatives, for example, have enabled a slew of emerging “challenger banks”. “Friendly” U.S. regulators have found it difficult to push Fintech innovation. In October, a federal judge ruled that the Office of the Comptroller of the Currency (OCC), did not have the authority to issue banking charters to Fintech startups — a significant setback for the sector. The OCC had planned to launch a “Fintech charter,” enabling Fintech startups to quickly offer loans and payments services.

However, as the report stated: “Fintech will continue to shift the financial services value chain in the U.S. Even without comprehensive regulation, top investors are continuing to bet on Fintech startups successfully building a new financial infrastructure.”

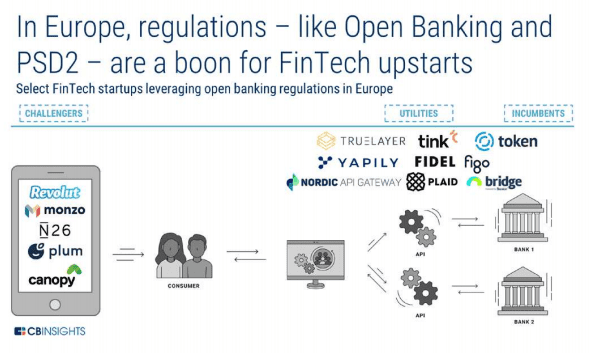

Europe: Friendly regulation boosts Fintech activity

In Europe, friendly regulation has helped transform the continent into a hotbed of Fintech activity. Open Banking and PSD2 have catalyzed the development of “Fintech utilities” – such as Yapily and Tink – which provide financial APIs to help incumbent banks comply and compete. These two frameworks have enabled the rise of challenger banks and middleware data players, and have also been leading to market consolidation.

Thanks to this, there are a good number of Fintech startups that are moving out of Europe and into new geographies like North America. For example, London-based Revolut has grown rapidly in Europe and has partnered with Mastercard to help it establish in the U.S. market. Another UK based challenger bank Monzo (disclosed funding of $416 million) is also looking to find additional customers in the U.S. on top of its more than 2 million existing customers (as of early Q3’19).

From mainland Europe, the best representative is Germany-based N26 (disclosed funding of $683 million). This challenger bank, which provides more than 3.5 million customers (as of early Q3’19) with personal finance and mobile banking solutions, launched in the U.S. in August last year after partnering with Axos Bank to hold and insure deposits.

As the report said: “Looking toward the future, European FinTech will continue to reap the benefits of comprehensive, friendly regulations. From a regulatory perspective, investors and startups in other geographies should look to Europe as a model.”

Asia Pacific: Southeast Asian startups are in an arms-race to become the next “super-app”

As per the report, Southeast Asia is at an inflection point in Fintech. With a rising middle class in a population totaling over 600 million people, as well as widespread mobile internet penetration, Fintech startups are finding fertile soil in which to build innovative financial services at scale. The largest internet economy in the region is Indonesia, which has more than quadrupled in size since 2015 to reach $40 billion. Startups are capitalizing on the opportunity.

Some of these, especially from South East Asia, are following in the footsteps of China’s “superapps,” Tencent’s WeChat and Alibaba’s Alipay. Both of these platforms first found product-market fit in verticals having nothing to do with financial services — social media and e-commerce, respectively — and have since expanded to provide comprehensive financial services to consumers and businesses. In the same vein, a number of Southeast Asian startups are moving from their primary lines of business into Fintech.

Some examples are Indonesia-based ride-hailing giant Go-Jek, which expanded into payments and saw the company’s mobile wallet Go-Pay a transaction volume of $6.3 billion in 2018 or Singapore-based Grab (disclosed funding of $8.8 billion), which has expanded too from on-demand transportation into financial services.

“Looking ahead, it remains to be seen whether Grab or Go-Jek can become super-apps. While investors want it, regulators — and the citizens they serve — have yet to make a decision,” was found in the report.

Latin America and the Caribbean: Lending to underserved consumers and SMBS

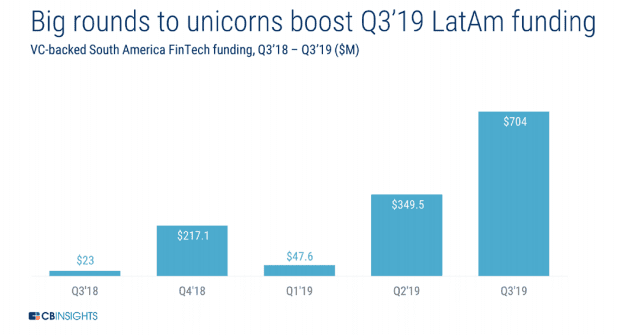

“Several emerging lending startups are transforming Latin America and the Caribbean (LAC) into a focal point for FinTech innovation. These companies are lending to underserved consumers and SMBs, with some countries in the region lacking developed financial infrastructure and facing political unrest,” stated the report.

Regulation in the area is fragmented, with stances varying widely between countries, although the general trend has been that LAC regulators have been slow to respond to Fintech needs and requirements, like Colombia, Chile or Panama.

However, Mexico has been proactive in its regulatory approach, enacting the Fintech Law, which offers legal standing and guidelines for Fintech companies, along with a regulatory sandbox in March 2018. Brazil is also making moves, establishing regulations in April 2018 to allow Fintech firms to provide P2P lending services.

Looking toward the future, Fintech startups in LAC should continue to flourish in spite of instability and sparse regulatory guidance, benefiting LAC consumers and business alike.

Middle East and Africa: Fintechs are finally enabling online and offline payments

In Africa, Fintech startups are leapfrogging legacy architecture, building mobile-first payments applications for the over 340 million adults in SubSaharan Africa without bank accounts.

One of those Fintechs is mobile payments platform M-PESA, that provides what is perhaps the most striking example of Fintech players leveraging vast and growing mobile penetration in the region. Started in 2007 by telecom operator Vodafone, the mobile money transfer and financing service is now widely accepted across multiple markets in the region.

From a regulatory perspective, Africa’s Fintech startups are largely working without much regulatory pushback. This is predominantly because African Fintech startups are bringing hundreds of millions of people into the financial system, while legacy banking institutions primarily cater to the continent’s wealthiest.

Fintech is a set of tech solutions that once began with digital payments for e-commerce and online transactions, but it made its way through to now be embedded in mostly all companies within the financial industry. In fact, Fintech startups are moving out of niche use cases and are beginning to operate at scale, providing services to all demographics worldwide. Comprising its own sector 15-20 years later, these companies provide services across the financial services value chain and are spreading across different demographics and geographies.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.