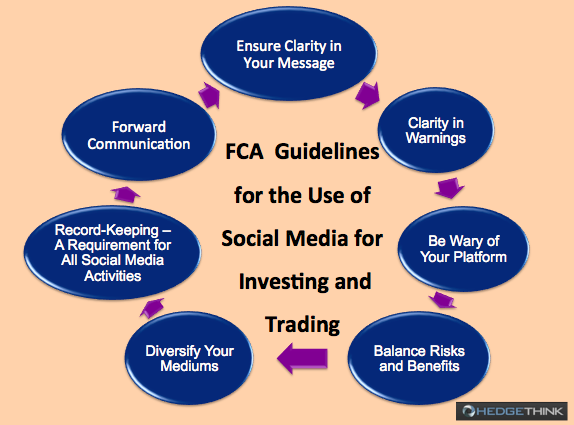

Financial activities are conducted under strict guidelines, both online and offline. Considering the free nature of the internet, particularly on social media, communication can be rather confusing and thus require a guideline for lucid communication.

Contrary to spreading misconceptions, the FCA highly recommends the use of social media as a tool for investing and trading. However, to ensure uniformity and fairness in practice, the FCA recommends certain guidelines companies are required to follow. Here is a guide to the Financial Conduct Authoritys recommendations and guidelines for the use of social media for investing and trading.

In building this Guide we consulted some industry experts. Dominic Crosthwaite from Black Swan Partners said about this:

The social media and customer communications consultation is a great opportunity for the financial industry to input into the future regulation of the use of social media by regulated companies.

The current legislation provides a reasonable framework from which the FCA will base their guidance, but we hope a wide range of companies have taken this opportunity to provide input and ensure the published guidance enables financial companies to embrace social media and take advantage of its benefits that include creating a more open, accessible and transparent financial market for retail customers.

Going forward, the guidance will provide clarity on issues around financial promotions, record keeping and how retail finance customer can communicate with each other about financial products, but there are greater challenges for companies that have multiple audiences.

An adviser can tailor their twitter account to target individual investors, but how does an investment management company target individual, professional and institutional investors through its social media presence. Is it obliged to use multiple twitter handles, provide links to a clear policy or simply focus on the lowest common denominator, which would seriously impact the effectiveness of its social media strategy?

The deadline for submissions is the 6th of November. About 40% of the submissions for the FCA Project Innovate in September were received on the the last day, so more submissions are expected right up to the deadline.

Social Media Ensuring Clarity in Your Message

Social media presents an opportunity for business people to connect and know each other prior to a phone call or email taking place Jeffrey Gitomer

What makes social media platforms unique is their ability to enable broad and rapid message propagation. As such, financial promotions can be posted and spread effortlessly to a huge number of clients. However, there are times when messages posted on social media may not be clear in their message. The FCA requires business to be absolutely clear in their posts in order to better serve clients and make use of the advantages of the internet.

For example, instead of stating click here for great mortgages, they should state, click here for more information about mortgages. Since both dont contain a warning, they cannot be promotions and thus the latter is more appropriate. To get more out of each tweet, businesses have begun to use other symbols and short-forms, such as @, $, & and CFDs. While it doesnt essentially pose a problem, it can if you are not clear with your message. After all, the clearer the message, the higher the chance those investors will take a proactive approach on your social media channel.

Clarity in Warnings

For any business thats looking to expand its investing and trading promotions, social media is a lucrative avenue. However, changes in communication policies have warranted the inclusion of new information on all promotions, particularly those on social media. When financial promotions are posted on any social media platform, companies are required to provide risk warnings in the message itself. If you are inviting clients to invest in a mortgage via a tweet, you need to ensure the picture features a warning. However, considering the probability of a picture to not show properly, its essential that some form of warning be contained in the textual content.

Regardless of whether a picture isnt used, the tweet should invite the client to their website without being overly promotional. In fact, it should contain both a promotional and warning message, giving the investor the information they need to make informed decisions.

Be Wary Of Your Platform

When delivering messages, both promotional and non-promotional, it is essential for businesses to clearly identify and acknowledge the platform being used. For example, businesses need to realize that on Vine, they only have 6 seconds to make a statement and up to 140 characters on Twitter. Realizing the appropriateness of each platform will ensure businesses deliver messages that are both fair and clear.

Diversify Your Mediums

To effectively use social media for investing and trading, businesses need to diversify their mediums and use each to their own advantage. For example, Twitter can be used to tweet about the release of a new promotional video on YouTube or a promotional picture on Instagram. The tweet itself can simply state the release of a new product and link to the video. This helps businesses garner greater traffic on multiple platforms, engage their clients better and thus strategically and effectively use social media.

Balance Risks and Benefits

If you are promoting a new financial product, the gains of a member or a new trading guide, ensure that you post a message, video or picture which contains a balance of benefits and risks. For example, if a Facebook post contains all the benefits of a guide and includes a Twitter link, the post will be deemed a non-compliant post. Instead, if it is stated that your investment is at risk and you can find a solution below, this post would be both a compliant and balanced post. It offers details of the product, both risks and benefits, and includes a link.

Record-Keeping A Requirement for All Social Media Activities

Businesses that choose to utilize social media platforms to engage and promote investing and trading are obliged to keep records of their digital media communications. Records should be signed off by a competent senior officer of the organization and should be kept safe from manipulation. Please do not rely on online communication records as many platforms can delete significantly older material.

Forward Communication

The FCA mandates that the original uploader of content, the initiating organization, will be held responsible for the information communicated. However, when it comes to the matter of forward communication, the same organization will only be held responsible if they forward the message further. For example, if a tweet is made by an organization, and their employees re-tweet it, then the communication is still the responsibility of the organization. However, if a client of the organization re-tweets it, the organization will not be held responsible.

Social media has become a measurable and lucrative platform for change and has become an ideal ground for promotions and marketing activities. For businesses who wish to utilize this platform to advance their own investing and trading activities, all they have to do is follow FCA guidelines. By doing so, they will be able to enjoy this platform to the fullest, grow with digital media faster than before and engage their clients on an entirely new platform. Non-compliance can lead to considerable hassle, so keep these guidelines in mind.

The FCAs consultation on its supervisory approach to financial promotions in social media ends on the 6th November. We have had had some excellent feedback so far but would encourage any other interested parties to let us know their thoughts by next Thursday. Richard Lawes, Senior Associate at FCA

Chris Turner is a versatile content writer with a passion for technology, finance, Investing and trading. He writes extensively on the subjects of Trading, Investing, Bitcoin, Forex trading, investing and general finance. He is writing and providing advice, education and encouragement to budding investors and traders, on Hedge Fund and alternative investments and other emerging financial trends. He is a contributor writer for HedgeThink.com and TradersDNA.com.