Funds of hedge funds: An Alternative Investment Strategy

Funds of hedge funds are an alternative investment strategy whereas the investment portfolio consists of a number of shares in various hedge funds. This is a substitute from investing directly into individual funds. There are many pros and cons of investing in funds of hedge funds and these are well-diversified investment vehicles that comprise of an array of other funds. This particular strategy comprises a portfolio that is made up of other investment funds instead of investing directly into various securities like bonds, stocks, derivatives etc.

Hence, the funds of hedge funds create a unique portfolio that only consists of other hedge funds. The way the hedge funds are to be invested in is chosen can vary at the managers discretion. The funds of hedge funds can merely only invest in hedge funds that fulfil a certain management strategy or plan, or they can be selected on the basis of many different investment strategies so as to gain exposure to all of them. Some funds of hedge funds invest in hedge funds that follow many different strategies along with a higher level of diversification, while on the other hand, some may invest only in those hedge funds that follow a similar set of investment strategies or the same strategies. This is known as a single-strategy funds.

Benefits of Funds of Hedge Funds

Since this is a strategy that makes use of a well-diversified investment portfolio, it has many other benefits as well.

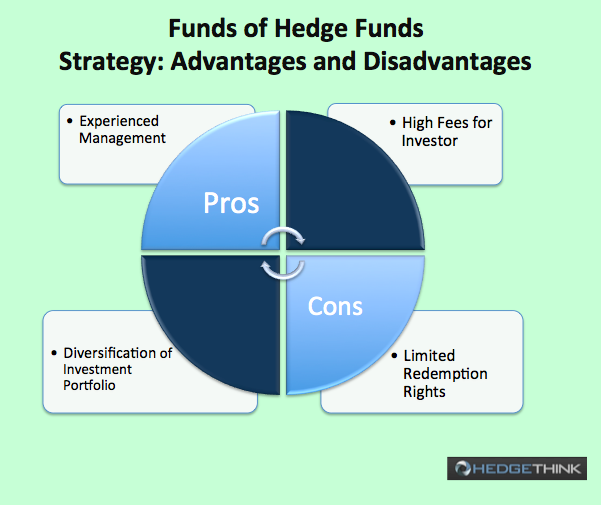

The foremost advantage of funds of hedge funds is the experienced management and the diversification of the investment portfolio. The strategy requires that the hedge fund manager has ample experience and skill to choose the most appropriate hedge funds based on its past performance and other factors that is important for the investor. Simply put, if the fund manager is highly skilled, he will choose the best hedge funds that will decrease the risk potential and raise the rate of return for the investor.

There is an opportunity of achieving instant diversification in a portfolio comprising of hedge funds. This is specifically advantageous for an investor who has a large portfolio to invest in hedge funds so as to reap the benefits of diversification to the fullest. For instance, if a large investor invests in a fund of funds with 15 to 20 hedge funds in his portfolio with a minimum investment of $500,000, it helps the investor to gain exposure to the alternative class of assets without sabotaging the overall portfolio structure.

Most hedge funds have an extremely high minimum initial investment requirement of up to one million dollars. However, via the funds of hedge funds, investors gain access to some of the best underlying hedge funds in the country with a smaller initial investment requirement. This initial requirement can become even less. In some cases, the funds of funds may invest in one hedge fund and offer shares at a lower initial minimum investment than the underlying hedge fund does.

Disadvantages of Funds of Hedge Funds

The main disadvantage of investing in funds of funds is the high fees that the investor has to incur. The fund manager has high performance fees among other fees. Typically, every underlying hedge fund may charge a fee that is 1% to 2% of the assets that are under management, additionally, an incentive fee of 15% to 25% of total profits garnered, is also incurred.

Another disadvantage of funds of hedge funds is the limited redemption rights. The investor of a funds of funds may be restricted to the timing and the amount of money withdrawn. Some funds may have the added feature of gates or lock ups on the investor capital. Lock-up is defined as the period during which the investors may commit their money and can last a few years or so. Gates are limits on the percentage of capital the investor is allowed to withdraw on the redemption date.

There is a complicated and intricate tax structure for funds of hedge funds. Even hedge funds themselves have a complex tax structure as they are usually formed as limited partnerships, with each investor as a partner. Then each partner is responsible for a proportionate share of expenses and profits and every partner has to pay tax on the capital gains enjoyed. The fund of funds enhances this complexity as it accumulates the profits, expenses and capital gains from each hedge fund in the fund.

Conclusion

In spite these criticisms for fund of funds, many investors are resorting to this alternative and as a result, this has been the fastest growing hedge fund as compared to any other category of hedge funds. The benefits of diversification, lower risk, professional oversight, experienced managers and potential for higher returns is what is enough for investors to opt for this alternative.

Related Post:

Guide to Research on Hedge Funds: Part 1 Introduction

Guide to Research on Hedge Funds: Part 2 Essentials

Guide to Research on Hedge Funds: Part 3 The Language of the Futures Industry

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals