Hilton Supra is a business and financial industry veteran and thought leader. Hilton has more than 30 years of Finance, Investment, Banking and Asset Management experience in international markets namely London, Europe, Africa and Asia. This while having a passion for growing businesses, for fashion and new technologies, especially fintech and blockchain where he has been deeply involved since these technologies inception. Now, Hilton is co-leading the fashion directory fashionabc as well as technology startup Ztudium.

From Quantitative Asset Management, Capital Markets, Trading software, Hedge Funds and Private Equity, Hilton has worked for Morgan Grenfell, Deutsche Bank, AXA Investment Management, EIM Fund of Hedge Funds (responsible $2.4bn of $13bn) and Cheyne Capital. Hilton is a graduate in Engineering from Oxford Brooks University and a Master in Finance at London Business School. Hilton has always been on the leading edge of innovation and technology in banking, derivative trading, quantitative asset management, hedge funds and since 2015 the application of FinTech, AI and blockchain to enterprise solutions.

Hilton Supra, is a partner and board member at ztudium, and the co-founder and one of the leading personalities driving techabc, openbusinesscouncil.org and fashionabc.org platforms.

This interview explores his career, highlights and how he sees the financial world, the fintech ecosystem, the startup and technology world and his views on the business challenges and opportunities.

Hedgethink: First of all, who is Hilton Supra? What can you tell us about your career? How did you get into the investment field? And what are the major milestones that have taken you where you stand now?

Hilton Supra: When I arrived in England 1977 from South Africa at aged 17, I was fortunate to experience the nascent growth of technology, where at school, we started programming in basic at the computer club and then this was followed by learning Fortran at Oxford Brooks University when I was studying Engineering. I was not a very good programmer, but I realised very quickly how powerful FinTech could be and started using technology tools when I joined Swiss Bank Corp in London on their Eurobond desk.

We started using technology for trading and then later an implied volatility programme written in basic for the top 100 UK companies and their options on the LTOM, when I had moved on to another broking company. Having had these positive tech experiences, I then joined a quantitative risk model provider and consultant, where the technology developed, was used to manage the risk of equity portfolios and global asset allocation. This experience took me to Deutsche Bank where I joined the quantitative development broking team that used quantitative risk, selection and timing systems to selected stocks, created equity portfolios/baskets against benchmarks and provided trading ideas to our clients.

Having been on the sell side, I had an opportunity to work on the buy side and joined Rosenberg Quantitative Asset Management, where the founder Barr Rosenberg was famous for developing one of the broadest used risk models (BARRA) for managing quantitatively driven global equity portfolios in a systematic way. Here not only did we use the risk model, but there was a very powerful alpha model which used multiple balance sheets and income factors to derive the alpha.

The company successfully became part of AXA Investment Management and having learned a lot about alpha and long short equities, I was fortunate to join Arki Busson at the EIM Group where I was able to apply my buy side skills and understanding of “quant” to build tailor made fund of hedge fund portfolios for Pension Funds and Insurance companies. This is where I really understood about all the different hedge fund and trading strategies from Global Macro, Event Driven, L/S Equities, Market Neutral, Arbitrage and Credit, with all their different applications. Building and managing these fund of hedge funds against pension fund liabilities and benchmarks led to the nascent development of risk premia and alternative beta, which is being applied today, very successfully in the industry.

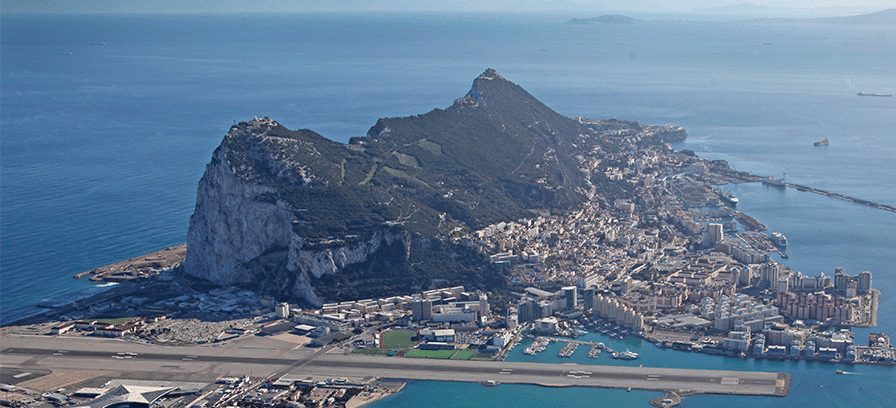

The financial crisis was a turning point and the de risking by clients led to many portfolios being liquidated and I joined Cheyne Capital, a specialist structured credit hedge fund manager. By then I was already living in Gibraltar and made the decision to develop my own incubator of Fintech focused companies and having seen the development of blockchain I realised that it was one of the tech solutions in FinTech, where it needed to be complimented by AI and Cyber security.

Meeting up with Dinis Guarda at Ztudium and joining the organisation as a partner was another key moment where I realised that in order to grow companies successfully, you not only needed the tech platforms but, the ability to develop and scale networks of potential customers to monetise the tech solutions, based on an industry and not just a single brand. This is where I am today, and we have various platforms that we have been incubating, which are now leaving the nest and beginning to be scaled.

Hedgethink: In your biography I can glimpse how cutting edge technology and investment practices have been two major pillars in your career, always from a financial perspective. How has this shaped your vision of the world?

Hilton Supra: Having always been on the leading edge of the application of technology to businesses, asset management and the financial world, the rapid growth of technology and its uses is becoming adopted to solve the many challenges that exist today. Having spent my youth and travelled extensively in Africa and Asia on business, I see how technology solutions can have an impact on people and lifting them out of poverty, access to economic inclusion and education. I am passionate about doing what I can to develop technology solutions that when deployed and scaled, bring as much benefit to as many people as possible. Working with the stakeholders, like governments and state institutions as an enabler rather than a disrupter is the best way forward. The technology revolution 4.0 is now and it is important that as many people benefit from this as possible, rather than a few.

Hedgethink: In your opinion, how healthy is the investment landscape in Europe? What are the best financial options (venture capital, private equity, ICOs, IPOs, hedge funds, etc) out there to get funding for newly founded companies?

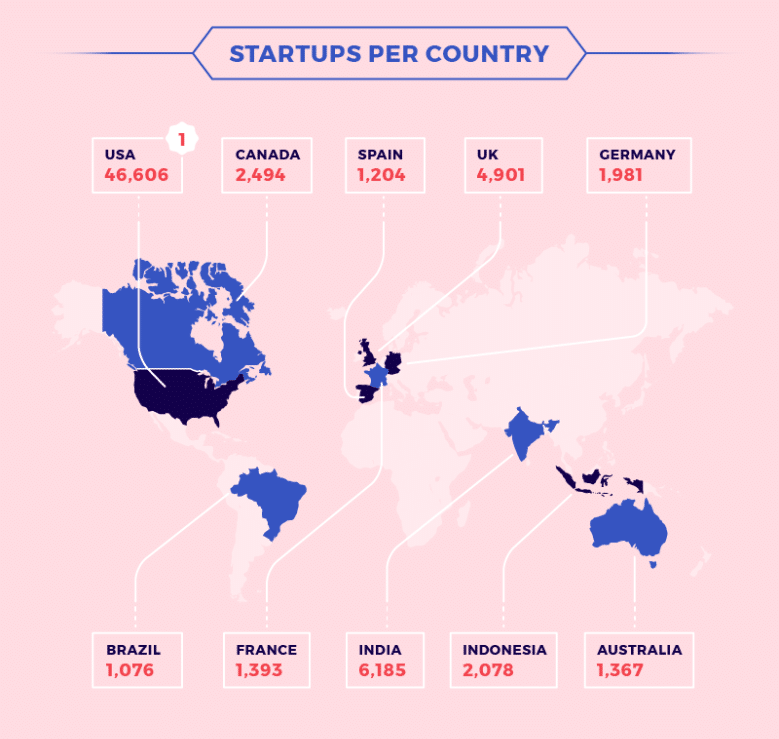

Hilton Supra: There are many centres of influence in the world, where the smart people and their ideas are concentrated, like London, Berlin, Silicon Valley, Singapore and Hong Kong for example. But, there are so may more centres and human capital, investment capital and resources which need to be supported and encouraged.

Europe is very strong with regards to start-ups, venture capital and there are many new ways in which capital is being raised for these companies. I have always been in a very regulated environment for investment and any new technology or new type of security needs to comply with these regulations. I witnessed many companies trying to circumvent regulations or disrupt the status quo, but as you will see today not many have succeeded. Those that have survived have fallen within the regulation. As I said before technology and innovation is for the benefit of the many to have an impact and the many need to be protected.

The biggest risk is where technology companies become the liquidity provider and their balance sheet fund the large proportion of the economic activity of a country, there has to be a risk here. Looking at other areas in Europe, you will see that Lisbon, Stockholm and Paris have healthy startup ecosystems, where the government has encouraged these innovation centres to develop by providing financial incentives for the establishment of start-ups. In terms of investment funding there are two types of investors, those large VC’s that invest a small amount in many, knowing some will fail and and that there will be a unicorn to make up for these losses.

The other are those that look at the landscape from a strategic partner perspective and provide capital when required, get to know the founders and product well and support their development and growth. This latter approach allows the founders to spend 90% of their time building their business and 10% of their time on finding investors. In reality the biggest risk to failure is where founders spend 90% of their time looking for capital and 10% of their time running their business.

Having a strategic investor is preferable where their experience and mentoring ensures that founders are well supported in terms of investment instruments, there are many and these that have to be clear, simple and transparent for the sharing of risk and reward, the alignment of interests and to incentivise one side to deliver and the other side for the financial support.

Hedgethink: What are the main hazards/opportunities for business startup incubators and investment funds today?

Hilton Supra: The main hazard for incubators and funds today is when they are making investments in new startup companies, most are essentially digital transformation companies of existing products and services and not as they believe “truly disruptive”. Their approach is from a disruptive perspective, where in reality many are either clones of existing alternative payment system or clones of a “gig “economy service taking on the legacy incumbent, like governments, regulators and big corporations. In order for these companies to succeed and scale, they need to have big and deep pockets.

These are not disruptive business models, they are digital transformative businesses models where apart from tech costs the majority of the investment required, is a budget for marketing to get customers, adoption and scale.

Another hazard are companies that are digitally transformative but then build their own tech, when the tech is already out there and can be created from white labeled providers. Another hazard is build the tech first and then scale and market to customers later.

Businesses that have already an engaged digital community, where through this engagement, they can truly identify the needs of the community and though this “live” market research, they can effectively drive the direction of the technology development. So in this preferred situation, the tech solution or platform can be introduced to the already engaged community with a higher likelihood of adoption and therefore success. Companies that look for strategic partners as investors have a higher probability of success.

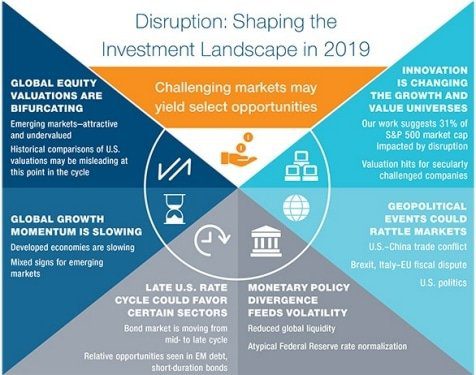

Hedgethink: And looking at the near future, how Brexit, or international economic tensions such as the trade war between US-China can alter the current state of things? Do you see them as an opportunity, or as a threat for investments?

Hilton Supra: What is interesting about entrepreneurs is that they are wired to see opportunities, find solutions in the face of insurmountable problems. By nature founders that succeed go the extra mile and take the tough decisions to succeed on their vision.

Brexit like trade wars present to most people a problem, but to a visionary this is an opportunity. Investment funds have already moved units to Europe so that they can continue providing investment services post Brexit. In our case, we have already planned a move to Portugal and regardless of the Brexit outcome we will benefit from being in Europe and London.

In fact the financial incentives and talented human capital available in Portugal are significant and regretfully this will be a loss for the UK. In terms of other existential effects like trade wars, capital is highly mobile and there will be many opportunities available for this risk capital to take advantage of the chaos and disruption.

Hedgethink: Is it technology-based new platforms and companies currently driving (and drawing) the investment landscape? And the financial industry as a whole? Do you think Fintech, and all the technologies around it, is a temporary buzz or a truly change in financing practices?

Hilton Supra: As I mentioned before we are at the beginning of the 4th industrial revolution where technologies and trends such as the Internet of Things (IoT), robotics, virtual reality (VR) and artificial intelligence (AI) are changing the way we live. Blockchain technology is just another technology that needs to be combined with AI and cybersecurity in order to succeed and be secure.

Tokenisation, whether as a utility, security or reputation token are essentially vouchers or points based systems and if developed as an alternative to fiat currencies or securities, will have to overcome many regulatory hurdles to achieve scale and success, which comes at high cost.

Tokens are frictionless value transfers of immutable trust and value within a business ecosystem and not “new money”. I have seen many so called buzz events in the last 40 years to realise that one should not get caught on the wrong side of the buzz.

You may recall the disruption of the financial industry in the 80’s, the ’87 crash caused by financial models and early computer trading that did not factor in illiquidity, also the significant flow of capital to Asia and the crash in the early 90’s where illiquidity was a result of high domestic interest rates to attract foreign capital, the dot com crash of 2001, where it was limited by network scale and technology, 3G and dial-up, which resulted in a mismatch between the number of customers required to justify the ROI, and the last credit crisis and more recently the blockchain hype.

In most of these hype periods, I recall that being in the financial markets, and particularly on the leading edge, one has to look beyond today and understand the drivers of change and the long term benefits of that change, conscious that a wall of capital will result in failures.

Ask the question, will the technology be able to scale and will there be customers engaged and being monetised to satisfy the return on the capital. And most of all understand the mismatch between the businesses and the lack of potential liquidity.

Hedgethink: You have been working since its emergence hand-in-hand with companies that are based on blockchain to develop their products. Is it blockchain the next revolutionary technology? How long do you think blockchain needs to become the technology that drives the industry?

Hilton Supra: Blockchain is just another technology that decentralises, provides immutable trust and frictionless transfers of value. It needs to be combined with other technologies to become a successful solution. These other technologies need to enable the secure way to prove identity, network behaviour, activity in a secure environment. Blockchain on its own that will not drive industry, but be adopted by industry as a technology to provide transparency and trust.

Take for example the supply chain, blockchain has a strong use case in ensuring the visibility along the supply chain of transparent and reputable businesses. Already we have developed and integrated blockchain along with other technologies in the supply chain solutions we have for industries, like the fashion industry.

Certifying that all the members along the supply chain, their level of sustainability, their ability to meet their financial obligations and payments, their impact on the environment, their treatment of employees and then to deliver this to the consumer at the point of sale will become an industry standard. This is where blockchain, for example and other technologies when combined together create an industry wide solution and platform for the fashion industry supply chain. Building a single brand silo of technology for a single company has significant risks, however I always advocate building an industry solution.

Hedgethink: Based on your experience and the companies you have worked with, how is blockchain and FinTech now changing the world?

Hilton Supra: Where I see blockchain and FinTech changing the world is in developing countries, regions and economies. I was born in Africa and still travel and invest there, so I am acutely aware of how FinTech can have a significant impact on the lives of many people currently excluded from the economic system. Likewise in Asia and South America any application of FinTech in terms of allowing participants with a phone, to make payments, identify whom they are, prove where they live and what they own and receive grants and aid immutably will have significant impact.

For example we are working with a West African country, one of the poorest in Africa where through the Central Bank and with a Government ID, we have delivered a complete mobile payment system operating on 3G network for nearly 5m people. Here the central bank is the liquidity provider, through loan and micro-loan financial co-operatives and in addition there is a marketplace for other financial services and education. As it gets adopted, it will have significant financial inclusion and impact on the country.

Change is always slow in the beginning and its important that the transfer of knowledge to run and maintain the system is key, so it will take time, however, the impact will be significant.

Hedgethink: You have a substantial experience and interest in the fashion world and have co-founded fashionabc.org. Can you explain your views and experience on the fashion industry and all the relationships with social impact, supply chain, technology, gender and environmental impact?

Hilton Supra: Over the years I have realised that 1 on 6 people world-wide work in the fashion and related industries, where 80% of them are women, 85% of textiles end up in landfill, textile manufacturing is the 2nd highest user of water in the world and the industries carbon footprint is around 10% of the global carbon emissions. Now the consumer is becoming aware of this and there are various initiatives by the big global brands and fast fashion to prove their environmental, social and sustainable credentials, but no brand has successfully scaled such an initiative yet.

I invested in a fashion business some time ago where we sourced materials and manufacturers which had some of the right sustainable elements in terms of paying workers properly, legally and equally, but this was not sufficient in proving the provenance and sustainability of the supply chain to the consumer apart from a massive marketing budget and 3rd party verification. The only way to do this is to step out of the brand silo and build a technology supply chain solution that was transparent, ethical and for the whole industry. This is where I became passionate about the technologies we had available to us at ztudium and hence the development of fashionabc.

Here we are able to provide an industry platform for participants on the supply chain so that they can immutably prove whom they are, what their sustainable and impact credentials are, how their products are produced and distributed along the supply chain. The key here is providing the consumer, technology that gives them the information regarding the transparency and trust that the item they are buying falls in line with sustainability and the circular economy. One of the biggest problems in the supply chain is finance, and with technology, this enables the underbanked to have access to supply chain trade finance, which has incredible impact on the participants in that supply chain, making payments to each other directly, and having access to global markets. One thing that it very important is that with technology education and skills training becomes easily accessible to participants and this we believe is the greatest gift to anyone, the transfer of knowledge and experience, since this I believe is where the greatest impact is and that can be provided via technology and such a platform like fashionabc.org

Hedgethink: What other thoughts do you have on digital transformation, technology and businesses?

Hilton Supra: Technology has always been in my life and career, going back to 1972 when as a 12 year old boy, I first saw two computer systems each filling up a room, one at the largest mining companies in South Africa where my aunt was using it in the accounts department and the other at the university.

Today my smartphone has more capacity and functionality than those two computer systems combined. When I first programmed in basic on a paper tape and then a magnetic cassette recorder, then fortran for designing a bridge, using my first URL, IMB PS2, first laptop in 1992 which are now 96% cheaper and 1000 times faster today, I realise how privileged I am having had leading edge technology in my career, and today with my smartphone I have more computing power and apps available than 20 years ago.

I am passionate about bringing digital transformation and these technologies to emerging economies in an ethical way, having a genuine impact on people’s lives and bringing them into the global economic community needs to be done. It surprises me that 75% of small businesses in the UK, and around the world the numbers are even larger, don’t have a digital presence, this is shocking. This lack of understanding of the 4IR, technology revolution will accelerate emerging economies beyond the developed economies. In fact all of this is happening today. This is an opportunity for business, financial and professionals that position their efforts and learn how to ride the wave with a view on the future.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals