Over the last few years approaches to wealth management have been changing. One such change is the introduction of robo advisors such as the services provided by Betterment and WealthFront. These have been good for enabling people to easily manage their own investments, and make changes quickly and simply.

According to Michael Raneri (2015) writing for Forbes, these types of wealth management services are resonating with investors because:

“Client attitudes towards how they invest and manage their wealth are shifting.”

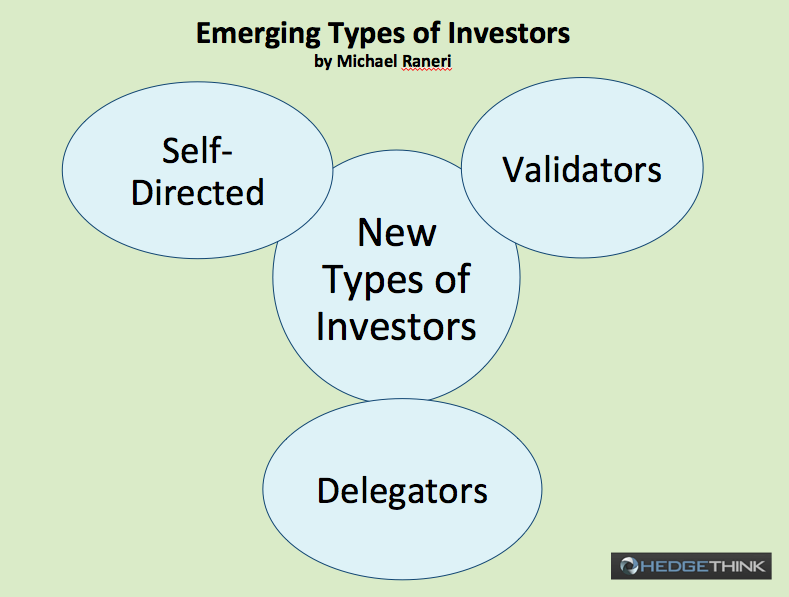

New types of Investors

The new companies that are emerging are focused on addressing these attitudes and the new needs. In some cases such companies are proactively driving change as well. The new types of tools have led to the emergence of three different types of investors, namely

- self-directed – those that want to do their investment themselves,

- validators – happy with doing it for themselves but like to get validation of what they are doing, and

- delegators – those that would rather hand off the task to someone else.

At the same time there argued to be seven ways of client behaviour that have emerged. These are now discussed.

Client behaviour’ types

Increased control – clients have been found to want a greater degree of control as well as involvement in what is going on. It is explained that they like to be involved at all stages of the process, including prospecting, onboarding, planning, advice, investing and monitoring. Wealth managers are able to deliver to this need by making sure that clients are able to do some or all of this online.

Know more – clients want to learn more regarding how their wealth will be managed in their own time. They like to be able to seek advice online before going and talking with someone who can help. They are not interested in having investment ideas sold to them, and rather they prefer to build up their own understanding.

Collaboration – in many cases people feel like they may have the knowledge they need and feel more in control, but they would still like to collaborate with someone professional in the field. The way that this has changed is that a high quality digital experience is offered in the first instance and a personal advisor is offered if it is considered that one is needed.

Increased level of savvy – it is argued that people are much better at understanding their finances, portfolio management theory and how a portfolio is developed. Clients understand that advisors may be clever, but they realise that the advisors use third party products and their own firm’s centralised advice.

Value is needed – clients are prepared to pay for good wealth management services and gaining access to advice. Companies that operate in this industry need to be aware that costs are appropriate to the individual.

Digitally minded – clients are able to use digital tools. They are comfortable with going online and are adept at using a variety of different devices to do so. They use devices and online platforms to connect with friends and family and they want to be able to communicate with investment advisors in the same way, such as through using messaging tools or other forms of interaction via online platforms.

Double checking – clients are not necessarily comfortable with taking one advisor’s word for it. Instead they like to make sure that the advice they are getting is accurate, by communicating with a range of different other people. This may include friends, other investors that they know, financial advisors, and any benchmarks that are available to them. It is argued that transparency is helpful in being able to help reassure clients in this regard.

It is thought that the changing attitudes of clients will continue to lead to disruption in the wealth management field, as well as in the financial industry as a whole. Those companies that do well going forward will be those that try to understand changing needs and attitudes and adapt to retain their customers and attract new ones. Failing to respond may lead to failing to survive. As we go forward it will be interesting to see which companies have been able to adapt, and which are falling by the wayside through not understanding changing attitudes.

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.