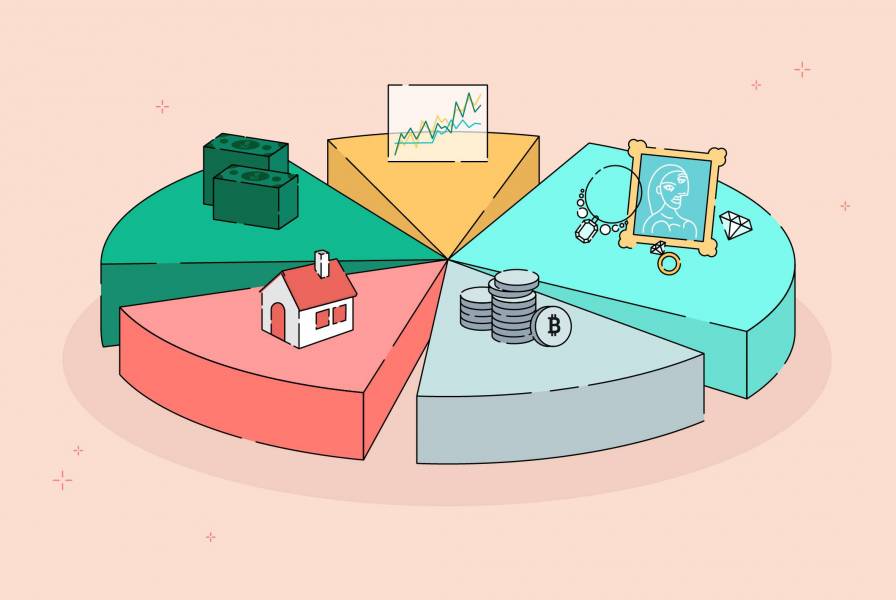

You need investment diversification because it will help protect your money from adverse market conditions.

You should spread your money around so you don’t put all your eggs in one basket. This is something you will always hear from savvy money managers. Diversifying is going to protect you from losing your assets if the market goes south. It is risky to put all your eggs in one basket, and this has become even more evident with the recent sharp decline in stock prices.

If you want to diversify correctly, it is important to know the types of investment to buy, how much to put in each of them, and diversify within a given category. It is best to have a long term perspective on investing.

Go for variety and not quantity

You don’t diversify by just having a lot of investments. If you want to be diversified, you need to have different kinds of investments. Some of the areas you can invest in include stocks, real estate funds, bonds, cash, and international securities. Read The Insiders’ Guide to Asset Value Investors (AVI) for advice.

Investing in these asset categories will do different things for you

Stocks help with portfolio growth

Bonds bring you income

Real estate is going to give you a hedge against inflation. It also has a low “correlation” to stocks – this means that it is going to rise if the stocks fall.

The international investment provides you with growth and it is going to maintain your buying power in the current world that is becoming more and more globalized.

Cash will give your portfolio stability and security

Allocating your money

How much money should you put into each of the different categories?

You need to start by setting aside enough cash and income investments to handle near-term goals and emergencies. You need to save for a rainy day. Make sure you have a cash reserve specifically for emergencies.

Another tip you can use in determining how much to invest is subtracting your age from 100 then put the percentage in stock, then the rest in bonds. If you are 30 years, you put 70% of your assets in stocks and 30% on bonds (Most 401(k) plans have both bond and stock offerings; you can use IRA to buy these investments)

If you want to diversify to other categories, adjust the percentages using the following rule of thumb:

Investing 10-25% of the stock in international securities. The percentage can go higher if you are younger.

Take 5% from your bond portion and 5% from the stock and then invest the 10% in real estate investment trusts (REITs). These are hybrid investments that give stock-like average returns, although you are going to get a large portion of your return in form of dividends. They are volatile and the value swings wildly. They can help in stabilizing returns because they move at a different pace compared to other investments.

If you are a 20 year, then you need to have an emergency fund then the remainder is split into 75% in stocks (25% going to international markets), 10% REITs, and 15% bonds.

Diversifying within investment categories

When you are done with the above process, the next process of diversifying again. It is not enough to get one stock; you need to have different types of stocks that make up your portfolio. This is going to protect you when a single industry – say, health care or financial services – takes a hit. Resources like Stocktrades.ca can help you research and identify strong investment opportunities across various sectors, ensuring a well-balanced and resilient portfolio, while providing valuable insights, market analysis, and expert recommendations to help you make informed investment decisions.

It can be costly to diversify by buying individual shares especially when you are not super-rich because it means you have to pay trading fees every time you buy a stock. Buying mutual funds is the best option for most people, especially those who have less than $250,000 to spend.

Mutual funds are a pool that combines money from many people to buy bonds, stocks, international securities, real estate, etc. if you want to make things simple, buy “index” funds, which is going to include shares of a given index, like the stock market’s Standard and Poor’s 500 index of big company stocks. Index funds can also have bonds, real estate index funds, international index, and money market funds, which is just index fund for your cash.

Balancing risk and return

Diversifying is going to help in protecting you from losses, but it is going to cost you in average annual returns. Risk and reward always go hand in hand when it comes to the financial markets. When you reduce your risk, you are also reducing your return.

Allowing yourself to take on a little risk is a good idea unless you are nearing your retirement and any additional security is valuable.

There are people who see the above method as being too conservative because it assumes that a 50-year-old has about 30 years to invest, and should have a 50-50 split of bond and stock. There are those who suggest subtracting the age from 110.

You should choose what you feel will work best for you. If taking in some risk is not going to keep you at night, then you can use the modified method. If it is going to cause stress or hassle, then use the original method, even if it is not that attractive. You are going to avoid a lot of headaches.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.