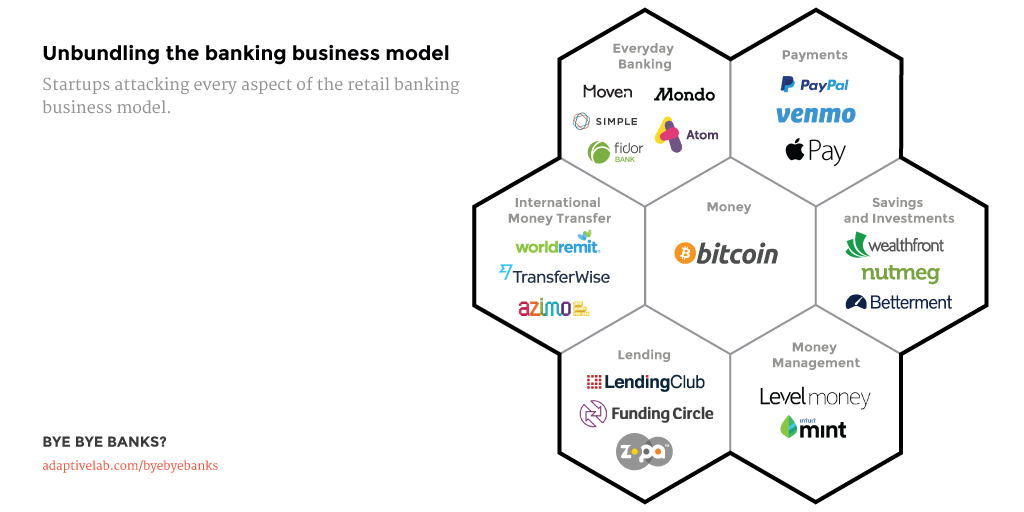

Why Unbundling is a growing concern in financial industry?

Unbundling has become a significant concern in the finance industry of late. Major financial institutions have been distressed about their most profitable customers being wooed away by innovative start ups. New technology has allowed the springing up new services like robo advisors as well as payments in real time. Old business models have been falling apart. Some people have been very concerned about the rate of change in this sector.

Unbundling from loyal customers

According to Bradley Leimer (2015) who is the head of innovation at Santander Bank, banks have been unbundling themselves. Things have changed, and banks have not necessarily focused on ways of bringing in younger customers. Older customers were drawn in to some degree because there was little choice. Leimer argues that younger people have never had any kind of personal interaction with their bank. Also, back in the day people tended to do everything through one bank, including having their current and savings accounts, as well as their mortgages and credit cards. It was more effective to do it that way – less fussing around going to different banks. But now people use different financial services from a variety of companies because it is easy to do so online.

Banks began unbundling their services and changing the way that banking had operated for many decades prior to that. All different products became “siloed”, but were not particularly optimal to the customer, rather, to the financial institution. This allowed start ups to be able to get their feet into the market. Fintech companies developed that were able to address the real needs of consumers, and banks found it hard to compete due to complexity and an inability to be agile. This is the situation that we are in today, where banks are often seen as reliable, while start ups are able to better focus and can be more flexible to deliver exciting new products. Customers that were disenfranchised by products that were not optimised for them were quick to take on new offerings from start ups.

What banks have systematically done is shown customers that they can look elsewhere for financial products, and customers have gone ahead and done precisely that. For the new generation that never had a personal relationship with their bank this has made it very easy for them to see new types of products and services as good for them. Services like ‘peer to peer lending’ have grown up out of this. They have helped people to get out of debt that the banks encouraged them to get in by allowing them too much credit. People often use Lending Club and other similar services for debt consolidation. Banks have let people be irresponsible and have not really helped them manage their money effectively. This has created a lot of opportunities for fintech start ups.

Rebundling and Partnerships

It is believed by some that it is possible to rebundle the bank. Technology can be used to help banks to achieve this, since it is able to carry out all kinds of activities that are helpful for users, such as aggregate and provide advisory input. It may be argued that this is what banks should have been doing in the first place. The way to go about this is for large established players to pair up with fintech companies that are smaller, more agile and innovative. Both sides can benefit from such an arrangement after all.

Rebundled banks could offer customers a view over all of their financial services so that they are better able to manage their money. By offering a dashboard that brings everything together, people will be able to see what they actually have and take into account either debts or income that was overlooked. This will help banks also to step in and add value by making suggestions and building relationships with customers. One very important element of this is catching the customer before he/she goes elsewhere. Banks already have a lot of information to do this, but there is a need to aggregate, to bring it all together. Making suggestions that create lifetime value for a customer will win them over, and that is something that larger institutions are not necessarily doing well at right now.

Source: Banks only have one option to survive digital disruption: launch a standalone Beta Bank

Overall, the picture is not that bleak, but banks do need to do more if they want to maintain their positions. Partnering with agile small start ups could be the way to do just that.

Bye Bye Banks?

In a research, carried out by James Haycock and technology reporter Shane Richmond, in their book “Bye Bye Banks?” it is very difficult to change the entrenched culture within the banking sector. The research is based on extensive qualitative and quantitave analysis from 110 senior managers, directors, C-Level executives, CEOs and Presidents within the banking sector.

In speaking to the numerous executives during the course of our research we believe the obstacles banks face, legacy technology, culture and people, are too great for them to overcome from within. Instead, they must reboot and create an autonomous organisation outside the bank itself, something we call the Beta Bank.

According to this book (1) Banking will be the next industry to be disrupted by new technology and start-ups (2) It cannot rely on incumbency to save it (3) and Banks must rethink their operating models, launching a new, standalone organisation with new leadership.

The only way suggested by the book in order to survive digital disruption is to launch a standalone Beta Bank. And for that the following steps needs to be taken:

- Define a purpose that inspires and attracts

- Organise around customers rather than products

- Appoint native leaders

- Hire triple D people

- Create a culture of experimentation and learning

- Establish principles that inform decisions

- Organise in small, multi-disciplinary teams

- Design around modern working practices

- Design technology and data that enables agility

- Take a long term view

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.