Important Questions You Should Ask to Identify Growth Companies

Nothing can be truer than the fact that it is indeed the customers that contribute to the success of any business, and are the main reason for their growth or failure. And that is why it is important that major investors must establish a clear standpoint which can help them to identify a growing business. Once a customer has established that a particular company’s sales and revenue will consistently rise and that they have bought the stock of that company at a reasonable rate, it is important to hold on to that stock to benefit from a potentially lucrative opportunity.

Having said this, an investor should always avoid evaluating the financial standings of the company he has invested in after finding out that the company has the potential to grow in the future. It is always better to wait and be patient. If you start analyzing a growing company’s financial ratios and stock value immediately, you might choose to not invest in any company.

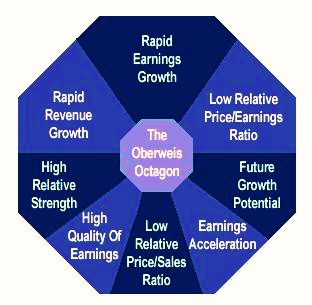

So what adds value and growth to stock? The answer is simple: a consistent growth in the company’s earnings. Future revenue growth depends on the company’s past earnings and the percentage of growth it experienced at that time. Companies that experience consistent growth in earnings are more likely to sustain their performance in the coming years as well.

Important Questions You Should Ask Before Investing in a Growth Stock

Does the Company have the Potential to Grow in the Coming Years?

Before you ask this question it is important to realize that a company’s potential to grow should be subject to a lengthy analysis and evaluation process. However, if you see that the stock price is too high or that the company has considerably slowed down and has experienced a drop in earnings, then it is time to sell the stocks and move on.

Single time events that allow a company to grow for a considerably short period of time significantly affects the stock price of the company but this spike in prices is temporary at best. For example, in the mid 1970s and the 1990s, when there was a sudden rise in the prices of oil, which led to several companies started providing oil drilling services because of the growing industry. But again, the secret is to sustained growth is not to experience it once or twice in a couple of years.

How is the Company’s Relationship with its Employees?

It is important that the management of the company you have invested in has a good working relationship with their employees as it leads to the employees performing better which in turn leads to the customers being satisfied. In order to gauge the employee-management relationship, you should approach the employees and engage in a polite conversation that would provide you the desired information.

Is Research and Development Important?

The R&D department of any company is important, not only for high-profile companies. The research and development department can be considered the lifeblood of a company, a tool important to carry out important research and testing of all products and or services. If a company you are interested in has significantly progressed through the years because of their R&D, it is important that you ask them that whether or not their research is at the same level as before.

There are also many companies which have been successful not because of their innovation or R&D but because they copied their rivals. It is unwise to theorize or deduce that if a company did particularly well last year, it will perform at the same level this year too without understanding its R&D or investing in a company that does not have its own R&D.

Finding out which company uses its R&D strategically to improve sales and the quality of the products can be quite complicated for an interested investor. You will fare better by analyzing the qualitative nature of a research and development department of a company and its expenses in order to find out whether or not they have increased their earning potential.

Are Profit Margins Important?

When profit margins increase and are sustained at a certain point, there will undoubtedly be a spike in sales leading to an increase in company revenue. Not maintaining your profit margins can often lead to a sharp decline in sales and profits. You will notice that good companies have precise profit margins as compared to other companies in the same industry.

Read More:

how would reconcile your bank account to avoid spending more than you have?

how is having a security system for your home a risk management strategy?

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals