- Inconsistent cross-border guidance and a lack of clarity on regulatory perimeter are major concerns, according to major players of the crypto and digital asset industry

- Global Digital Finance’s 2021 annual compendium review highlights the US, EU, and UK as the priority jurisdictions

Inconsistent and unaligned cross-border regulatory guidance is the top regulatory concern for the crypto and digital asset industry identified by a survey of members for Global Digital Finance’s 2021 compendium review of the global crypto and digital assets sector.

The annual report from the leading industry body championing the adoption of digital finance, DIGITAL MONEY AND NEXTGEN MARKET INFRASTRUCTURE – Macro and Regulatory Headwinds Prevail found 45% of members chose inconsistent or unaligned cross-border regulatory guidance with 42% highlighting a lack of clarity on regulatory perimeter and 33% Travel Rule compliance as their top regulatory concerns for 2022.

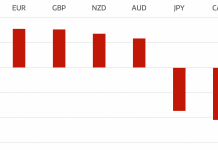

62% of those questioned chose the US as their priority jurisdiction followed by 58% selecting the European Union and UK with Singapore following closely behind.

Survey results showed conduct regulators in GDF’s Regulator Only Forum, a forum of over 25 jurisdictional regulators, chose stablecoins, DeFi and data reporting as their priority areas for 2022 compared with the wider GDF Membership who prioritized DeFi, digital custody, KYC/AML, and crypto and digital asset derivatives as their top focus.

GDF’s yearly compendium review of the crypto and digital assets industry includes contributions from industry leaders, financial institutions, regulators, and policymakers on the extraordinary growth in the digital asset sector throughout the past year.

Here are some voices from the finance world asking for more regulatory clarity:

Lawrence Wintermeyer, executive co-chair of Global Digital Finance, says: “In a sustained period of global regulatory uncertainly with crypto and digital assets, GDF members have demonstrated to customers, stakeholders, industry and regulators that they can abide by high conduct standards through the GDF Code and further collaborate on cross industry issues like meeting FATF travel requirements, AML/KYC/CFT best practices, and shared market surveillance.

“GDF looks forward to greater dialogue and commitment with policymakers, agencies and regulators in our co-regulatory model as the crypto and digital asset sector matures and continues to demonstrate its financial and social utility.

“Meaningful compliance is the result of committed industry engagement with regulators on the evolving challenges, together with innovative approaches to regulation that meet the demands of new technologies.”

Jeff Bandman, GDF board member and former LabCFTC head says, “Regulatory clarity and greater certainty for the crypto and digital asset industry took many positive steps forward in 2021.

“Through the GDF Regulator Only Forum and our Regulator’s DeFi Knowledge Series, we are enabling the cross-border, cross-industry dialogue needed to promote sound policies for the global sector. As we progress, industry engagement with regulators is key to balancing consumer protection and new innovation.”

Rupert Thorne, Deputy Secretary-General, Financial Stability Board (FSB) writes in the report: “The success of this work [Cryptoassets and Enhancing Cross-Border Payments] will depend heavily on the commitment of public authorities and the private sector, working together to implement the agreed changes in the coming years and to achieve the targets that have been set for the Roadmap.”

The report includes GDF Patron Members’ insights into everything from NFTs to DeFi, self-hosted wallets, and the role of the sector can plan in ESG and the race to NetZero, with a particular focus on the institutional adoption of crypto and digital assets and distributed financial market infrastructure.

Coinbase Chief Legal Officer Paul Grewal writes in the report: “Policymakers are right to press pause and take stock. Given the complex and evolving nature of the market, industry engagement is key. Market players can provide insight into the specific (regulatory) concerns and how these could be addressed.”

Rene Michau, Global Head of Digital Assets, Standard Chartered writes in the report:

“Institutional adoption is not only focussed on the use of blockchain to improve market efficiency and offer different structures for assets but there is pervasive interest in cryptocurrencies and in finding safe and appropriate paths to diversify into this asset class.”

Todd Mcdonald, Chief Product Officer, R3 writes in the report: “Combined with continued collaboration amongst FMIs, regulators, financial institutions, fintechs, and industry bodies, [regulatory certainty] will drive wide-scale DLT adoption across global financial markets in 2022, unlocking the next generation of financial market infrastructure.”

The report highlights updates from the GDF working groups, including Shared Market Surveillance and how the global industry in self-establishing a transparent market surveillance reporting regime; V2 of the Stablecoin Code of Conduct focused on ‘algorithmic’-backed stablecoins; Private Markets Digitization, the new decentralized network for private markets primary and secondary issuance, and; the new Global Financial Institutions Cryptoasset working group focusing on institutional standards for brokerage, custody and settlement of cryptoassests.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals