Hedge funds which focus their investments in India recorded their first loss in twelve months in February according to a report from Eurekahedge. According to the report the average hedge fund lost 0.51%

The movement came during a month in which hedge funds concentrating in other areas of the world managed decent returns. There are many reasons posited for the underperformance of the Indian hedge fund industry, but the most compelling reason for the loss is the volatility surrounding the reveal of the Union Budget on February 19.

Indian hedge funds underperform

In the same month, as recorded by the Eurekahedge, hedge funds from both Europe and Russia saw outsized returns. The Eastern Europe and Russia Index increased by 12.49% in the month of February, while hedge funds from Western Europe managed to gain 2.39%.

The underperformance of hedge funds in India wasn’t directly led by underperformance in the Indian stock market. During the month of February the CNX Nifty gained 1.06%. The S&P BSE SENSEX gained 0.61% in the period.

Red Art Capital Advisors, one of the country’s more prominent hedge funds, weighed in on the performance of the Indian industry during February. Speaking to Sachin P Mampatta of the Business Standard, Red Art’s managing director Anuj Didwania said that underperformance in less valuable stocks may have caused the fall in performance.

“It seems all the funds are in similar kinds of positions. February was the first month that small-cap and mid-cap stocks gave a negative return. My guess is that most fund managers are concentrated in mid and small-cap stocks, which is what led to the negative return,” he said.

Vaibhav Sanghavi, managing director at Ambit Investment Advisors told the same paper that volatility caused by the Union Budget was more at fault for the lack of a positive return.

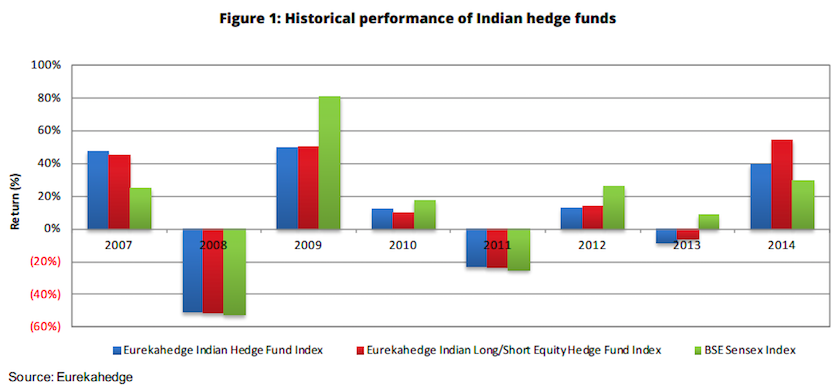

After so many months of great performance, India’s hedge funds are seeing a compression which may test their resilience to market volatility and negative returns. In 2014 Eurekahedge recorded an average gain of 38.8% in Indian hedge funds, driven by new Prime minister Narnenda Modi’s economic policies and hope for the country’s economic future.

Testing the Indian hedge fund

Outsized performance often leads to outsized asset gain in the hedge fund industry. After an incredible 2014, wealthy investors are much more aware of the country’s hedge funds, and much more willing to make investments that target the South Asian nation.

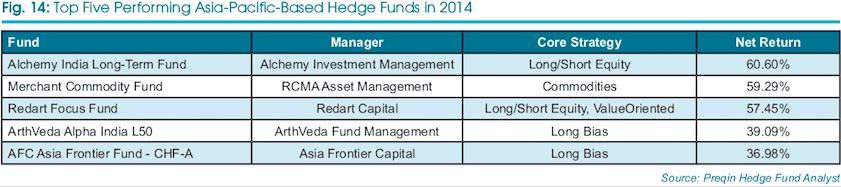

According to a recent Deutsche Bank survey of investors, 26% are looking to increase their exposure in India during 2015. With returns of 60% from the Alchemy India Long-Term Fund, and comparable numbers being recorded by funds focused on India that’s no wonder. The top performing Asia-Pacific funds last year were dominated by those concentrating on investment in India.

36% of respondents in the same survey thought that India was going to be the among the top three best performing regions in 2015. With those expectations, 2015 is going to be the most trying year so far for Indian hedge funds. So far this year the funds have managed to secure a net gain in India so far this year, with 5.3% gains in January beating out the small loss in February.

CLSA, in a note concerning investment prospects in India for 2015, said that “While there is a general agreement on the attractiveness of India’s structural long-term story, several investors appeared to be seriously re-evaluating their positioning and incremental inflows seem unlikely in the near term.”

International hedge funds have become more bearish on emerging markets in recent weeks as an increase in interest rate expected from the Federal Reserve drives investments back to the United States in search of safety.

The WisdomTree India Earnings Fund (ETF) fell by close to 6% in the month of March, as can be seen in the above chart of its progress in the month. The index tracks the top companies on the subcontinent. All of the bearish factors are coming together to suggest a less buoyant medium term for the Indian hedge fund industry.

The question is whether the hedge funds that made their names in the last twelve months will be able to maintain the attention of investors even as those returns inevitably fall, and performance comes back down to Earth. That will be the real test for the Indian hedge fund industry, and one that will decide what the future of the country’s investment market looks like.

Paul Shea is an experienced money, trading and investing writer who cut his teeth writing stock, investment and industry analysis and covering macroeconomics. Paul Shea work has been linked and quoted by MSNBC, BusinessWeek, Barrons, Zerohedge and The Blaze, and his work appears regularly on Google News and Google Finance, as well as other prominent news aggregators. He’s also written about the tech industry for the likes of Valuewalk and The Street. Paul is a senior contributor writer for TradersDNA and HedgeThink.