This special blog article is jointly written by Alastair Hawker, Quantitative Brokers, and Michael Koegler, Market Alpha Advisors, a market structure and FinTech advisory firm that offers subject matter expertise on the LIBOR transition.

After Quantitative Brokers have commenced support for the CME’s 1 month and 3 month SOFR futures, we are going to look back at how SOFR has come about, the transition ahead and its impact on the industry.

The London Interbank Offered Rate (LIBOR), used in calculations of interest on Eurodollar deposits, is the most widely used interest rate benchmark in the world. It is estimated to be referenced in over US$200 trillion of financial contracts, including corporate loans, mortgages, consumer debt and many types of derivative securities. This underlying market for LIBOR-based instruments has driven the enormous historical growth of the Eurodollar futures market, making it one of the most actively-traded interest rate futures markets in the world.

The Eurodollar market originally came into being during the Cold War era of the 1950s, as the Soviet Union moved its dollar-denominated revenue, generated by crude oil and other commodity transactions, out of U.S. banks. Eurodollars have grown into one of the largest short-term money markets in the world, making LIBOR the most widely used interest rate benchmark in the world. In a little more than two years, this will all change as LIBOR gets phased out.

Why is LIBOR being phased out?

LIBOR is based on daily submissions by a panel of banks that attempt to estimate interbank lending rates. The regulator responsible for overseeing this process is the Financial Conduct Authority (“FCA”), which is based in the U.K. Due to the 2008 financial crisis, MiFID II regulations and LIBOR manipulation scandal, the vast majority of panel banks no longer want to be responsible for making LIBOR submissions. Several years ago, the FCA agreed with panel banks that they only have to continue contributing LIBOR submissions until the end of 2021, which will likely result in the phase out of LIBOR as a benchmark interest rate.

The process of eliminating LIBOR as a benchmark interest rate has come about for primarily two reasons:

• LIBOR Trades Infrequently and Lacks Credibility as a Benchmark Rate

The use of LIBOR as a benchmark interest rate has always relied on daily submissions by a panel of banks. Without these submissions, it would not be possible to rely on market observations for establishing rate levels. The volume of interbank lending based on LIBOR has never been enough to justify its use as benchmark rate. In the aftermath of the 2008 financial crisis and resulting regulation, in particular MiFID II, it has become undesirable for banks to administer LIBOR. Since the volume of interbank lending based on LIBOR is so low, it is not possible for it to remain in place as a benchmark rate without submissions from the banks.

• LIBOR Manipulation Scandal

Reports of irregularities in the submission of LIBOR led to the global LIBOR scandal and demonstrated how easy and widespread manipulation of the index was. Banks have paid fines and civil settlements in excess of $10 billion and may ultimately reach as high as $35 billion. In the aftermath of the scandal, global regulators have sought to fundamentally change the way that benchmarks are set and used in financial instruments.

As mentioned above, a major contributor to the demise of LIBOR is the fact that panel banks have grown uncomfortable with providing submissions that are based on judgment instead of actual borrowings and have therefore indicated to the FCA that they no longer want to submit rates. In a speech in 2017, Andrew Bailey, Chief Executive of the FCA, said that they would not persuade or compel LIBOR panel banks to make submissions beyond the end of 2021. This date will likely represent the discontinuation of the widespread use of LIBOR or it will lead to it becoming a nonviable index in the judgement of the regulator.

Each jurisdiction has their own solution to benchmark reform. In the U.S., the solution proposed by the Federal Reserve is to transition from USD LIBOR to the Secured Overnight Financing Rate (“SOFR”), which is tied to the U.S. Treasury repo market and directly observable from market transactions. Since the Federal Reserve started publishing SOFR in April 2018 there has been over $800 billion in average daily trading volume in the repo transactions underlying it.

What happens next?

October 16, 2020 is the date when both the CME and LCH intend to begin using SOFR for the calculation of PAI and discounting for all OTC-cleared derivatives. We expect the trading volume and open interest in SOFR futures to increase as we move closer to that date while the opposite happens in the Eurodollar futures market. (Interestingly, the CME originally chose July but moved it to match the LCH so the industry could have a single date when all USD denominated swaps will be converted).

Another significant event will occur at the end of March 2020 when the FHFA has issued guidance to FHLBs that they stop entering into transactions linked to LIBOR if those instruments mature after December 31, 2021. This has significant implications for financial institutions in the U.S. as over 7,000 institutions use the FHLB system to fund themselves. After March 31, 2020, the FHLBs will no longer offer funding options based on LIBOR if those instruments mature after December 31, 2021.

These two events, in and of themselves, will create a powerful incentive to move away from LIBOR and into SOFR.At the end of 2021, when the LIBOR panel banks are no longer obligated to make submissions, LIBOR may become a non-viable or “zombie” index. It will become a precarious position to be in if you are left in instruments linked to LIBOR as liquidity and viability begins to wane. The Federal Reserve may view LIBOR instruments as more risky and could require regulated institutions to hold more capital against those instruments.

“At some point the Fed may turn honey into vinegar by informing institutions they regulate to begin analyzing their capital requirements for LIBOR instruments via the CCAR process,” says Pieter van Vredenburch, Principal at Market Alpha Advisors. “This may very well cause a mass exodus out of LIBOR, creating a strict pecking order of priorities for dealers that need to reduce their LIBOR exposure.” Banks regulated by the Fed will seek to terminate LIBOR instruments in the most expeditious way possible so that they can reduce their capital requirements. If you find yourself as a counterparty that is not a top priority, you may wind up in the back of the queue. This is another powerful incentive to transition out of LIBOR before the end of 2021.

What does this mean for interest rate futures trading?

In a nutshell, we expect Eurodollar futures to phase out and SOFR futures to become the replacement. In this section we will describe the trends in both. Given the 2021 timeframe, It is worth noting that this may directly affect white and red in Eurodollar futures today. Green (3 years out) to Copper (10 years out) will likely cease to function properly long before their expirations – there will of course be a point in time when you will no longer want to hold positions in these contracts. But there are different opinions on this and it is still not clear exactly what will happen. The CME has recently announced a proposal to automatically convert Eurodollar open interest into SOFR in the event that Libor is officially discontinued.

Under CME’s proposed plan, a formal declaration that Libor is dead would trigger the automatic conversion of all Eurodollar futures outstanding into SOFR futures, with a price adjustment to account for differences between the two contracts. CME floated details of its plan in a video posted on its website last week.

It will also be a poignant moment for QB when Eurodollars disappears since this was the first instrument QB supported upon launch in 2010.

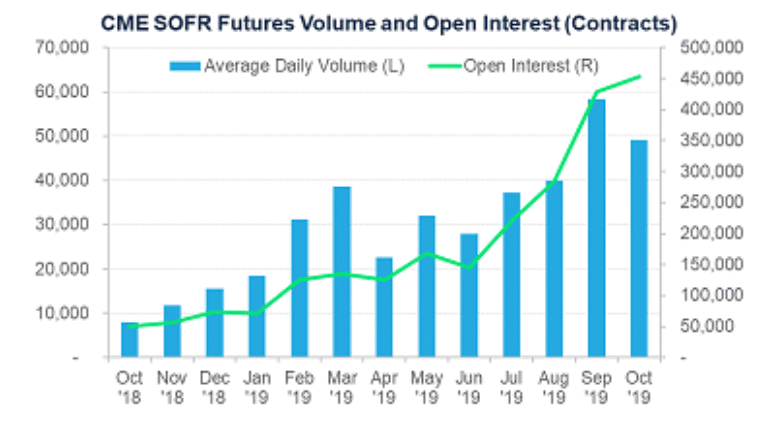

In addition to large trading volumes in the underlying SOFR rate, the CME’s SOFR futures contract, launched in May 2018, has grown steadily in volume and open interest. Open interest grew to 502,000 contracts ($1.8 trillion notional) in October on average daily volume of 45,000 contracts. The CME has reported that this has been aided by an influx of new participants and continued usage in repo market applications. (Large open interest holders hit a new high of 133 in the Oct 22. CFTC COT report).

Relative value trading vs. Fed Funds and Eurodollars accounted for 47% of the SOFR volume in September, via the CME’s listed inter-commodity spreads. (QB also plans to support these, likely early in the new year). We also offer our Legger strategy for synthetically trading these and other combinations of instruments. In fact, such a combination of STIR futures presents wonderful opportunities for cross market integration, which is a speciality of QB.

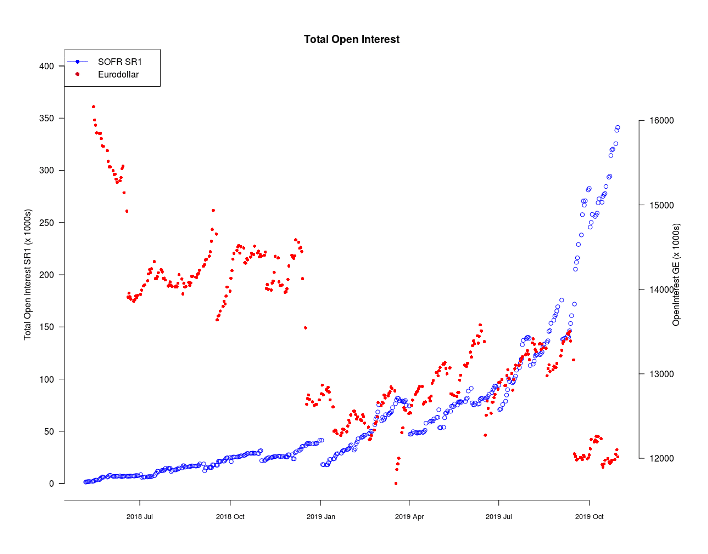

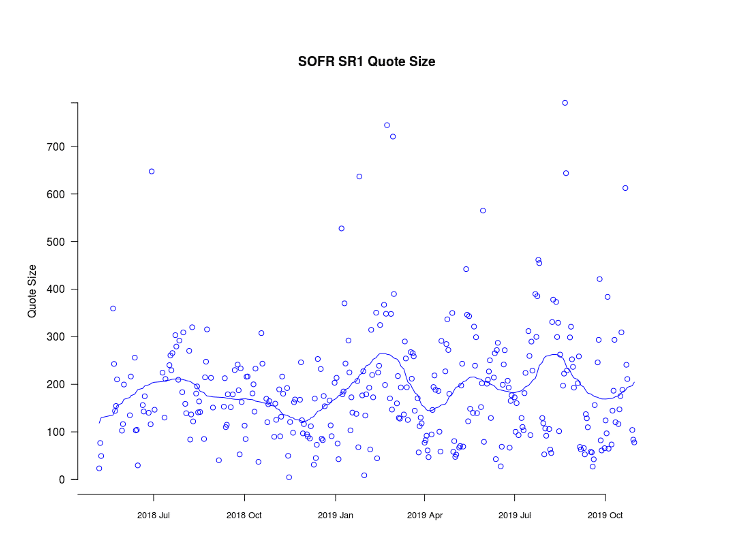

While SOFR has been on the rise, Eurodollar futures have been heading in the other direction. Though this descent is from a mighty peak, it is a trend we expect to continue given where things are headed over the next 2 years. We have found that open interest, quote size, and liquidity (based on price change to signed order flow imbalance) have diminished dramatically in Eurodollars since July. There is roughly a 3:1 decline in Eurodollar open interest vs. the growth in SOFR in the last 4 months. We believe there are some other structural shifts happening in Eurodollars (note that the open interest decline dates back to 2018) but it is fair to assume that part of this trend is due to the rise of SOFR. Contrastingly, in SOFR futures, quote sizes and liquidity have been stable.

It is also worth noting that SOFR is not the only new interest rate benchmark. AMERIBOR is another alternative – on which the Cboe’s futures exchange launched futures contracts in August. It is designed specifically for small to medium sized US banks, to be reflective of the interbank borrowing costs of those smaller, regional institutions. However, it does lack Fed support, and the trading volume in the underlying loans that make up the AMERIBOR index is a miniscule fraction of the trading volume in the overnight Treasury repo market.

We also believe that SOFR alone will not be an appropriate hedge for certain risks. For example, SOFR based derivatives will likely not have the same degree of correlation to mortgages as LIBOR-based derivatives do. Therefore, we think that new instruments will need to be developed to address this – perhaps futures instruments that are a combination of SOFR plus a credit or volatility index.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals