HedgeThink presents an interview with Don Steinbrugge, probably the most influential personality and thought leader in the digital ecosystem when it comes to the hedge fund industry. Don is the founder of Agecroft Partners a global, award-winning hedge fund consulting and marketing firm that has won 23 awards as the Hedge Fund Marketing firm of the year. Agecroft is a top dedicated thought leader in the hedge fund industry, and frequently writes white papers relative to trends they have identified by leveraging the knowledge they gain through the thousands of investors they are in contact with on a regular basis. He kindly answered HedgeThink big list of questions about the state of the hedge fund industry, both giving HedgeThink his input about investment, regulation, trends, marketing, and other important views. He also advised about the most accurate way to evaluate a diversified hedge fund portfolio.

His achievements over his powerful 30 year career are wealthy, diverse and include institutional investment management sales, serving as the head of sales for one of the world’s largest hedge funds, and institutional investment management firms. Don was a founding principal of Andor Capital Management, which was formed when he and a number of his associates spun out of Pequot Capital Management. At Andor he was Head of Sales, Marketing, and Client Service and was a member of the firm’s Operating Committee. When he left Andor, the firm was ranked by assets under management as the 2nd largest hedge fund firm in a survey by Absolute Return Magazine. Don is a proactive writer frequently releases white papers on trends he sees in the hedge fund industry. He is an active speaker and has been participating at over 80 hedge fund conferences, has been quoted in hundreds of articles relative to the hedge fund industry, and is a regular guest on business television including Bloomberg Television, Fox Business News, CNBC, Reuters Insider, and CCTV.

Prior to these stints Don was a Managing Director and Head of Institutional Sales for Merrill Lynch Investment Managers, which at the time was one of the largest investment managers in the world ranked by assets under management.

Don was also Global Head of Institutional Sales and member of the executive committee for NationsBank Investment Management (now Bank of America Capital Management). Don is a member of the Investment Committee for The City of Richmond Retirement System, a member of the Board of Directors for the Hedge Fund Association and a member of the Board of Directors of Lewis Ginter Botanical Gardens. In addition he is a former 2 term Board of Directors member the University of Richmond’s Robins School of Business, The Science Museum of Virginia Endowment Fund, The Richmond Ballet (The State Ballet of Virginia) and the Richmond Sports Backers.

This is the first part of this interview.

D. Guarda: How do you describe Agecroft Partners and how do you differentiate yourself and the company?

D. Steinbrugge: Agecroft Partners has changed the model of hedge fund third party marketing. Most third party marketing models are based on leveraging personal relationships and doing extensive entertaining. Ours has been to build a global brand with a reputation as an industry thought leader, strong institutional investment knowledge and representing very high quality managers. Building a high quality brand is difficult and requires a long term plan, but once created it allows access to many investors that other marketers have difficulty meeting with and often at a high level within the organization. It also, enhances the investors initial perception of a manager, because investors understand that the hedge fund has made it through the firms intense due diligence process, which is the exact opposite reaction directed at many other marketing firms. Finally, a strong brand attracts the top hedge funds looking for marketing help, which ultimately continues to enhance the brand.

D.G.: What do you see as the most accurate way to evaluate a diversified hedge fund portfolio?

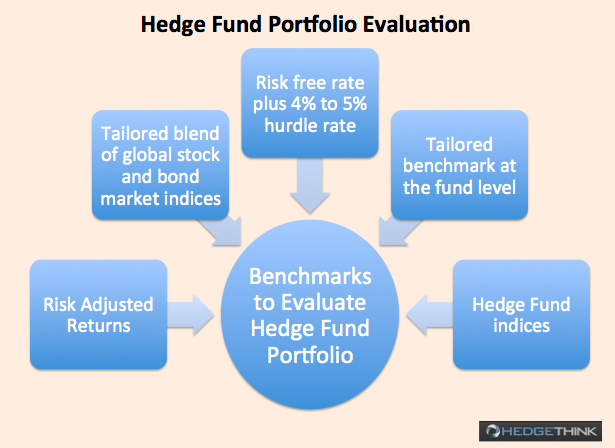

D. Steinbrugge: With any benchmark used to evaluate a hedge fund portfolio it is important to remember that, since most hedge funds hedge a portion of their market exposure, all benchmarks are more accurate comparisons over longer time periods.

The most accurate benchmark to use is focusing on risk adjusted returns. The main objective of most investors is to get the highest return for a given level of risk and the most common way to measure this is by calculating the portfolios Sharpe Ratio. This statistic is commonly used by individual hedge fund managers and fund of funds, but rarely used by hedge fund investors to analyze their overall hedge fund portfolio. The hedge fund industry as reported in a recent article by AIMA has significantly outperformed long only benchmarks on a risk adjusted basis over time. It is also the most fair way to compare the performance of a portfolio because it equalizes the return generated based on the level of risk taken. Other ways to evaluate a hedge fund portfolio include:

Tailored blend of global stock and bond market indices. Since hedge funds are a legal structure consisting of a diverse group of strategies, investors’ hedge fund portfolios can be highly divergent in their allocation to various hedge fund strategies. Some only invest in equity related strategies, while others may have no equity market exposure. Investors should consider using a blend of various long only indices that most closely match their underlying portfolio. A simple benchmark to use on a monthly basis is to use a 60% blend of the MSCI All Country World equity Index and 40% of the Barcap Global Aggregate Bond Index. There are a lot of flaws with blending these 2 indices as a benchmark for the hedge fund industry; however, it is simple and would be an improvement over just using the S&P 500. The 60-40 split is also the approximate asset allocation pension funds used before diversifying into alternatives.

Risk free rate plus 4% to 5% hurdle rate. Before 2008 this was a very common benchmark used for diversified hedge fund portfolios and is a good benchmark for hedge fund strategies with little or no market exposure (beta), and a bad benchmark for strategies with a lot of market exposure. Unfortunately, most strategies have a fair amount of market exposure. This benchmark led to a large disconnect between investors’ perception of how hedge funds should perform, and the reality of how they actually performed during the major market correction in 2008. Many investors did not expect to experience negative returns which led to heavy redemptions in the fund of funds industry.

Tailored benchmark at the fund level. The best way to evaluate hedge funds is at the fund level, where a customized benchmark can be used based on their strategy. For example, it is very appropriate to compare a long/short equity manager to an equity index like the S&P 500 over a rolling 3 and 5 year time period. However, if the fund can invest in small cap stocks along with non US equities, it makes more sense to use a global index that includes all market caps.

Hedge fund indices. Comparing a hedge fund portfolio to a hedge fund index is a useful tool to evaluate the quality of the manager and strategy selection. There is a broad array of hedge fund indices that can be used which record a broad return for the industry, and also show the return broken down by market strategy. The main issue with hedge fund indices is that there are large differences in their reported performance. The first issue all hedge fund indices have is getting hedge fund managers to report their performance to them on a monthly basis. Many hedge funds do not report their performance to hedge fund indices, most only report to a few databases which creates discrepancies among the composition among various hedge fund indices. However, the main driver in dispersion of performance across hedge fund indices is how they are constructed.

D.G.: The Hedge fund industry has a sensitive relationship with its reputation. How do you see that duality and what can the industry do to get a better general reputation?

D. Steinbrugge: There is a disconnect between the public’s perception of the hedge fund industry and reality. In order to change this we need more people within the hedge fund industry to take a leadership position, write white papers and speak directly to the media in order for the public to hear the other side of the story.

D.G.: Hedge fund marketing is still a taboo for a lot of hedge funds. How do you see marketing direct impact on investors perceptions of the hedge fund organizations they represent and their peers?

D. Steinbrugge: Hedge fund marketing has a massive impact on a hedge fund’s organization perception in the market place. The 3 biggest mistakes hedge fund managers make relative to marketing include:

- Hiring low cost junior people to market their fund. It is pretty obvious that these type of people are not going to create a strong positive impression on the people they meet with.

- Not having a high quality market message that clearly articulates the firm’s differential advantages across each of the evaluation factors investors use to select hedge funds. This results in a lot of meetings with a very low close rate and the creation of a negative brand in the market place.

- Not having enough recourses to effectively penetrate the market place in order to build a strong brand and create momentum in asset growth.

D. G.: Social media and big data are becoming increasingly more important for hedge funds. You did some reporting in this subject can you highlight your findings and views?

D. Steinbrugge: Having a high quality fund alone is not enough to raise significant hedge fund assets. Most assets in the hedge fund industry are flowing to firms with the strongest brands and not necessarily the highest quality funds. Social media including LinkedIn and Twitter have a number of tools that can help build a firms brand in the market place.

D. G.: The most successful marketing and sales strategies are well thought out, and are process oriented. What do you advise in this area?

D. Steinbrugge: Yes, raising assets is very process oriented and includes three steps;

- Making sure the fund offering is high quality across each of the evaluations factors investors use to select hedge funds.

- Having a strong marketing message that is concise, linear and clearly articulates the firms differential advantage across each of the evaluation factors investors use to select hedge funds.

- Implementing a high quality marketing and sales strategy.

The first step in the process is having a high quality product offering. Agecroft Partners hedge fund research process looks at thousands of hedge funds each year and the reality is that most hedge funds are not very good based on multiple evaluation factors. With over 15,000 hedge funds to choose from, it is almost impossible for these sub-par managers to raise assets from investors outside of friends and family.

The biggest mistake most of these lower-quality hedge funds make is not understanding the evaluation factors investors utilize to select hedge funds and therefore not creating a top-quality offering. These factors typically include an evaluation of a firm’s operational infrastructure, investment team and their pedigree, investment process focused on their differential advantages, risk controls, performance, service providers and fund terms. A weakness in any of these factors can eliminate a firm from consideration. In some cases a minor adjustment can significantly improve the marketability of the fund. Hedge fund performance tends to be a quantitative screen to eliminate a majority of managers, but once performance has reached a certain hurdle its weighting in the evaluation process is less important than most managers realize.

The second step in the process is making sure the market’s perception of the firm is equal to reality. This requires a consistently delivered, concise and linear marketing message that identifies the differential advantages across each of the evaluation factors investors use to select hedge funds. Many high quality hedge funds have difficulty raising assets because they do a poor job of articulating their message to the marketplace and as a result, investors perception of the fund is below reality. The marketplace is highly competitive and hedge fund investors use a process of elimination in selecting hedge funds. This typically begins by screening the thousands of hedge funds in the market place, meeting with a couple hundred and hiring a select few each year. It only takes one poorly worded answer to get a firm eliminated from consideration.

It is important that the marketing message is clearly understood by all employees of the hedge fund and that the message is consistently integrated throughout all the firm’s mediums of communication, including the website, oral presentations, written materials, due diligence questionnaires and quarterly letters. A well-prepared and accurate marketing presentation eliminates inconsistencies and helps foster a level of integrity when interfacing with potential investors.

The final step in building a strong brand is implementing a highly-focused marketing and sales strategy that broadly penetrates the market place while being compliant with regulatory guidelines. The hedge fund investor marketplace is highly inter-connected. Many investors exchange ideas on managers and, as a result, the more deeply a manager penetrates the marketplace the stronger their brand will become. Building a strong brand and raising assets takes time and cannot be rushed. The hedge fund industry is not transaction oriented. In many instances, being too aggressive will eliminate a firm from the selection process. Many investors require a minimum of three or four meetings with a fund before they will invest.

One way to truncate the process is to utilize a well-seasoned, highly respected internal sales team, top-tier third party marketing firm or a combination of both. Experienced and well-thought of salespeople can have a large impact on a hedge fund’s success in growing their asset base. They will often have a reputation or brand in the marketplace themselves. If their brand is strong, it can significantly increase the possibility of meeting with an investor and increase the initial credibility of a firm. Prime broker capital introduction areas can be a valuable resource to introduce a firm to investors through their conferences or other activities. However, they should not be relied upon solely. As mentioned before, it usually takes multiple meetings for an investor to invest and it is very important to have multiple people focused full time on the sales process.

The days of a hedge fund participating in hedge fund databases and then sitting back and waiting for the assets to flow are over. The firms that will be successful in growing their business in the future are organizations that stay highly focused on providing a top-quality offering, clearly articulate their firm’s differential advantage across the multiple evaluation factors investors use to selected hedge funds, and have a highly professional sales and marketing strategy.

D.G: What are the best ways for Investors to evaluate Quantitative Strategies in your view?

D. Steinbrugge: Evaluating a quantitative strategy has many similarities to evaluating other strategies such as the quality of the organization, investment team, process, risk controls, historical track record relative to pears, service providers. The difference is that they need to clearly understand what inefficiency in the market the managers is trying to capture and how their quantitative strategy give them a competitive edge in taking advantage of the inefficiency. In addition, many quantitative strategy models become stale over time. It is important that the firm continue to reinvest in enhancing their models.

The 2d part will be published tomorrow.

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.