New technologies and solutions have been applied to a number of long-running services. These always try to make them more accurate, faster and issues-free as far as they can go, and they have achieved (in most cases) an impressively high hit rate. The latest comes in the shape of a new revolutionising solution able to sort out a psychographic credit score based on cultural and behavioural principles besides the well-known economic data. AdviceRobo’s team are behind such invention and it is said to give another twist to a controversial metric measure.

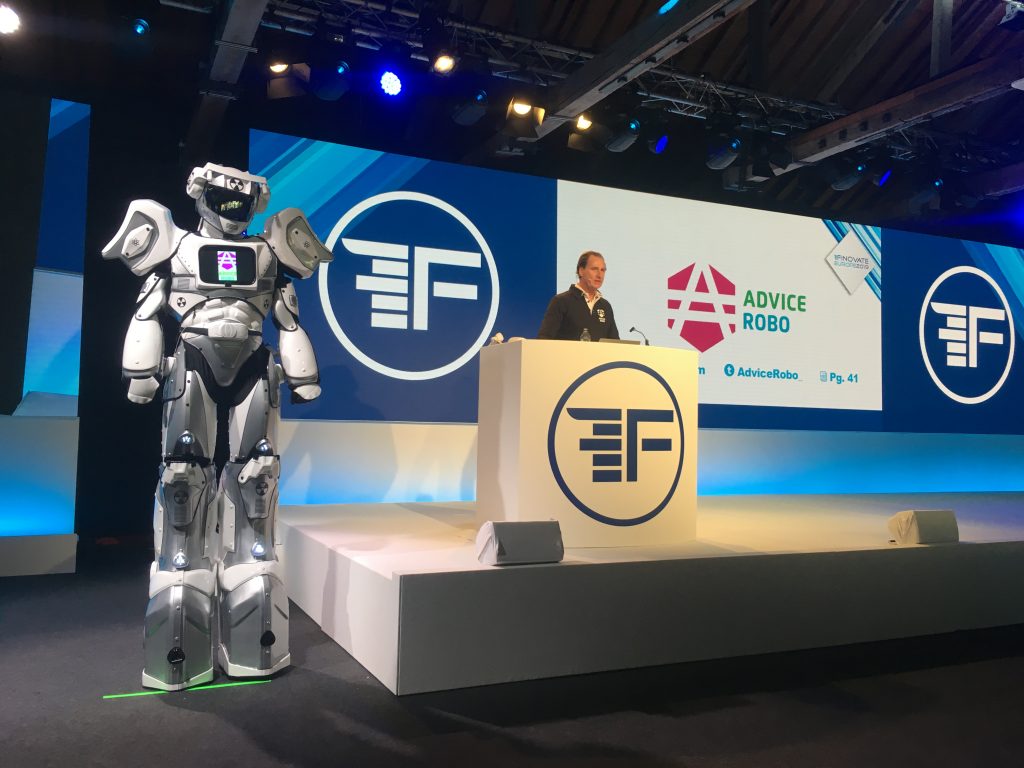

AdviceRobo demoed at FinovateEurope 2019 its revolutionizing solution to “assess credit quality by applying smart psychographic credit processing, artificial intelligence and the internet of things. This is world’s first solution that integrates lifestyles, attitudes and beliefs of people and other behavioural data into smart credit software,” they said in a press release.

Their goal is to improve the credit decisioning process by providing lenders credit software to expand their acquisition to so called thin file customer segments. Think SMEs, self employed people, migrants, millennials in the western countries and also billions of consumers in developing countries. “We leverage the psychographic and behavioural data explosion into smart risk robots that improve lenders revenue and reduce their operational and risk costs big time,” company co-founder and CEO Diederick van Thiel said.

Global market leading banks like BNP Paribas and many others already experience compelling benefits by using AdviceRobo solutions: 15% more sales at a 20% lower default rate, the highest NPS in the market and over 20% operational cost reduction.

Access to loans and Financial Inclusion

According to the company, their aim is towards providing financial inclusion as well as there are some 4.5 billion people worldwide who have insufficient or no access to loans, because they have little or no credit history. “Our software enables lenders to target these underserved customers and streamline their credit processes,” said Van Thiel. “This stimulates prosperity and the economy. Moreover, our software accelerates credit processes and identify the key risk signals of existing clients.”

Customer is in the drivers’ seat in this brand new release

Integrating facial recognition in authentication, a personal dialogue program and smart data validation are the core of this new software. The customer is in the lead in sharing data to further smoothen and shorten the lending process. AdviceRobo intends to transform global credit with JACQ, its Psychographic Credit Scoring Robot.

The AdviceRobo solution is Psychographic processing. “Using our questionnaire, we look at borrowers’ personality and behaviours, rather than relying only on credit histories. This gives a more rounded, accurate indication of an applicants trustworthiness. Our risk robot JACQ gathers data from potentially unlimited data sources and applies AI to accelerate our clients’ acquisition process – allowing them to immediately fulfil loans,” said the company.

Credit score is a data-driven metric used by banks worldwide to measure the economic health of an individual. A credit score, also known as a credit rating, is a number that reflects the likelihood of the paying credit back. Lenders like banks and credit card companies will look at the credit file when they calculate a person’s credit score, which will show them the level of risk in lending. The higher the credit score, the better the chances of being accepted for credit, at the best rates.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.