Bridgewater manages $170bn in assets

Bridgewater Associates with $170bn in assets under management is the largest hedge fund. Founded by Ray Dalio in 1975 out of a two-bedroom apartment, Bridgewater has carved out a unique place for itself among over 5000 hedge fund managers. It is far away from its nearest competitor are AQR Capital Management with just $65bn in assets. Bridgewater manages more than 2% of $3tn Hedge Fund Industry assets.

Bridgewater has been a top-performer manager and an industry innovator. Since inception the firm has averaged 13% annual returns. It was one of the few firms to have positive performance during the 2008 financial crisis.

Ray Dalio: How the Economic Machine Works

Ray Dalio, the founder, is the man behind the spectacular success of Bridgewater Associates. Today Dalio has a personal net worth of $15 billion and is the second-wealthiest hedge fund manager, next only to George Soros.

65 years old Dalio is recognized as one of the world’s most respected big-picture economic thinkers. In his popular video ‘How the Economic Machine Works’, Dalio shows the basic driving forces behind the economy, and explains why economic cycles occur by breaking down concepts such as credit, interest rates, leveraging and deleveraging. He simplifies the economy as the interaction of short- and long-term debt cycles over a productivity growth line.

Talking about his success, Ray Dalio refers to basic approach he followed all his life and that helped him build the company:

- Working for what I wanted, not for what other wanted me to do

- Coming up with the best independent opinions I could muster to move toward my goals

- Stress-testing my opinions by having the smartest people I could find challenge them so I could fin out where I was wrong

- Being wary about overconfidence, and good at not knowing

- Wrestling with reality, experiencing the results of my decisions, and reflecting on what I did to produce them so that I could improve.

Bridgewater’s strategies

Bridgewater Associates LP, based in Westport, Connecticut, is a global investment management firm; but it is available only to institutional investors like public pensions, university endowments and charitable foundations. It is not available to retail investors.

The firm with 1,400 employees is considered employee- owned and employee-run hedge fund. An exhaustive manual developed by Dalio guides Bridgewater employees. The manual contains 210 principles to be followed by all employees. Initially it was a confidential document available to Bridgewater employees only, but now it is available at the Bridgewater’s website.

Bridgewater Associates has been consistently following two main investing strategies, known as Pure Alpha and All Weather.

Pure Alpha

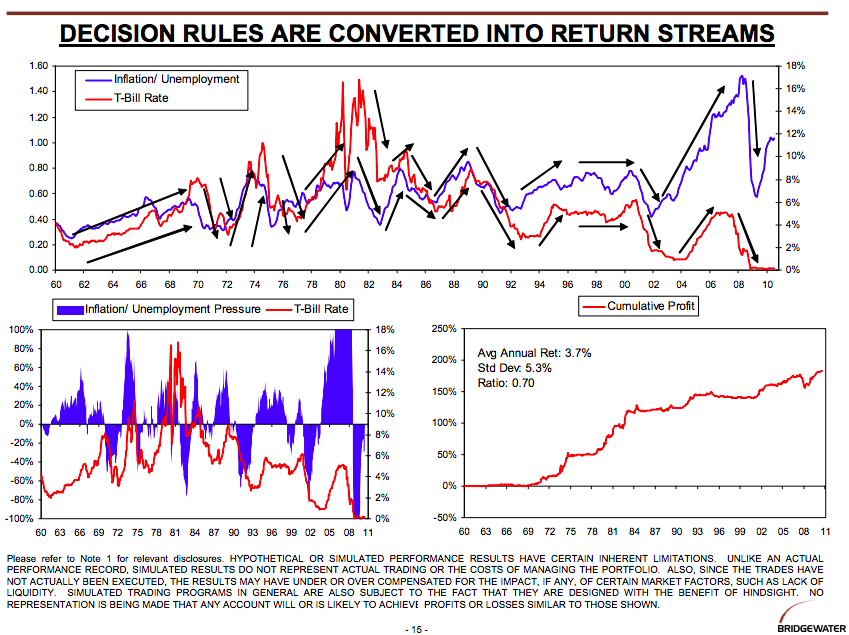

Pure Alpha is a traditional hedge fund strategy that actively bets on the direction of various types of securities—including stocks, bonds, commodities and currencies—by predicting macroeconomic trends. Pure Alpha has given average return of 13 percent annually since 1991.

Source: RD at Harvard, slideshare presentation

All Weather risk-parity strategy

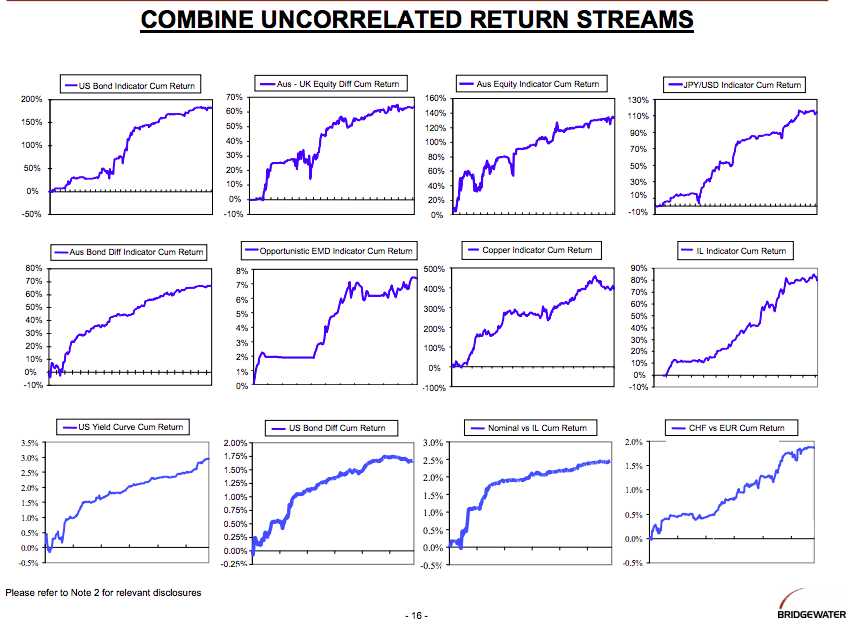

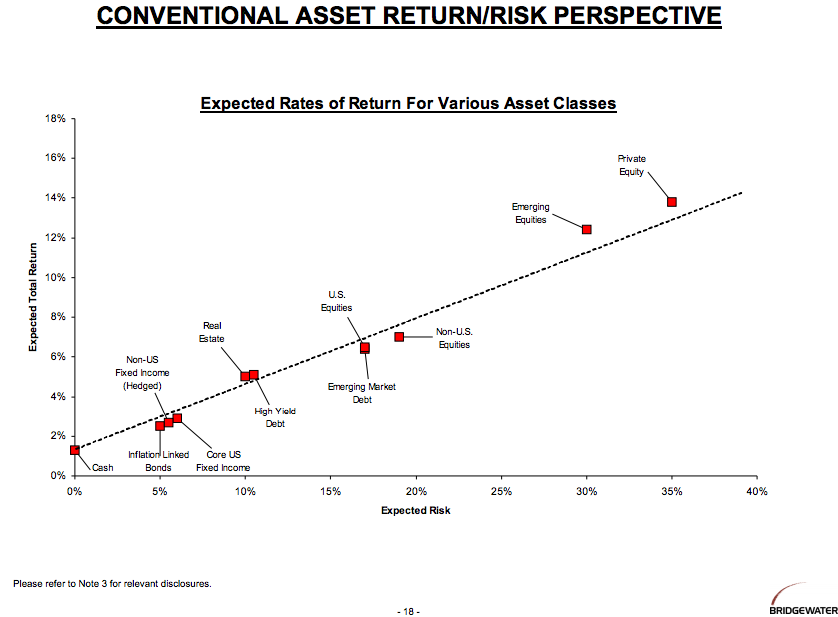

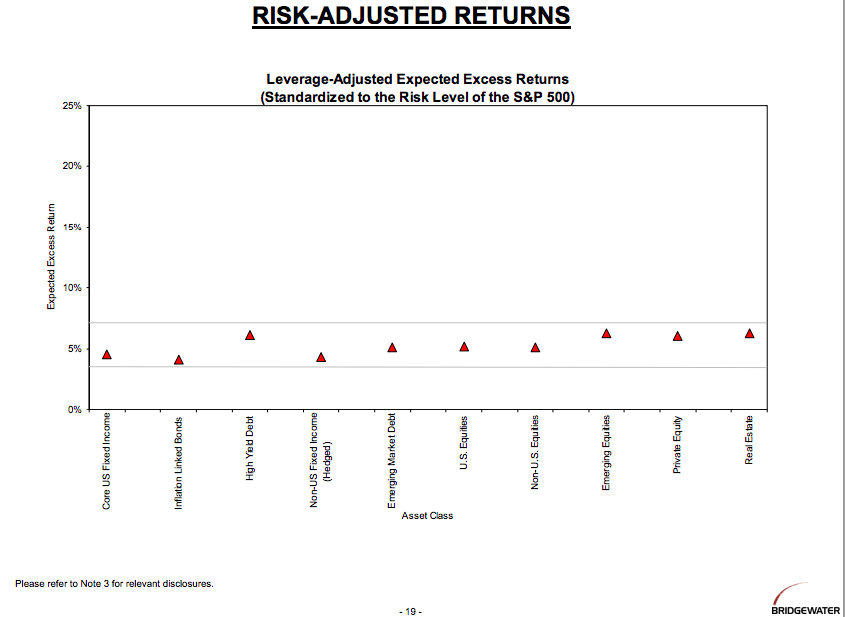

All Weather, pioneered by Dolio in 1996, is a risk-parity and leveraged beta strategy. The philosophy is to reduce the volatility of investing in assets that naturally move in the opposite direction in different economic environment. It says there are four basic economic scenarios: rising or falling growth, rising or falling inflation. And different class of assets behave differently in each of these economic scenarios. Future is unknown, but it will fall into any two of these four scenarios. The All Weather strategy allocates a quarter of a portfolio’s risk to each of these scenarios. It is not same as allocation of assets, it is allocation of risk.

Source: RD at Harvard, slideshare presentation

The portfolio makes money in any economic environment. Bonds in the portfolio are often modestly levered by using borrowed money to increase their return. All Weather has given 8.95 percent average annual return since its inception in 1996.

Bridgewater launches third strategy: Optimal Portfolio

After a gap of 18 years, Bridgewater launched yet another strategy, Optimal Portfolio. Optimal Portfolio combines the firm’s other two main investing styles, Pure Alpha strategy and All Weather risk parity beta strategy. It also adds alpha short and market-neutral positions. Thus the Optimal Portfolio strategy combines Bridgewater’s best beta with tailored, value-adding and risk-reducing alpha to producing a high, consistent and diversifying return stream. The strategy is expected to to produce a net annualized return of 8.5% with a 10% risk level, which would be in line with the historical returns for All Weather and Pure Alpha. It’s new portfolio, which started trading on 1 Feb 2015, has got good response, already raised $10bn.

Bridgewater uses leverage to try to magnify returns on stocks, bonds and commodities. The firm follows cheap leverage as an alpha generating strategy as long as short rates stay low. Investment in public equities constitutes a small proportion of Bridgewater’ portfolio and is made through ETFs.

The company’s $170 billion assets under management has 47% each in the Pure Alpha and All-Weather strategies and 6% in the Optimal Portfolio.

Thus, Hedge fund leader Bridgewater Associates is poised to grow even larger with its innovative strategies. Its leadership position will remain unchallenged in near future.

Relevant Posts:

Bridgewater Founder Ray Dalio’s Biggest Fear Is 1937

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.