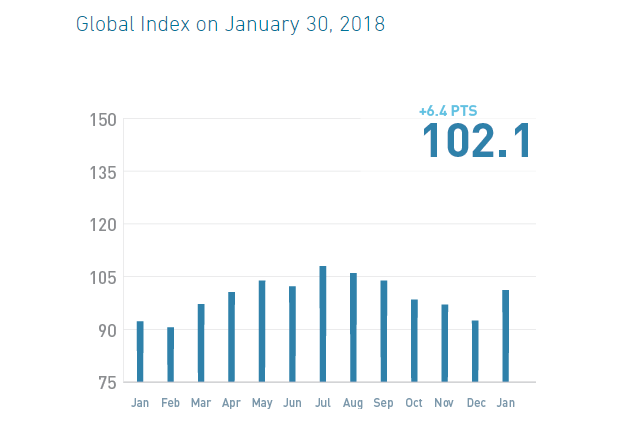

State Street Global Exchange today released the results of the State Street Investor Confidence Index® (ICI) for January 2018.

The Global Investor Confidence Index increased to 102.1, up 6.4 points from December’s revised reading of 95.7. Investors across all regions showed an improved appetite for risk, with the European ICI rising by 16.0 points to 113.4, the Asian ICI increasing by 6.1 to 100.8, and the North American ICI increasing by 1.7 points to 97.2.

The Investor Confidence Index was developed by Kenneth Froot and Paul O’Connell at State Street Associates, State Street Global Exchange’s research and advisory services business. It measures investor confidence or risk appetite quantitatively by analyzing the actual buying and selling patterns of institutional investors. The index assigns a precise meaning to changes in investor risk appetite: the greater the percentage allocation to equities, the higher risk appetite or confidence. A reading of 100 is neutral; it is the level at which investors are neither increasing nor decreasing their long-term allocations to risky assets. The index differs from survey-based measures in that it is based on the actual trades, as opposed to opinions, of institutional investors.

“Global equities have seen the best start of a new year in three decades. Stocks are hitting all-time highs, earnings forecasts are rising, and positive earnings surprises have outweighed disappointments across global markets. Given this backdrop, it is not surprising that global institutional investor confidence is showing signs of optimism,” commented Kenneth Froot.

“We seem to be witnessing a sense of confidence in Europe after two years of subdued risk appetite,” commented Rajeev Bhargava, managing director and head of Investor Behavior Research, State Street Associates. “Improving European economic growth, subsiding political uncertainties, and the European Central Bank’s accommodative policies are possibly feeding into stronger enthusiasm.”

State Street Corporation (NYSE: STT) is one of the world’s leading providers of financial services to institutional investors, including investment servicing, investment management and investment research and trading. With $33.10 trillion in assets under custody and administration and $2.80 trillion* in assets under management as of December 31, 2017, State Street operates in more than 100 geographic markets worldwide, including the US, Canada, Europe, the Middle East and Asia.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals