Investor confidence is on the rise as inflation expectations decline, according to the HL Investor Confidence Index, which has recently reached a level of 78.

This increase in confidence is particularly notable in various markets, including the Asia Pacific, European, Global Emerging, and UK markets. However, in the US market, confidence has experienced a slight decrease. Interestingly, this hasn’t deterred investors from actively investing in funds.

The UK’s inflation figures, set to be released this week, are being closely monitored as they are expected to confirm a more positive outlook. Emma Wall, the head of investment analysis and research at Hargreaves Lansdown, attributes the rise in the Investor Confidence Index to the prevailing belief among economists and investors that the peak of the inflationary period has passed. Economists are projecting a slower inflation rate for the UK in the upcoming July inflation rate report, which is anticipated to be published on Wednesday. This optimistic regional perspective is reflected in the substantial increase in confidence in the UK market for this month’s Index. Conversely, confidence in the US has seen a minor dip due to a slight rise in inflation last week, albeit not to the extent seen in recent times.

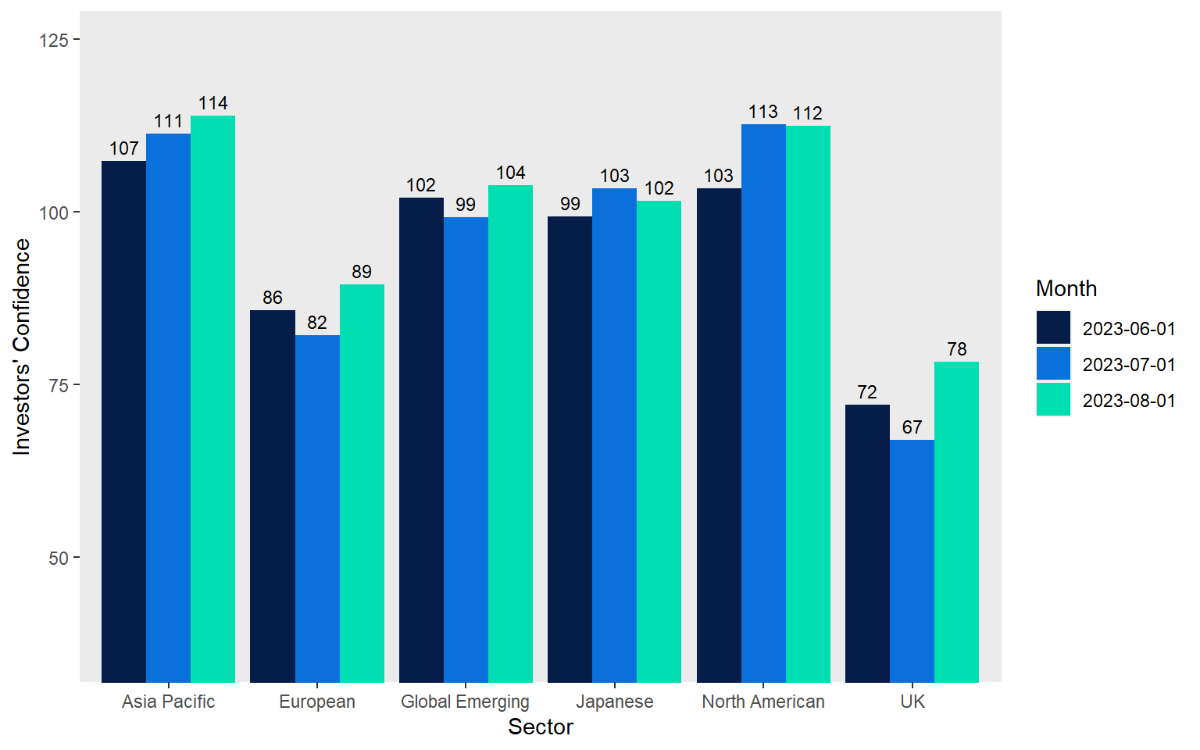

Investor Confidence – Global Sectors

Interestingly, even though investors express reduced confidence in the US region, trading activities paint a different picture. The most popularly purchased funds and trusts this month are centered around the US, including US-centric trackers, active funds, and investments in global and tech sectors with a US bias.

HL data

| Top Funds, August 2023 (net buys, alphabetical) |

| abrdn Sterling money Market |

| Baillie Gifford American |

| Fidelity Global Technology |

| Fidelity Index World |

| Legal & General Cash |

| Legal & General International Index Trust |

| Legal & General UK 100 Index Trust |

| Legal & General US Index |

| Premier Miton UK Money Market |

| Royal London Short Term Money Market |

| Top Investment Trusts, August 2023 (net buys, alphabetical) |

| AVI Global Trust plc ORD GBP0.02 |

| Brunner Investment Trust plc Ordinary 25p Shares |

| F&C Investment Trust plc Ordinary 25p |

| Greencoat UK Wind plc Ordinary 1p |

| India Capital Growth Fund Ltd Ord GBp0.01 |

| JPMorgan Global Growth & Income plc Ordinary 5p |

| NextEnergy Solar Fund Ltd Ordinary NPV |

| Pantheon International Plc ORD GBP0.067 |

| Pershing Square Holdings Ltd NPV |

| The Renewables Infrastructure Group Limited Ordinary Shares NPV |

Confidence has not only surged in the European market but has also extended to emerging markets. Nevertheless, the overarching influence of inflation and its consequence of higher interest rates continue to impact consumer and corporate decisions globally. These effects are visible across various aspects, from a sluggish housing market and labor sector strikes to increased purchases of government bonds (gilts). The push for higher yields has also propelled money market funds into the top 10 most purchased funds, indicating that despite market rallies, the economic cycle is still undergoing some abnormal or unsettling shifts. As such, all eyes are currently focused on the actions of the Bank of England in the upcoming week, with expectations of their confirmation of a more optimistic economic outlook.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.