Last week we continued to see yields as the main driver for the markets. We had US CPI which was higher than expected but although yields failed to push higher, they still remain at elevated levels. Risk off continued as the sad events in Israel and the Gaza strip brought uncertainty to the markets as fear about escalation increase.

The Dollar rallied again with the DXY rising 0.5% to close around 106.68. The greenback was helped by the CPI print but mostly as risk assets were sold and dollar safe haven came into focus with the middle east developments from the weekend.

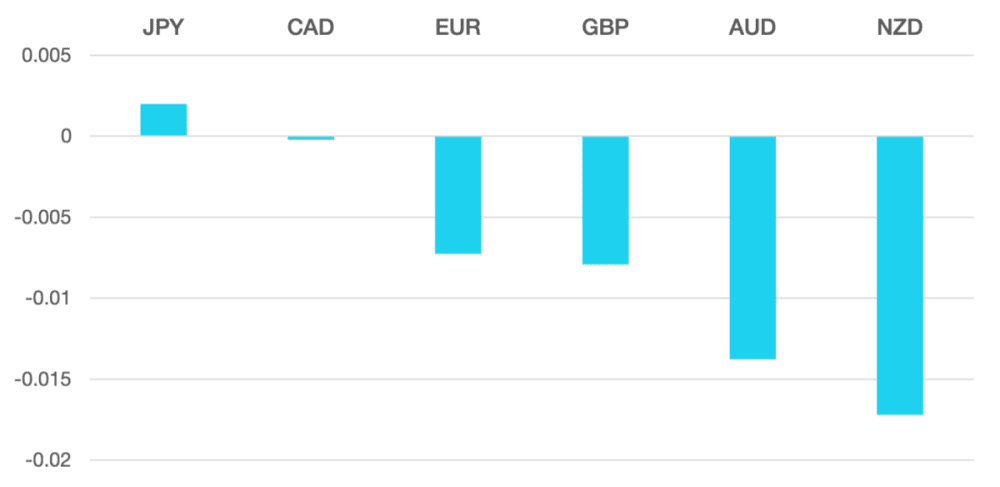

Both the Euro and the Pound lost ground against an appreciating US Dollar but gained against most other currency pairs. The Euro continues to look weak as it touched 1.05 and markets are looking once again at parity for the Euro.

Commodity currencies had a difficult week. As the dollar appreciated and the risk sentiment for the week became worse both AUD and NZD lost around 1.5%. JPY remained broadly flat as safe haven positioning took place.

Oil unsurprisingly rose snapping last week’s losing week. WTI rallied 6% to close around $67.70.

The week ahead is a complicated one. The troubles in Israel / Gaza will be the focus. Any further escalation will weigh on risk assets. Yields will remain in focus as the US 10Y sits at the top of the range.

In terms of data, we have inflation numbers from most developed countries which will once again give clarity to any further interest rate changes.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Israel Conflict Weighs on Risk first appeared on trademakers.

The post Israel Conflict Weighs on Risk first appeared on JP Fund Services.

The post Israel Conflict Weighs on Risk appeared first on JP Fund Services.