Last week was a busy week but with the long Easter break the week ended more subdued. An unexpected oil production cut from OPEC+ which spiked oil price. The week ended with Non -Farm Payrolls which came inline so now the market will be looking towards the Fed and if the tightening cycle has come to an end.

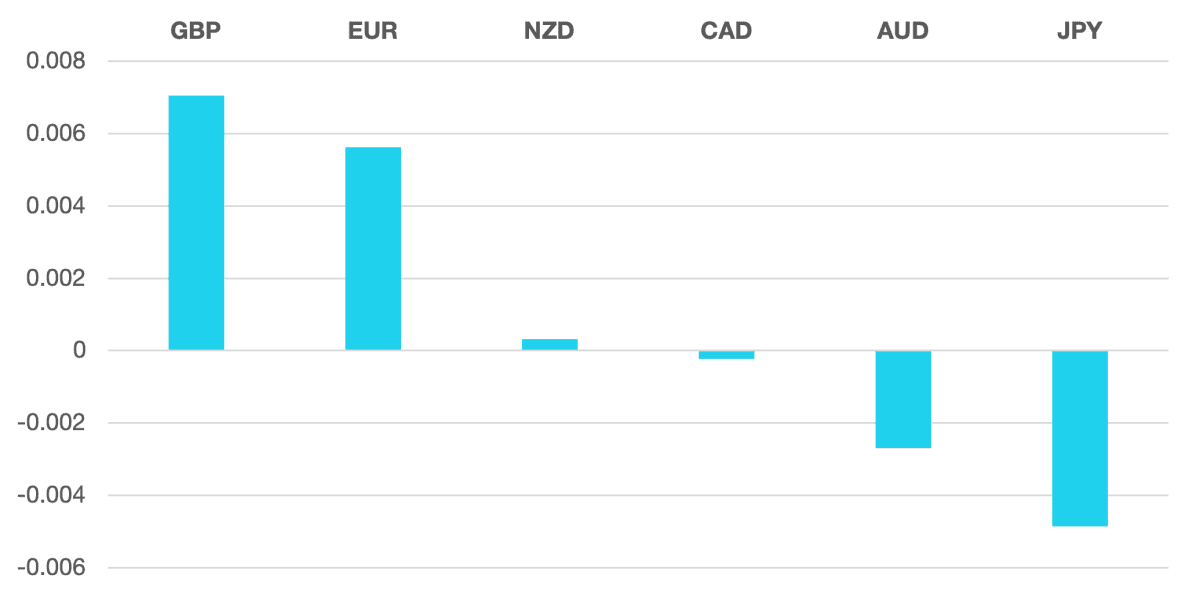

Euro had a positive week as both PPI and PMI came in line with expectations. The single currency traded broadly flat on the week vs its peers but gained vs the US Dollar as the dollar had a broadly weaker week.

GBP had a better week though the economic data is still not pointing to anything to maintain any upward trajectory.

Commodity currencies had a very quiet week ending the week flat as risk assets failed to make any move higher.

Oil had a very strong week. An unexpected oil production cut by OPEC+ WTI rallied 6% to close above the $80 per barrel price.

The week ahead is shorter with the European holiday on Monday but with US CPI during the week it could lead to predictions on when the Fed may at last pivot.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Long Weekend Leave Markets Subdued first appeared on trademakers.

The post Long Weekend Leave Markets Subdued first appeared on JP Fund Services.

The post Long Weekend Leave Markets Subdued appeared first on JP Fund Services.