There are a million and one theories about the best strategy investment, often completely contradictory but held in equally high esteem by their proponents. For example some believe that the bear market’s the time to make hay as prices fall and there are bargains to be had while others think that if it’s not a bull market then they’ll hold tight till it becomes one. Others like the much-quoted Warren Buffett believe that it’s simply a question of maintaining the self-control to avoid making the sorts of decisions that may seem obvious but, on closer or more objective inspection, may be potentially disastrous.

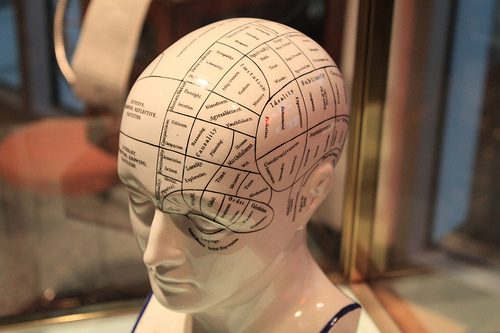

Underlying the latter position is a profound understanding of the psychological aspects of developing an effective investment strategy and the more you can understand about human inclinations and how to harness them, the better it will serve you. This is equally applicable whether you’re considering stock options or investing in indices as the natural motivations remain very much the same.

One of the most common psychological traits that comes into play is overconfidence. A natural facet of many of us, especially when things are going well, it can also lead to one of the most damaging psychological states for investing. It can come from previous experience and often also goes hand in hand with selective memory. In this we put on our rose-tinted spectacles and re-imagine trades that went well as going spectacularly while pushing those which failed to deliver their promise to the back of our minds. Both of these areas have been extensively studied in a field called behavioural finance and how it can affect everything from FTSE investment to the typical sequence of emotions experienced by investors.

The root of the issue lies in the the fact that we like to consider ourselves to be rational beings capable of digesting and processing both information and experience in order to achieve the right conclusion. However various psychological states can override rationality to create a view of the market which is more based on how we would like it to be than in objective reality.

Two further psychological phenomena that can also have a significant effect on investment success are loss aversion and confirmation bias. The former refers to the natural human inclination to focus on the aspects in life which are going well while turning our gaze away from less successful areas. In financial terms this can be interpreted to mean that we concentrate on investments that are appreciating in value and dismiss others that are under-performing. Often this can lead to premature disposal of stocks when a longer-term view could return a slow-burning success.

Confirmation bias, which has received a great deal of academic scrutiny, is the inclination to give greater weight to evidence that supports our suppositions than to signs that the opposite may be true. Together, they can help make the irrational seem logical in our minds – a fatal combination when clear thinking is required.

So by taking a little time to stand back of seriously interrogate one’s assumptions, not to mention state of mind, the obvious may soon become far more open to question. And that, as any psychologist will tell you, is when we can all start to make real progress.

Thought leadership series on the collaborative economy, sharing economy and blockchain, powered by Humaniq