The finleap ecosystem is growing. Penta, who offers fast and easy business banking for digital companies, is becoming a finleap portfolio company by acquisition. This is a new extension of the finleap ecosystem and steering the internationalisation of Penta at the same time: In the course of 2019, the company will collaborate with Beesy, a finleap portfolio company focusing on digital business banking for freelancers, which launched in Italy.

Penta, which counts over 5,500 digital businesses like AirHelp, bepro11 and Global Digital Women as customers, adds a new asset to the finleap portfolio. Penta’s customers can open a business bank account in just a few minutes, completely online. They have a fast and easy real-time overview of their finances, they can get credit cards with individual limits for their employees and even do their accounting within Penta. In the course of this year, Penta plans to release many features like direct debits, loans, international transfers and more.

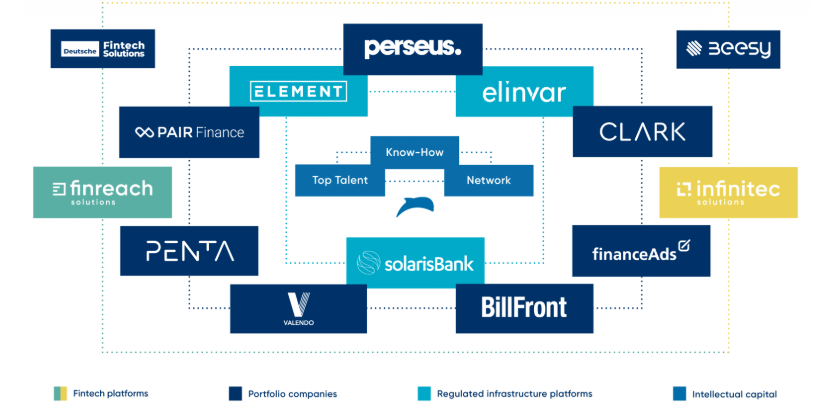

Therefore, the innovative Penta business model complements the existing value chain of services, designed for companies and self-employed workers from the digital industry, in the finleap ecosystem like Cybersecurity with Perseus and digital debt collection with PAIR Finance. Furthermore, Penta is already an extended part of the finleap ecosystem, by using digital banking, debit cards as well as the banking license of solarisBank as an enabler for their business bank accounts in Germany.

Ramin Niroumand, Founder and CEO finleap: “We are very pleased to welcome Penta to the finleap family. The team has a great product, which matches perfectly with our existing fintech ecosystem. We believe firmly in vertical banking, and so does Penta with its focus on providing banking solutions for the digital industry. Through our strong network, we are able to accelerate Penta’s business significantly. “

Jessica Holzbach, Co-Founder Penta: “By becoming part of the finleap ecosystem, Penta moves to the next level of growth. With finleaps powerful backbone of strategic partners, investors, tech know-how and top talents, our company can prosper at an unprecedented pace.”

As a first step, Penta will collaborate with Beesy. Beesy was launched by finleap in September 2018. The company offers services like digital banking and invoice management for freelancers, very similar to Penta’s services. Both companies aim to digitize financial management for companies and micro-businesses of the digital industry, in order to help entrepreneurs and business owners to bank less so that they can focus more on their business. By collaborating with each other, Pentas digital banking solution for digital companies will be available over Beesy also in Italy.

Luka Ivicevic, Co-Founder Penta: “Beesy and Penta complement one another in their respective strengths, while at the same time sharing the same vision. By collaborating, we benefit from each other by expanding our product range and focussing on a larger customer base. It is a really exciting new step ahead.”

The management team of Penta is formed by the two Penta Co-Founders Jessica Holzbach (Chief Customer Officer) and Luka Ivicevic (Chief of Staff), as well as Lukas Zörner (Chief Product Officer). Lav Odorovic, founding CEO of Penta, will step back to a shareholder role.

finleap is Europe’s leading fintech ecosystem, based in Berlin and with an office in Milan. Founded in 2014 by HitFox Group and Ramin Niroumand, finleap has already developed 16 ventures with its infrastructure and added others by acquisition to its ecosystem. These include companies such as solarisBank, the first banking platform with a full banking license, ELEMENT, a fully digital insurer, PAIR Finance, a provider of data-based receivables management, and the fintech platforms, finreach solutions and infinitec solutions, for contextual finance. finleap provides access to seed capital, a network of investors and experienced entrepreneurs as well as customers and top talents. The finleap group employs around 800 people from 60 countries.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals