As the COVID-19 pandemic continues to create uncertainty, many fintech companies (“fintech’s”) are under stress on a number of fronts. At the same time, the coronavirus crisis may create new opportunities for some fintech’s. For example, as social distancing has taken hold worldwide, there has been tremendous growth in the use of digital financial services and e-commerce. FinTech’s have a unique capability to extend financial inclusion, improve the daily lives of people and spur growth. Fintech firms can use a fintech software company to build their reputations and emerge stronger once the crisis has passed.

Fintech’s tech savvy developers are working on big ideas and new digital offerings that meet consumer demand for an increasingly frictionless and seamless banking experience. Now, the technologies are also divided into many different parts, and the ones that are covered under Fintech are insurance technology, financial data APIs, payments, regulatory technology, banking, and mobile banking. Each of these categories is connected with one or another sector of Finance technology.

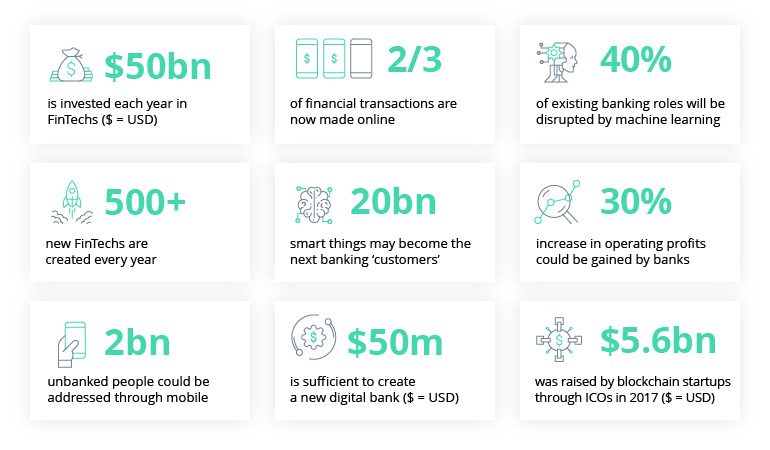

In recent years, people are getting more focused on the internet and mobile internet. That is the reason we can notice rapid development in financial technologies. Even most of the merchants and businesses are accepting the Fintech innovation or trend. Fintech has created a major impact in the financial sector, leveraging some of the latest innovations such as Artificial Intelligence, Robotics, Biometric applications, Blockchain, Peer-to-Peer lending, and so on. If FinTech has created a bigger revolution in the financial sectors, then there will be subsequent opportunities to seize the market. Fintech money service businesses have fulfilled the need for easy, accessible and affordable financial services and now play an integral role in the global economy.

Fintech trends show that people are more comfortable managing their money and business online, and they’re less willing to put up with the sometimes glacial pace and bureaucracy of certain traditional financial services. PayPal, GoldMoney, and Alipay are the examples of financial technology which is adopted by almost every startup company. To elaborate more on the options, for example, PayPal customers can send and accept money in all types of currencies. The additional benefit of PayPal is that customers can also convert the foreign currency to local currency and transfer the converted currency directly to the bank. Currently, the use of PayPal have grown significantly in all the regions throughout the business ecosystem. It is expected that the investments in the FinTech would increase up to $150 Billion across the world. Leading a global business entity in itself, one quickly understands the fundamental importance of fintech services to the developing world. The virus has changed our ways to operate but hasn’t halted our progress or our commitment to this cause.

As the COVID-19 pandemic continues to create uncertainty, many fintech companies (“fintech’s”) are under stress on a number of fronts. As the financial services market shifts, we are witnessing a swing towards factors such as simplified access, embedded financial services and financial inclusion. Financial inclusion in developing markets has become even more important during the pandemic. Access to funding was already becoming difficult, especially for some early-stage ventures, as many investors focused on established FinTech’s with clear business models. In addition, recent interest rate cuts and the economic slowdown have radically changed many industry assumptions.

Yet as the broader economy shifts from respond to recover, COVID-19 may create new opportunities for some fintech’s. For example, as social distancing has taken hold worldwide, there has been tremendous growth in the use of digital financial services and e-commerce. FinTech’s have a unique capability to extend financial inclusion, improve the daily lives of people and spur growth. Fintech firms can use this opportunity to build their reputations and emerge stronger once the crisis has passed.

What are the main FinTech challenges?

These are the main challenges for any FinTech start-up or traditional financial institution that decides to go mobile:

Security issues and lack of trust

Security is by far the biggest concern when it comes to mobile banking, payment apps and FinTech in general. Traditional banks have security guards, cameras, vaults, and heavy bulletproof doors to keep their assets safe. Vulnerabilities in virtual banks are much more discreet and have potentially more impact on users. When it comes to virtual security, things start getting harder: vulnerabilities are much more discreet and have potentially more impact on users, as not only their money is at stake but their personal information too.

Just like with physical money, you need to establish a high level of protection for your FinTech app. to make your FinTech app secure you need to implement: Two-factor authentication, Biometric authentication, Data encryption, Real-time alerts and Behaviour analysis There are so many cybercrime solutions that Fintech industries follow, but the Blockchain technology is able to control this issue. As the new industries are emerging each day, the Blockchain industry has to look for the best solutions.

Big data and AI integration

The Big Database offers both opportunities and obstacles for Fintech technology providers. Big data and artificial intelligence are two necessary technologies for any modern banking software. Most of the Industry experts work with the belief that AI will soon transform almost every aspect of the financial services industry. Big data allows businesses to collect and organize information about a user, from their name, family members, and social status to financial behavior, habits, and in-app activity.

All this information is crucial to a bank, especially when it comes to credit ratings and offering other high-risk banking services. Combined with big data, artificial intelligence can help you automatically detect fraud, perform risk analysis, and manage transactions effectively. However, these technologies are challenging to implement: they require exceptional engineering skills and constant maintenance. The best solution is to hire an expert in big data and artificial intelligence and allow them to learn your business from the inside to find out your needs and determine how to meet them with industry best practices.

Blockchain integration

It is said that Blockchain is a key component of battling against the cybercrime. But when we talk about the financial sector, Data security is not the only application of the Blockchain. Many FinTech applications are based on the block chain. Some think the block chain hasn’t lived up to expectations, while others are sure it’s the future of all data exchange on the internet. Whereas, it has already proved that Blockchain has the value in the variety of investment applications and banking. With a block chain, you can make your FinTech software more trustworthy, as a block chain allows you to track all stages of a transaction and prevent any changes to it so that you can always see what’s happened to your money. However, integrating a block chain is a challenge for many financial institutions and it is said that the industry-wide adoption of the Blockchain is quite difficult.

Compliance with government regulations

Finance is one of the most regulated sectors. Government regulations will be your concern even if you have more traditional FinTech software that doesn’t use a blockchain and other yet-to-be-proven technologies. Check your software and internal processes for legal compliance and, if needed, hire a legal consultant to lead you through all the details.

Lack of mobile and tech expertise

In many countries, finance is very traditional, and most banks don’t have proper mobile banking or other FinTech services that are convenient for users. Some banking app makers try to replicate websites, but mobile software is very different. Lack of expertise in fintech mobile app development results in non-user-friendly applications that don’t use mobile devices to their fullest potential. A fintech bank is able to provide outstanding experience using these technologies. With an infrastructure, built in physical banks, streets and shops, a banking app becomes a powerful tool. Create your own development department or hire developers from an outsourcing company to build FinTech products app with mobile development best practices in mind.

Growth issues

This challenge is about finding your niche, audience, and strategy. In the world where most people still use services from traditional banks, FinTech start-ups can find the competition hard to overcome.

To grow your financial technology start-up, you need to make sure you’re significantly better than your competitors. And for this, you need to either invest loads of money, effort, and human resources to bring a whole package of services to your users or you need to cooperate with traditional banks.

Future Trends of Fintech

The following are the unique trends that enable the future growth of the fintech industries:

Platform as a Service (PaaS) Offerings Expand

Customers crave convenience. However, financial institutions struggle to meet their demand while safeguarding information. As banks comply with evolving regulations, customers will benefit from the opening of APIs to customer data. With PaaS, institutions can adapt to changing needs with customized infrastructure that allows them to embrace cloud platforms fully.

Increase in Dependence on Intelligent Technologies

From traditional establishments testing robo advisors to advanced algorithms assessing credit profiles, we’ll see companies expand their use of intelligent technologies. The mixture of artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) provides multiple benefits to those in the financial industry, such as:

· A decrease in risk from loan defaults through the use of alternative credit decisioning models (ACD) that use ML.

· Smarter risk management that uses predictive and proactive models instead of reactive processes.

· An increase in operational improvements resulting from data collection and analysis.

· Better customer experience through the adoption of virtual customer assistants (VCA).

Technologies that deliver, manage and analyze data help financial services reduce the time and cost associated with workflows. As use grows, customers expect conventional institutions to keep up with the pace.

Mobile Payment Options Go Mainstream

There are other platforms where customers can pay or get paid. This low-cost initiative has become famous across the world, enabling the customers to accept money, send money, and transfer the money to the bank. Using this technology, customers are using the mobile-based money transfer/accept as an alternative method. One of the primary reasons that Mobile Money has become famous is because people do not have to worry about internet banking, credit cards, password, PIN, and so on. Similarly, financial industries such as life insurance and general insurance can also follow this initiative to attract the customers, for new policy and renewing the policies. In the US, consumers feel comfortable with wallet-less options and rally behind big players, like Google and Apple. Payment options use blockchain technologies to verify identities for greater financial inclusion.

While customers embrace smartphone payments, those in the financial services industry worry about how their technology stack will handle increased transactions. However, the upcoming 5G technology ensures that networks can handle higher quantities of transactions and provide a reliable experience.

Use of Regulatory Tech (RegTech) Grows

The investment increase will be driven by the increasing amount of regulatory oversight with regards to fintech as well as the increasing number of regtech solutions allowing large financial institutions to implement tech instead of hiring more compliance employees. RegTech uses AI to automate risk assessments while delivering insights on big data.

Regtech solutions address regulatory reporting, compliance checks, risk management, identity management, and transaction monitoring. The breadth and scope of solutions housed under the regtech umbrella provide financial institutions with a wide range of use cases and potential for efficiency improvement.

Regtech investment improves operational efficiency in compliance activities, allowing compliance departments to reduce overhead and improve performance. Regtech has proven its value for many financial institutions, and investment in this category of solutions will continue to rise.

Blockchain Technology

Blockchain pushed fintech into the media spotlight, and blockchain technology will drive mobile banking adoption outside of the high growth areas in which it currently maintains the most market share. Blockchain software and applications outside of cryptocurrency will prove their staying power in the financial services industry, and real estate is the industry in which they’ll have the greatest impact.

While cryptocurrency may never solidify itself as a mainstay in the markets due to its volatility and the uncertainties regarding its viability as a store of value, the underlying technology is applicable. Blockchain, by providing unbanked individuals a verifiable, easily created online identity, will allow more individuals to be financially included than ever before.

Great user experience is no longer enough

Back when banks had cumbersome websites that didn’t render on mobile, it was easy for fintech’s to win over customers by building a half-decent app with a great user experience (UX). Today, most financial institutions have transformed their retail user experience, offering full mobile functionality with best-in-class design principles. Great UX is now the norm. Customers, as a result, require more reasons to switch to new fintech offerings.

Simple interfaces, ease of use, and free stuff no longer equate to a viable business model. A FinTech app should keep a balance between user experience and security: for example, you should make sure it’s neither too easy nor too hard to get access to a mobile banking application. Attackers now need to find more robust ways to differentiate themselves from incumbents. Make sure your UI/UX decisions are both secure and user-friendly.

The introduction of cloud native solutions

Banks are realising that to stay competitive, they need to push beyond the regulatory and market mandatory ‘Open Banking’ strategy into new services and new products, and cloud technology is a perfect leverage for this. During 2020 we will see traditional banks increasingly realise the huge benefits of migrating their core systems to the cloud. Banks can cut costs, as they will not have to invest heavily in dedicated hardware, software and related specialised manpower, and will be able to take advantage of the cloud’s modular, pay-on-demand model.

Banks can drop their on premise monolitic software and embrace the modular shared approach that cloud applications provision for, creating greater efficiency and closer relationships with their clients. They can make use of the cognitive, processing and storage cloud capacities to better know themselves and their clients and with it innovate in products and services. Through using cloud computing, banks can adapt to changing market needs and regulatory developments faster to launch either on a stand-alone basis or in a partnership.

Finally, to survive the dynamics of the industry, fintech players should focus on the flexibility of their product architecture and be ready to adjust it to accommodate market and technological changes. To do so, these companies must have the brightest talent and provide these people with educational opportunities, including those in robotic technologies and automation. This year will also show which trends will solidify in fintech and which ones may lose their relevance, so it’s important to keep on keeping up with these trends.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.