Global risk sentiment improved further last week, with equity markets extending their rally and investors cautiously embracing hopes of de-escalation in trade tensions.

While no breakthroughs were confirmed in US-China talks, positive signals from other trade negotiations—notably with Japan, South Korea, India, and even Switzerland—helped bolster optimism. President Trump hinted that “many” trade deals could fall into place within a month, adding fuel to the recovery narrative.

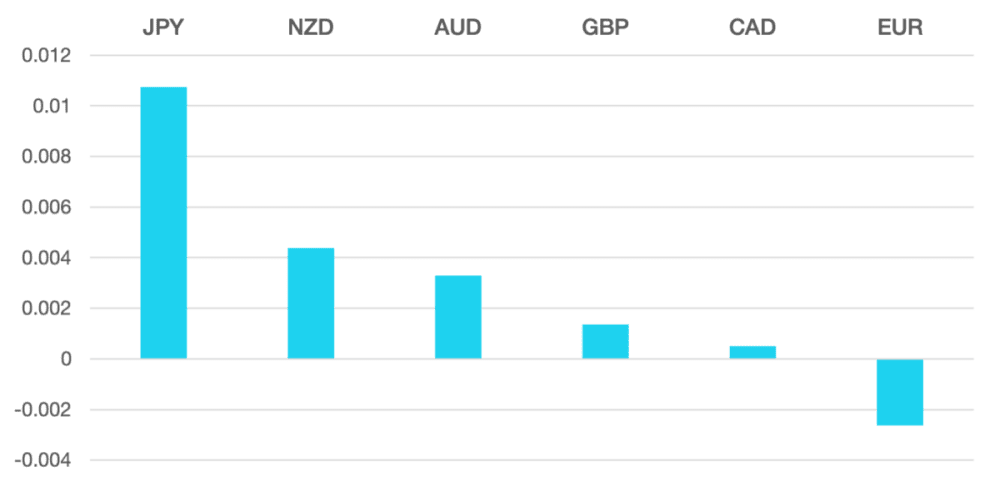

Despite the rebound in risk assets, US assets continue to show signs of hesitation. The Dollar gained 0.4%, with the DXY closing at 99.587, but the move was modest and driven more by positioning than fresh conviction. Mixed housing data and lingering policy uncertainty continue to weigh on the broader USD outlook.

In FX, commodity currencies consolidated their recent gains. The AUD, NZD, and NOK posted small advances, while the CAD finished broadly flat. Kiwi remains the top performer month-to-date, underpinned by risk appetite and supportive yield differentials.

The Euro and Pound traded sideways, with disappointing PMIs capping any upside momentum. Both currencies remain rangebound for now.

Safe-haven currencies underperformed as risk flows remained in play. The Swiss Franc and Japanese Yen eased slightly, reflecting reduced fear levels even as markets stay alert to fresh tariff headlines.

In commodities, WTI crude slipped 0.8% to $63.14, still attempting to stabilize above key support after weeks of volatility.

The Week Ahead:

We’re heading into a busy macro week with high-impact data on deck:

- US GDP, JOLTS, Average Hourly Earnings, Nonfarm Payrolls

- Eurozone and Mexico GDP

- Canada GDP

- BoJ Interest Rate Decision

While these releases will help shape expectations, trade headlines will continue to dominate sentiment. Any progress or escalation in US-China talks could quickly reshape risk appetite and FX positioning.

Technical Watchlist:

- DXY: Attempting to base above 99.20; a daily close above 100.00 could shift bias.

- EUR/USD: Rangebound between 1.1220–1.1400; bias neutral near-term.

- NZD/USD: Holding gains; breakout above 0.6340 would suggest renewed bullish momentum.

With risk sentiment improving but fragile, stay flexible—headline-driven moves are still likely.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Markets Cheer Trade Progress, But Dollar Still Lagging first appeared on trademakers.

The post Markets Cheer Trade Progress, But Dollar Still Lagging first appeared on JP Fund Services.

The post Markets Cheer Trade Progress, But Dollar Still Lagging appeared first on JP Fund Services.