Understanding Market Dynamics

In the constantly changing financial markets, traders seek innovative tools to gain a competitive edge. The Weis Wave is one such tool, derived from Richard D. Wyckoff’s trading methodologies.

This method, developed by David Weis, relies on wave volume analysis, allowing traders to understand market trends with precision. Unlike conventional approaches, it emphasizes volume over price, offering a clearer view of market sentiment. By interpreting fund flow in the market, traders can spot significant turning points, trend reversals, and potential breakouts. This technique serves as a guide through the volatility of price fluctuations, aiding in informed decision-making.

Identifying Accumulation and Distribution Zones

In the complex world of trading, grasping the concepts of accumulation and distribution zones is like decoding the market’s hidden language. These zones, often puzzling for new traders, play a crucial role in predicting major price movements. Wyckoff’s techniques, focusing on volume, reveal these concealed patterns, providing traders with a valuable tool to interpret the market’s intentions.

Accumulation Zones: Strategic Gathering of Institutional Investors

Accumulation zones denote periods during which experienced institutional investors, often termed as smart money, quietly accumulate significant positions in a specific asset. Despite seemingly stagnant or minor price fluctuations, a significant process unfolds beneath the surface. Weis Wave methods excel in detecting these subtle shifts in volume. As smart money accumulates assets strategically, distinct signals emerge within the volume patterns. Cumulative volume waves enable traders to spot these signals, indicating a potential price surge on the horizon. Identifying accumulation zones enables traders to position themselves early, aligning their strategies with the upcoming uptrend and maximizing profit potential.

Distribution Zones: Smart Money’s Exit Strategy

Conversely, distribution zones mark periods when smart money decides it’s time to exit their positions. After an extended uptrend, signs of distribution become apparent. Prices might continue to rise, but the volume patterns tell a different story. Weis Wave meticulously monitors these patterns, highlighting instances where prices rise amid decreasing volume. This contradiction indicates that despite apparent market enthusiasm, smart money is discreetly divesting their holdings. Traders well-versed in Weis techniques can interpret these signals as a warning. Recognizing distribution zones offers a crucial opportunity for traders to exit their positions before a potential downturn, safeguarding profits and minimizing losses.

Analyzing Accumulation and Distribution: Wyckoff’s Unique Approach

What distinguishes Wyckoff’s method in accumulation and distribution analysis is its ability to grasp the subtleties of volume fluctuations. Conventional methods often miss these nuances, leading traders astray. Wave techniques, however, delve deep into market dynamics, uncovering not only the presence of accumulation or distribution but also their intensity and duration. Understanding these intricate volume patterns equips traders with a profound comprehension of market sentiment, enabling well-informed decisions.

In essence, Weis Wave techniques act as a tool, shedding light on the intricacies of accumulation and distribution zones. Proficient recognition of these pivotal phases grants traders a significant advantage. Armed with this knowledge, they can foresee market movements, tactically enter or exit trades, and, most importantly, navigate the market’s complexities with confidence. In the hands of a skilled trader, a simple cumulative volume indicator transforms accumulation and distribution zones from mysteries into profitable opportunities, ensuring every trade is rooted in a deep understanding of market dynamics.

Refining Trade Entries and Exits

Weis Wave techniques introduce traders to various patterns indicating potential market shifts. Patterns such as No Supply, No Demand, and Stopping Volume serve as crucial signals for entering or exiting trades. No Supply patterns emerge when prices rise with low volume, suggesting a potential upward movement. Conversely, No Demand patterns occur when prices fall with low volume, indicating a probable downward trend. Stopping Volume, characterized by unusually high volume after an extended trend, hints at a potential reversal. Mastery of these patterns enables traders to make timely decisions, ensuring they navigate the waves of profitability effectively.

Real-Life Examples: Practical Applications of Weis Wave Techniques

Understanding the methods is one aspect, but witnessing their efficacy in actual market situations demonstrates their practical value. Let’s examine a few real-life instances that showcase how the Weis Wave indicator can be used effectively, simplifying seemingly intricate market dynamics and turning them into profitable prospects.

Example 1: Detecting Trend Reversals in Stock Markets

Imagine a stock market scenario where a company’s stock has been in a prolonged uptrend. While traditional indicators may suggest the trend will persist, paying attention to Weis Wave cumulative volume indicator can reveal a different narrative. Through volume pattern analysis, traders can spot a Stopping Volume pattern, signifying a potential reversal. This signal functions as an early alert system, enabling traders to exit long positions or even contemplate short positions, capitalizing on the impending downtrend.

Example 2: Navigating Cryptocurrency Market Volatility

Cryptocurrencies, notorious for their extreme volatility, can pose challenges even for seasoned traders. Let’s take Bitcoin, the leading cryptocurrency, as an example. If it undergoes a sudden price surge accompanied by a No Supply pattern, indicating a lack of buying interest, it implies the potential for a price correction. Traders proficient in Weis Wave would interpret this as a signal to close their positions, safeguarding profits and mitigating losses during the subsequent market decline.

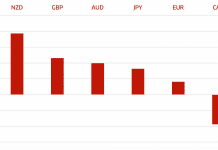

Example 3: Forex Market Breakouts

Breakouts are commonplace in the forex market, but not all translate into sustained trends. Weis Wave techniques aid traders in distinguishing genuine breakouts from false signals. Picture a currency pair nearing a significant resistance level. Conventional analysis might trigger premature buy orders in anticipation of a breakout. However, incorporating Weis Wave allows traders to wait for confirmation via increased volume, indicating authentic market interest. This patience prevents falling prey to traps set by temporary market fluctuations, ensuring more precise entries and exits.

In conclusion, these real-life examples vividly illustrate how Weis Wave techniques empower traders to navigate diverse market conditions successfully. By honing the ability to interpret volume patterns, identify critical zones, and recognize essential patterns, traders can transform market complexities into profitable opportunities. Armed with the knowledge and practical application of these powerful techniques, traders are better equipped to make informed decisions, ensuring their trading endeavors are not just profitable but also sustainable in the long run.

Empowering Traders, Unleashing Potential

In the dynamic world of trading, adapting to changing market conditions is imperative for success. Weis Wave techniques offer traders a unique perspective, enabling them to navigate market complexities confidently. By understanding volume analysis nuances, identifying accumulation and distribution zones, and recognizing essential patterns, traders can develop enduring strategies. Embrace these techniques, master the waves, and open the door to a future where trading endeavors reach unprecedented heights.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals