Last week we saw a plethora of important data as we moved in September. US Inflation and GDP were inbound along with the all-important payrolls.

By the end of the week the data coming in painted a mixed picture leading to uncertainty about how the Fed may react in September.

The Dollar was weak for most of the week however the US PMI on Friday moved the dollar slightly better on the week closing just 0.1% better.

Euro continues to lose ground. Disappointing data from Germany keeps the pressure on the single currency and we see little room for upside potential in the coming week.

GBP consolidated during the week. In the absence of any meaningful data the pound traded in a tight range.

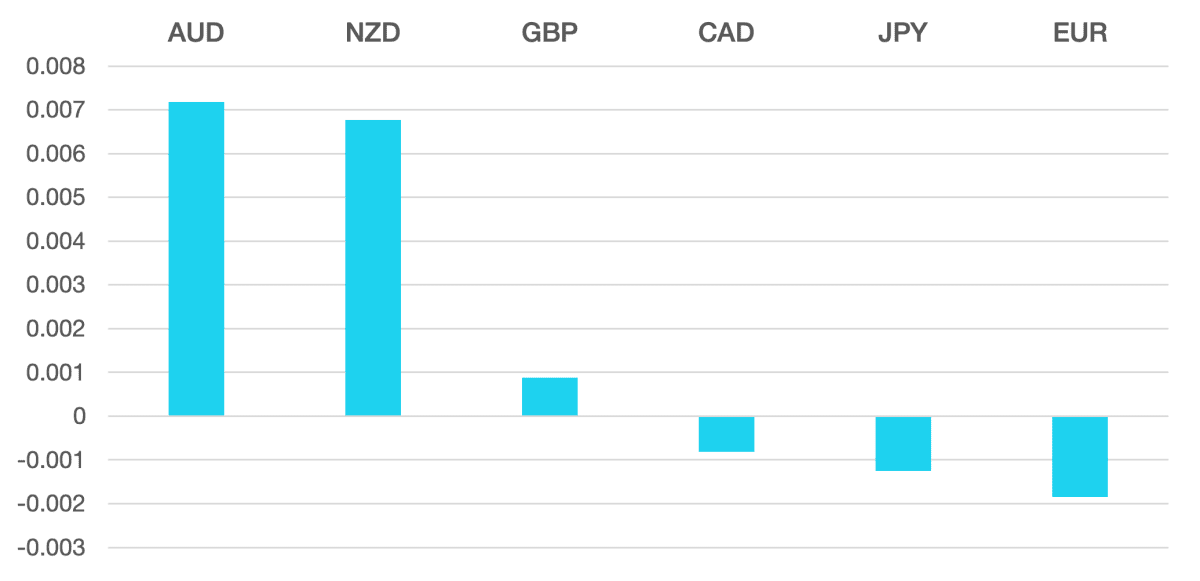

Commodity currencies eventually broke their 4-week losing streak but failed to make any real advances. A strong dollar continues to keep all the currencies capped at least for now. AUD and NZD were the best performers gaining around 0.5% each.

Oil reversed its losses of the last 2 weeks having a massive 7.5% gain on the week to close just below $86.

The week ahead will be a suck it and see as the markets look for direction from a week of mixed signals in the data. The week will see more PMI’s released along with the BoC rate decision.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Mixed Data and Mixed Signals first appeared on trademakers.

The post Mixed Data and Mixed Signals first appeared on JP Fund Services.

The post Mixed Data and Mixed Signals appeared first on JP Fund Services.