Last week was all about consolidation in the currency markets as traders took stock of recent moves and began repositioning ahead of the key tariff escalations in April.

While risk aversion deepened in US stock markets, the Dollar’s selloff slowed, and modest buying interest emerged. However, this stabilization appeared to be more of a pause in the broader downtrend rather than a true reversal in sentiment.

Despite the temporary reprieve, uncertainty remains dominant as investors weigh the impact of escalating trade tensions on global growth. The US administration’s inconsistent trade policy continues to fuel speculation about how reciprocal tariffs from key trading partners will shape the next phase of market moves. With this looming over April, traders seem reluctant to commit to strong directional positions.

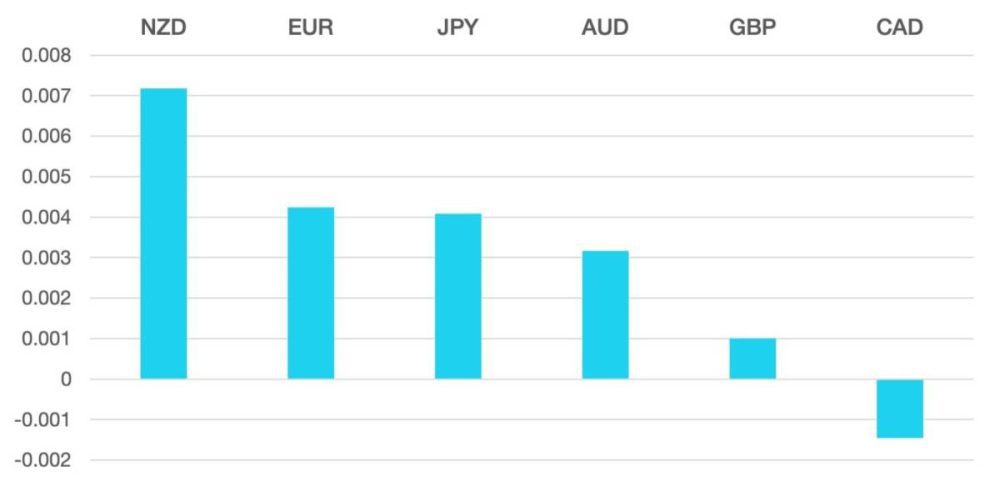

In the FX space, New Zealand Dollar overtook Euro as the week’s top performer, although its gains lacked strong momentum. Australian Dollar, which came in third, showed signs of stabilization after recent declines. However, both currencies remain trapped within broader downtrends, and any sustained upside will likely hinge on how global markets react to the next round of tariff measures.

The Euro slipped to second place, but its outlook remains constructive, particularly after Germany’s major political parties reached a breakthrough on a historic debt deal. This development could help sustain positive momentum for the single currency in the weeks ahead.

On the weaker end, Japanese Yen, Swiss Franc, and US Dollar were the three worst performers, reflecting a shift in sentiment that saw safe haven flows slow down. Meanwhile, Sterling and Canadian Dollar remained caught in the middle, showing neither significant gains nor steep losses.

Oil finally broke its losing streak, but the recovery lacked conviction. WTI crept 0.1% higher to close at $67.11, as increased global uncertainty kept buyers cautious. The broader downtrend remains intact, with key support levels approaching.

In equities, risk-off sentiment dragged major indices lower, while FX markets showed surprising stability. US CPI and PPI data came in softer than expected, keeping downward pressure on the Dollar. The DXY index fell 0.2% to close at 103.734, marking another week of losses.

The Week Ahead

Volatility is set to return as Central Banks take centre stage. This week brings interest rate decisions from the Federal Reserve, Bank of Japan (BoJ), Swiss National Bank (SNB), and Bank of England (BoE).

Markets will be watching not just the rate decisions but also the forward guidance from policymakers, which could dictate the next big moves in FX.

With tariff battles approaching, central bank decisions on deck, and risk sentiment fragile, expect sharp moves across currency markets.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post New Week of Consolidation first appeared on trademakers.

The post New Week of Consolidation first appeared on JP Fund Services.

The post New Week of Consolidation appeared first on JP Fund Services.