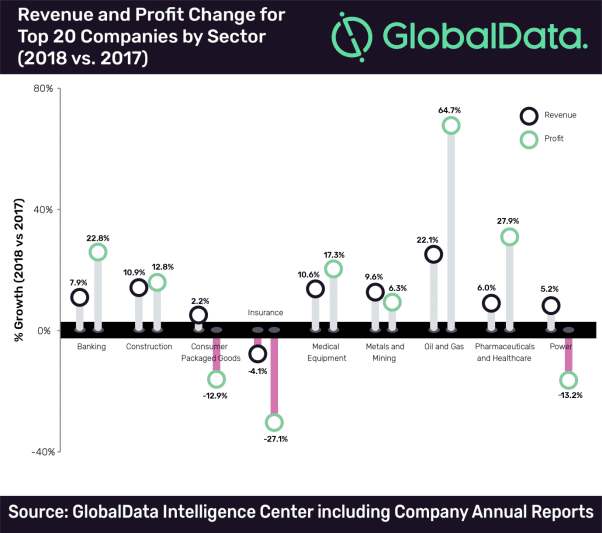

Oil and gas outperformed other sectors in terms of combined revenue and profitability in 2018. Besides oil and gas, technology, construction and medical equipment were the standout performers as they witnessed double digit growth in terms of combined revenue and profitability.

This data comes from GlobalData, the analytics company, which analyzed the total year-on-year (YoY) revenue and profit change of 10 core business sectors, based on the performance of the top 20 publicly-traded companies picked based on market capitalization in each sector.

Parth Vala, Company Profiles Analyst at GlobalData, comments: “Oil and gas companies benefitted from the rise in oil prices due to tightening supply on account of production adjustment agreement between OPEC and non-OPEC oil-producing members, and the US sanctions on Iran and Venezuela. In the coming months, oil prices are expected to further rise as recent attacks on Saudi Aramco’s oil facilities can have prolonged disruption in global oil supply.”

Likewise, top technology companies continued to remain on the growth path. Vala explains: “The growth is driven by the growing need to achieve operational efficiencies cutting across sectors. Driving these transformations are disruptive technologies such as artificial intelligence, cloud computing, cybersecurity, Internet of Things, blockchain and digital payments.”

The list of top 20 construction contractors was dominated by players from Asia-Pacific, especially from China and Japan. In China last year, in view of slowdown in the construction sector, the government issued guidelines to invest in infrastructure projects and use special bonds to finance such projects. The Tokyo 2020 Olympics is one of the major drivers responsible for growth in the Japan’s construction industry.

Meanwhile, investment in next generation medical technologies, growing need for portable medical devices, innovative diagnostic and surgical procedures involving robotics and Internet of Things, rising prevalence of chronic diseases and growing opportunities in less penetrated emerging markets are driving medical devices sector.

This growth has been reflected on recent mergers and acquisitions, which are also on the rise. Companies such as Abbott, Thermo Fisher, Danaher, Becton Dickinson and Co, Stryker Corp and Boston Scientific made several acquisitions in 2018. “To benefit from such growth-conducive environment, mergers and acquisitions are also on the rise, which were witnessed even among the top 20,” Vala added.

On the other hand, insurance was the only sector that reported decline in both combined revenue and profitability. “Drop in revenue was largely due to decline in the performance of European majors such as Allianz, AXA, Prudential, Zurich Insurance and Munich Re. Low interest rate environment, uncertainty over Brexit and complex insurance-based investment products remain major headwinds,” Vala pointed out. US insurers such as Berkshire, Aflac, AIG and Prudential Financial too reported substantial YoY decline in profitability.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals