Credit Benchmark have released the September Credit Consensus Indicators (CCIs). In it, the indicator found a further credit deterioration for UK industrials and a dip back into deterioration for EU companies. On the other side of the spectrum, the US maintains a positive trend.

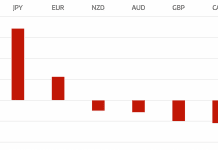

Going further into detail, the UK CCI for September is 48.2, compared to 49.3 last month, dropping deeper into negative territory and suggesting a return to a downgrade trend. It’s 49.5 for EU industrials, compared to 51.2 last month and 50.2 this month for US industrials, compared to 51.8 last month.

Talking about the results, David Carruthers, analyst at Credit Benchmark commented that Brexit has cast a long shadow over UK Industrials, and the sector has struggled to maintain any level of net improvement to credit quality since the vote took place in mid-2016. Uncertainty around future trade agreements, export potential and workforce supply has reduced output and dented lender confidence, and after a weak blip of improvement 3 months ago, the September CCI continues the longer-term trend of deterioration.

“EU companies show a more balanced picture, with neither upgrades nor downgrades dominating across the past year,” David went on to say. “While the region’s export market will undoubtedly feel the impact of onerous trade renegotiations with the UK, the Union’s safety net provides reassurance for lenders. That said, EU companies are not immune from a broader slowing down of the global economy, and the CCI for EU Industrials has been unable to sustain more than two continuous months of credit improvements in the past year.”

Lastly, US industrials have faced trade related headwinds due to the tension with China in recent months, but have managed to weather these so far. They are continuing a run of improvement since May; the overall trend has been mostly positive across the past year, but the gains are modest. The ongoing uncertainty regarding US/China trade policy and a weak rate of growth globally have created a climate in which US Industrials have struggled to flourish.”

The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

Similar to the IHS Markit PMIs, the CCI data is drawn from more than 800,000 contributed credit observations and tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month; below 50 means deterioration and above 50 means improvement.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.