Last week consolidation was the key phrase. Monday, we saw Asian markets swan dive post the week before US job numbers. The Nikkei losing around 12% as Asia sold off heavily as the Yen carry came to a sudden and very abrupt end.

Across the board consolidation was the end of the week. Despite this the markets are still in a fragile position. DXY ended the week broadly flat and stock indices did recover some ground, but many risks still prevail. The US September Fed meeting will be the one to watch.

A 50bps rate cut is now expected and further speculation of an emergency cut still seems to hang over the markets. Despite this the Fed have remained composed and relatively quiet. Their view is the recent job market data is more of a slowing economy rather than anything more sinister and economist are still looking for a more modest 25bps rate cut.

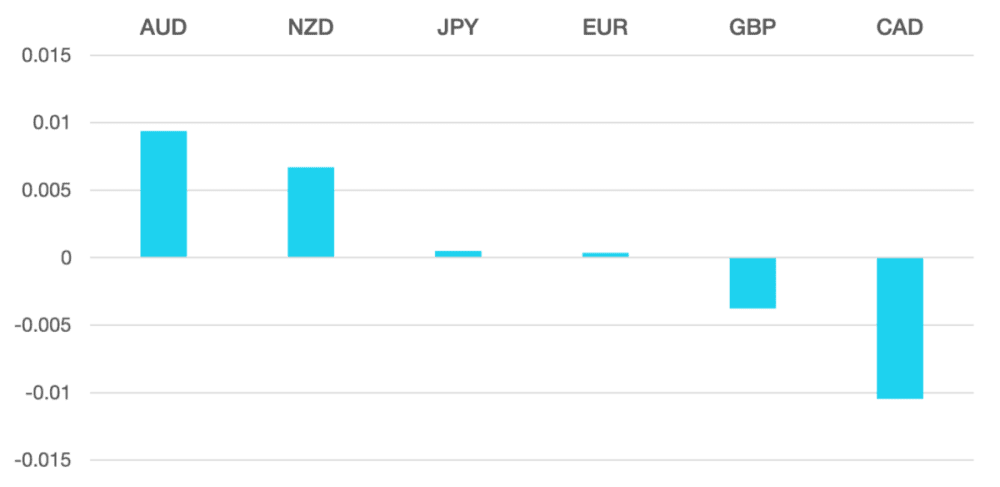

Risk currencies ended in positive territory as a small amount of risk on came back into the market. CAD along with AUD and NZD ended the week positive as the market is now looking to see where the next event will take us.

Oil had a good week as it regained the previous week’s loss. Oil continues to trade within its long-term trend with WTI closing +4% on the week to trade around $77.

The week ahead sees Japan closed on Monday but the markets will be looking more at stocks as to where we go from here. Was last week’s consolidation just that or is it the bottom of the current move?

Data for the week is quiet with RBNZ decision and US CPI.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Panic… What Panic? first appeared on trademakers.

The post Panic… What Panic? first appeared on JP Fund Services.

The post Panic… What Panic? appeared first on JP Fund Services.