Past, Present and Future of Trading and Crypto – Interview with Pedro Borges

Pedro Borges is a unique personality, entrepreneur and financial and trading expert that has been through the various developments of modern trading and investment. And now, he has stepped all the way into the crypto revolution. With over 20 years’ international financial trading services experience, Pedro has led major institutions across countries in the two hemispheres holding progressive leadership roles.

A proactive in digital banking and online trading/brokerage – in terms of creating ‘state-of-art’ customer experiences, and transforming key internal support functions to fully align with the overall goal – he has been going through all the different stages of online trading and investment digital transformations. He is now deeply involved in the new blockchain / crypto / tokens / ICO world having created and leading projects such ICO Sofa, Aprendersobrebitcoin.com.br and many other projects that bridge crypto, exchanges and token economics through media and educational perspective.

As an outstanding entrepreneur, Pedro was the founder CEO of Saxo Bank Brazil and has a large and successful experience on startup environments. He even promoted the launch of Gobulling Pro platform at LJ Carregosa; the Online Brokerage business at Orey Financial; or the development of the first worldwide white label partnerships for Saxo Bank.

Brazilian born, he always has shown concern about his country and has developed part of his career as a startup founder there. An easy example of this would be Carlicity, a Brazilian company that helps advertisers to take advantage of a seriously underutilized medium and aids everyday people to earn extra money doing what they already do; Driving. He sold the company with more than 100k drivers and almost one billion routes registered in Brazil.

With such an outstanding career, we have brought him to Hedgethink to share his rich experience about him, the trading/crypto economy and the future of this exciting world:

Question: Can you tell us about you, education and your career?

Answer: Risking this sounding like a cliché, my career was decided the day I watched the 80’s movie “Wall Street”, starring Michael Douglas and Charlie Sheen. Since then, I have always sought to focus my professional life on the area of financial markets. Therefore, I graduated in Business and Management, and the first workplaces to receive my resume were Banks. Following this I completed a post-graduate in Assets and Financial Markets. I was lucky from the beginning of my career as I had the opportunity to work as a trader in a Family Office in Portugal. There, I had a lot of independence in both the investment decisions as well as in choosing assets. This allowed me to not only to trade a broad range of financial instruments, but also to develop great responsibility in risk management. As it was not a large financial institution, the control mechanisms were reduced and the establishment of guidelines almost nonexistent. This allowed me to develop, in a couple of years, the skills that would have taken a much longer time to acquire in a more traditional career.

Since then my career has developed essentially in startup environments. I began working in Saxo Bank when it was still just a broker, where a business model was being introduced (the platform´s white label) without really knowing how it would unfold. It was in Portugal where the first white label partnership was made and that was an extraordinary experience. When I then worked at CMC Markets it was also with the intention of exploring partnership in the Iberian Peninsula. After returning to Portugal, I started leading institutions that sought to introduce themselves and grow in the digital world. Both projects were virtually started from scrap. Even my return to Saxo Bank was in a startup environment, since it involved leading the launching of the Bank in Brazil in political, regulatory and cultural environments completely different from Europe or Asia. I would say that my career has been met with an increasing load of responsibilities, however with the common denominator of the start up atmosphere. Therefore, it was almost inevitable for me to become fascinated by the crypto world from the beginning and that ever since I have been trying to become more involved in this world.

Q: You have been in the beginning of the online trading and investing industry. Can you tell us about this?

A: My first contact with the online trading world began as a client. To access the online platform, it was first necessary to wait, as the modem produced all sort of thuds as it connected to the internet. Granted, after various attempts had to be made for the Trading platform to actually connect to the internet. However, I was well aware that the evolution and improvement of platforms was extremely fast and, I recall that, in less than one year around 1999, I went from almost a residual use of online trading- where the use of telephone was almost prioritized- to trading essentially 100% online. The relationship between the provider of the technology and the client was very close and the user’s experience was crucial in fixing mistakes. Therefore, the fact that my first contact with online trading was as a client, helped me immensely when switching roles. When working in Saxo Bank, whenever I had to “sell” a new white label partnership, besides succeeding in explaining the technology I also managed to explain effectively to the partner what would be the response and the behavior of the client facing online trading. I was selling not only a technology but also a new business model.

If you look at the history of trading lots has been happening in the last 50 years but it is a new industry. In 1969, an aerospace analyst built the first ECN: Instinet. He saw it as way to eliminate the brokerage industry and the exchanges. In the early 1980’s Bill Lupien, a Pacific Exchange specialist, took the company over.

This created a new industry and by the time Reuters bought Lupien out in 1988, ECNs were becoming the way most NASDAQ stock were valued and traded. Instinet quickly became the preferred method for large-scale professional investors to trade in multiple exchanges and over-the-counter systems (Millman, 56).

In 1994, the economists William Christie and Paul Schultz published a paper that described an anomaly that they had discovered when examining computer-collected data of stock prices on NASDAQ. The brokers that are responsible for maintaining liquidity on NASDAQ are called market makers. They make their money from the difference between what the buy and sell prices listed on NASDAQ, known as the spread. Christie and Shultz found that the market makers where colluding to keep the spreads artificially high. The paper led to investigations by the Justice Department and rule changes by the SEC. The market makers used ECNs to carry out the truly competitive trading amongst each other, so the SEC made it mandatory for the ECN prices to be listed on NASDAQ, and they changed the order-handling rules to the benefit of small investors. The rule changes cleared the way for new ECNs that were available to anyone, such as Island.

Since 1996 the World Wide Web gained momentum and discount online brokerages such as E-Trade and Ameritrade were becoming very popular. They offered extremely low commissions and complete control over your portfolio.

Conventional discount brokerage firms such as Charles Schwab and TD Waterhouse began offering more online services for less money, while still providing personal advice from its brokers (Ecommerce).

Electronic trading was becoming so popular; it was actually encroaching on the profits of traditional brokerages like Goldman Sachs and Merrill Lynch (Ecommerce).

The growth of online investing has been explosive, (1.1 million in 2000 to 7.2 million in 2003) it has been limited the 40% of the population that already own stocks.

After this came the forex online trading industry revolution in the 80s that I was part. The foreign exchange market (Forex, FX, or currency market) became the major global decentralized or over-the-counter (OTC) market for the trading of currencies.Players such as FXCM, Oanda, Saxo Bank made the industry evolve very fast.

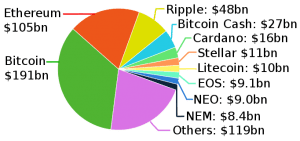

Last years the evolution went to crypto that has changed and will be changing the face of the industry forever. Although it is still early days. Coinbase has now over a 8 billion USD valuation.

Q: When you started working in Saxo Bank and other major brokers the online trading industry was starting, partly like now the crypto trading industry. How do you see the parallels, differences?

A: One of the biggest challenges that online trading presented to the financial industry was the need for all players to find new ways to interconnect. Suddenly, everything was made online but the different players did not “speak” with each other online wise. Suddenly, there was a need to present custodian, prime brokers, final clients and even different departments of the same institution, everyone “talking” online. This is also what must happen very soon in the crypto world; the existence of platforms, exchanges or markets (the name being irrelevant) offering crypto to all its participants and connecting them simultaneously.

The main difference being that online trading was about an enormous industry that already existed, but that we were able to access differently. The trading of crypto coins is about something completely new where everything is still being created.

Q: You lead major global broker operations in both Europe and Latin America, such as Saxo Bank, CMC Markets and others. How do you see the past and present future global challenges in these markets?

A: Long story short: in Europe, the future is about compliance and regulation, in Latin America the future is about politics.

The trading and investing industry has been always on a fast growing and disruptive path with challenges with regulators, tech, sales, marketing and institutional clients versus retail. What are your views on this?

Innovation acts is what introduces competitive advantages to companies within a certain industry, causing that industry to grow and in turn promoting more competition and consequently more innovation acts. This is a sequence of events, which has been repeating itself through the decades in the financial industry. It promotes innovation acts in technology, marketing, sales, etc, which begin in the financial industry and then propagate to other industries. Regulation therefore does not innovate, it follows what already exists and what the market has already decided that is here to stay. Regarding the institutional or retail clients, I believe there is no conflict at all. These are completely distinct spaces with different motivations and principles, but of course, both needed.

Q: In the last years crypto / tokens / ICOs have been changing the investing and trading industry. What are your views on this?

A: Honestly, I believe the emphasis should be placed in the future. I believe the way we make the investments and the investments themselves will be changing completely; however, for now they have barely changed. The number of investments remains very low and the institutional side is virtually nonexistent. It is necessary to bring all participants of the traditional industry to this industry, creating the said spaces of connection, marketplaces or exchanges, which I referred to in a previous question;

Being a person that worked with major players on trading and investing and regulators you have also recently started working with ICOs, tokens, crypto currencies. How do you see the institutional industry / traditional and the new players?

To bring the Blockchain to the real world and really allowing its use is fundamental to the globalization of this industry. It seems to me however absolutely crucial to retrieve the focus from price and place it in the product. Almost everything is about the price and that must change. If the current and future ICOs continue to attempt to attract investors by focusing on the price or the potential future rise in token’s price, they are doomed to failure.

Until a few months ago everybody rose money with a potential good product and a nice white paper. However, things changed! You have to mix the traditional with the new. Before launching an ICO or even start a private sale you need a private placement to start things going. You can’t expect to raise money to pay your bills because It´s necessary money in advance. Launching an ICO is every time more expensive and a private placement will allow to get some money in advance but also allow institutional money to get in.

Of course, much of this is because of regulation. As we all know bad actors slink in the ICO space and ICOs are attracting fraudsters looking to fool would-be investors. Regulation will play an important role here and only in a safe environment will be possible to attract for institutional investors and continue to attract retail investors.

Q: You have been working with major global banks, brokers, exchanges and regulators around the world. How do you see the present landscape?

A: I believe that all of the above which to be a part of this new industry. None of them think “this isn’t for us”. In some way or another, all of them are ready to participate in this new world and if this current industry is able to organize itself and generate the necessary conditions, all of this will take place much more quickly. Personally, I think this process will most likely be fast than slow. Take countries like Switzerland, they have created regulatory environments extremely favorable and where nowadays it is possible to build an ecosystem with all the safety and regulation of a traditional industry.

Q: Can you tell us about your crypto digital education platform in Brazil?

A: When in 2014 I began to express interest in Bitcoin, many of the words and expressions sounded foreign to me. As I did not have any knowledge in the area of IT, this required a lot of exploring and studying. Additionally, almost all the information available was in English, which made it even more challenging for non-English speakers to access it. Therefore, I decided to create a blog with the aim of introducing this world in a very clear way to the Portuguese-speaking community. This blog ended up becoming 100% educational and currently, it is possible to find tutorials, guides and analysis of almost all-important things within the crypto would, always expressed out clearly in Portuguese

Q: Utility tokens and security tokens, how do you see the industry going?

A: From my point of view, tokens are neither security nor utility. Like almost everything in this industry, tokens are a new thing and is not easy to adapt it to the existing framework and determine what it is. It’s urgent to ask for specific regulation and not try to adapt the existing one like is being done. Anyway I think the industry should and will put the focus on the utility side until we don´t have different regulation for it.

Q: How do you see the crypto exchanges challenges, from liquidity, custodian and what is necessary to push the industry to maturity?

A: The institutional side in this industry is virtually nonexistent and the game changer will be when it arrives into this market. One of the key players for that to happen are exactly the exchanges. Almost all the most known and largest exchanges in the world are focusing on retail clients or small to medium traders. Projects focusing Institutional are necessary and It´s important to involve all the players like custodians, prime brokers, managers, funds administrators, clearing houses etc on this. This industry can learn a lot from OTC markets for example.

This can be solved, by creating marketplaces on friendly jurisdictions. Those marketplaces would join all the different players allowing at the same time not only the development of the institutional business but also creating a safer environment for the retail exchanges.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals